Paul Jesinskis, CFP®

Financial Advisor

“In investing, what is comfortable is rarely profitable.” ~ Rob Arnott

Prologue

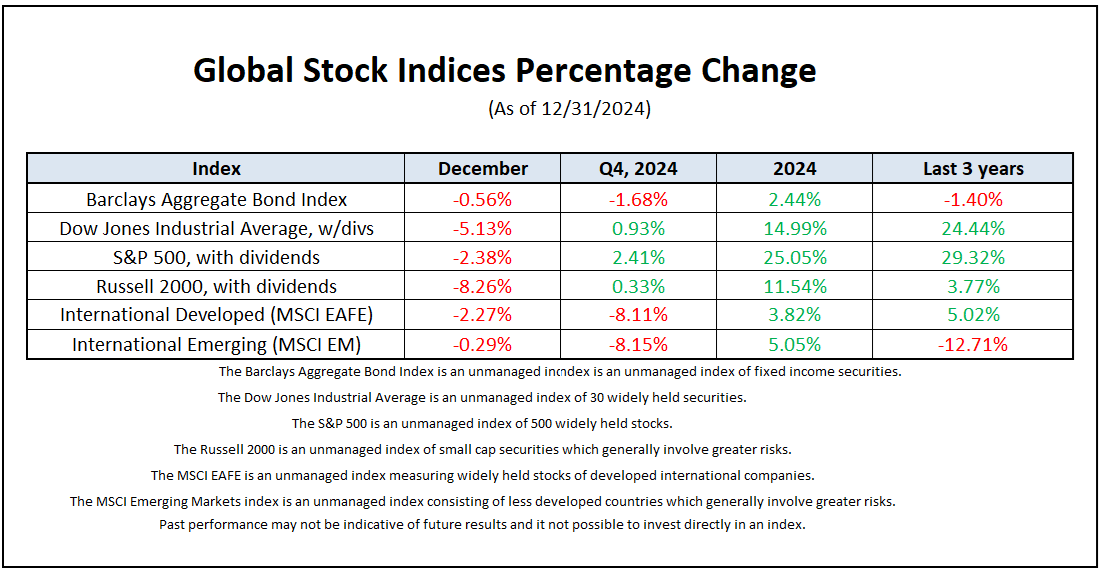

2024 was another strong year for asset returns, as economic growth outpaced expectations and the Fed initiated rate cuts. The S&P 500 achieved a total return of +25%, marking the first back-to-back annual returns above 20% since the late-1990s, powered by a +67% gain in the Magnificent 7 stocks. The theme of US Exceptionalism took hold as markets priced in the potential impacts of Trump 2.0.

December added a question mark to the end of an otherwise strong year of growth for the equity markets. As inflation numbers continued to stagnate above its 2% year-over-year target, the Federal Reserve (Fed) – despite cutting current interest rates by another 25 basis points – expressed diminished confidence in inflation reaching its 2% target. Back in September, investors expected four rate cuts to arrive in 2025. Now the expectation is two. This news caused a chilling effect in the markets, resulting in a flat month for the S&P 500 and a 5.3% loss for the Dow Jones. Only three of 11 equity sectors were positive for the month.

Continuing a now-familiar trend, mega-cap tech stocks stood strong while volatility ruled elsewhere in the market. Small-cap stocks were hit the hardest, with the Russell 2000 dropping over 8%, reflecting their perceived vulnerability to higher interest rates relative to their larger peers. International stocks had a difficult last quarter of 2024 and dramatically underperformed their US counterparts on the year. How much further can the underperformance go? Currently, international equities are trading at a significant discount to the US, more than double the historical average.

The Fed’s surprising tone on inflation and messaging about future rate cuts caused the 10-year Treasury yield to sharply jump from 4.17% at the end of November to 4.57% at the end of December. Markets are pricing in 2 rate cuts for 2025. Given the potential for resurgent inflation, persistently strong economic data, and unease regarding the impact of tariffs amidst current geopolitical tensions, I would not be surprised that the Fed expects to proceed with caution in 2025.

There are clearly perceivable risks looking out over the horizon – geopolitical risk, inflation, a slowdown in consumer spending and international trade to name a few. There always has been and always will be a list of concerns or red flags if you look hard enough… Despite these risks, it's advisable to avoid overreacting or dramatically changing long-term plans. Market concerns will always exist, but not all will materialize.

Please reach out with questions.

-Paul

Noteworthy links:

- Howard Marks: On Bubble Watch

- RJ: Investment Strategy Quarterly

- RBA: Certainties for an Uncertain World

- Russell Napier: We Are Headed Towards a System of National Capitalism

Chart of the Month

US Exceptionalism is a thing today, but if history is a guide, leadership tends to change hands from decade-to-decade

Article of the Month

Through the back door to bigger retirement savings

“Backdoor” strategies let you enjoy the benefits of a Roth while getting around some of the limitations.

For people looking to build a balanced retirement savings portfolio, a Roth IRA can serve as a great companion to an employer plan such as a 401(k). But if you earn too much money, you may not qualify to invest fully – or at all – in a Roth IRA. And no matter how much you earn, you may find that contribution limits prevent you from building as fat a fund as you’d like.

Fortunately, there are “backdoor” strategies that may help you get around these limitations. Here’s what you need to know.

Backdoor Roth IRA

Once your modified adjusted gross income (MAGI) tops $161,000 for single filers or $240,000 if married and filing jointly, the IRS begins phasing out your ability to invest directly in a Roth IRA.

But you can contribute after-tax dollars to a traditional IRA, then shortly thereafter convert those funds to a Roth IRA. Because there are no income limits restricting your ability to put after-tax dollars in a regular IRA, you can use this backdoor strategy to build a Roth IRA no matter how much you earn.

You can’t go through this backdoor if you own any IRAs with any pretax dollars in them. The reasons for that are complicated, but it all boils down to two IRS rules (the pro rata rule and the aggregation rule). Consulting your financial advisor and tax professional prior to doing a backdoor Roth is a smart move, to ensure that you’re following every rule.

Mega backdoor Roth IRA

If your problem is not how much you earn but the size of contribution limits, there’s a mega backdoor strategy that could help boost your savings.

For 2024, the limits on how much you can contribute to an IRA are $7,000, or $8,000 if you’re over 50. A mega backdoor strategy may empower you to put away much more than that.

Your current employer must offer a 401(k) or 403(b) plan, and you must pay into it. Whichever of those plans you use must also allow employees to make after-tax contributions into the plan, which count above and beyond employee elective deferral limits.

This is simplest to achieve if your employer offers a Roth option attached to its retirement plans, one that supports in-plan conversions to the Roth – that’s your mega backdoor to a bigger retirement fund.

There are plan-specific limits on how much you may contribute in after-tax dollars to convert into the Roth, and are other rules affecting whether you can apply a backdoor strategy and how big a fund you can build. Again, a chat with your financial and tax advisors is an essential step in any backdoor plan.

Pros of backdoor Roth IRAs:

- You may still be able to fund a Roth IRA even if your income is above IRS limits.

- If you have access to an employer plan with a Roth feature, you may be able to save more than the usual IRA limits.

- Because the money going into the Roth has already been taxed, you can take tax-free distributions in retirement.

Cons of backdoor Roth IRAs:

- Not everyone will be eligible to apply a backdoor or mega backdoor approach.

- Typically, only high earners benefit.

- Both require careful planning with a tax professional.

Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional. Unless certain criteria are met, Roth IRA owners must be 59 1/2 or older and have held the IRA for five years before tax-free withdrawals are permitted. Additionally, each converted amount may be subject to its own five-year holding period. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion.

Here is a link to the full article: Through the back door to bigger retirement savings

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery