Paul Jesinskis, CFP®

Financial Advisor

“Systematic investing will pay off ultimately, provided that it is adhered to conscientiously and courageously under all market conditions.” ~ Benjamin Graham

Prologue

May saw markets rebound after a lackluster April. Positive corporate earnings and increased participation from sectors other than technology drove the recovery. Across the board we saw benchmark indexes reverse the prior month's losses with notable gains in May. The tech-heavy Nasdaq led the way, followed by the small-cap Russell 2000, benefiting from a decline in interest rates.

Fixed income continues to struggle in 2024... The U.S. 10-year Treasury rallied 17bps in the month of May, closing the month with a yield of 4.51%. This is a far cry from the level yields started the year; 3.86%, all the while the market has been pricing in rate cuts. Hard economic data continues to be resilient while survey data looks less than fine. Said another way, consumers are enjoying their financial situation while they think their neighbor's situation is terrible… This murky situation suggests that interest rate cuts are likely to be further delayed.

With the S&P 500 up 50% over the last 400 days, consolidation is not unexpected, especially considering investor uncertainty on the pace of disinflation and the timeline of Fed actions. The path to inflation normalization is unlikely to be smooth, so while equities may be in an uptrend, some fluctuations along the way are possible.

May’s bounce back performance certainly elicits optimism, however volatility is always a possibility – especially with the continued uncertainty regarding inflation, interest rates and international conflicts.

Please reach out with questions.

-Paul

Noteworthy links:

- FT: How Liz Truss still haunts markets

- RBA: Something's gotta give

- Morningstar: 3 Assets That Might Not Diversify as Well as You Think

- Hartford: Roth IRA Conversions: Not An All-or-Nothing Idea

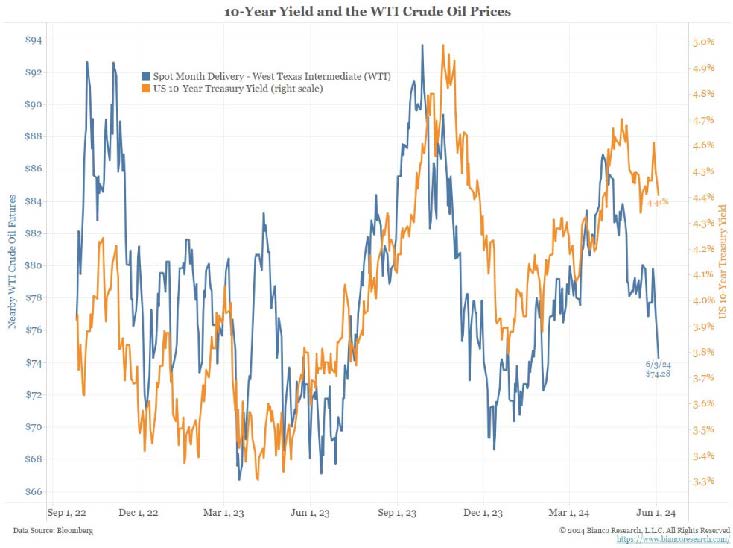

Chart of the Month

Interesting to see the similarity of U.S. 10 year yields with the oil price

Article of the Month

What if the Fed doesn’t cut interest rates this year?

By Darrell Spence, Economist with Capital Group.

Published April 25th, 2024.

Earlier this year, many investors were convinced the U.S. Federal Reserve was on track to reduce interest rates four times by the end of 2024. Back then, it struck me as wishful thinking. Today, given higher-than-expected inflation, I think it’s even more unlikely. I believe there’s a strong chance we will get no rate cuts at all this year — and that markets should be fine without them.

To be fair, I should note that not everyone at Capital Group holds this view. As is often the case, we have multiple viewpoints on the investment team and among our economists. That’s the heart of The Capital System.TM

For some investors who have been eagerly awaiting a rate cut, this may sound akin to canceling Christmas. However, if the Fed decides to stand pat it’s not necessarily a bad outcome, depending on the reason. In my view, there are three solid reasons to keep the federal funds rate right where it is throughout 2024.

1. The U.S. economy can handle it

The U.S. economy continues to grow at a healthy pace despite a dramatic rise in the fed funds rate to its current range of 5.25% to 5.50%. That’s a 23-year high. And yet the International Monetary Fund (IMF) is now predicting that the U.S. economy will expand this year at more than twice the rate of other major developed countries. Last week, the IMF raised its forecast for U.S. economic growth to 2.7% on an annualized basis, compared to 0.8% for Europe and 0.9% for Japan.

The resilience of the U.S. economy, in the face of much higher interest rates, has been one of the biggest surprises of the past two years. It wasn’t long ago that many investors and economists thought we would be heading into a recession. Now it appears the U.S. economy could grow at a rate above the IMF forecast, potentially hitting 3.0% as American consumers continue to spend, the labor market remains tight, and manufacturers invest in newly diversified supply chains in the post-pandemic era.

This type of solid growth isn’t normally associated with rate cuts. In fact, the U.S. economy appears to have adjusted quite well to a higher interest rate environment. Even with home mortgage rates around 7.1%, as of April 18, total home sales and home prices have been rising in early 2024.

Given this resilience, there is reason to worry that the U.S. economy could overheat if the Fed lowers rates prematurely, which could reignite inflationary pressures.

Which brings me to my next reason.

2. Progress on inflation is stalling

There’s no question that the Fed’s battle against inflation has gone well, but it isn’t over. Consumer prices have fallen from the highs of June 2022, but remain significantly above the Fed’s 2% target. Going that final mile — from 3.0% to 2.0% — could be the toughest part of the journey. And I think it will take longer than Fed officials expect.

Fed Chair Jerome Powell admitted as much last week when he said: “We’ll need greater confidence that inflation is moving sustainably towards 2.0% before it would be appropriate to ease policy.” That was right after the March inflation report came in hotter than anticipated, and it caused markets to adjust the previously more ambitious rate-cut expectations. The January and February inflation readings were also above expectations, so this isn’t just a one-month blip in the numbers.

Ultimately, if the Fed doesn’t cut this year, it will likely be because inflation isn’t falling as quickly as anticipated by central bank officials. In my view, that is a likely scenario. Much of the recent decline in inflation has occurred in the consumer goods sector, where prices have been falling at the fastest pace in nearly 20 years. I don’t think that is sustainable, particularly with the U.S. dollar no longer strengthening at the pace witnessed over the past year.

In addition, higher home prices may have a greater impact on rental inflation than in the past, given recent changes in data-gathering methodology. Outside of housing, service sector inflation is headed in the wrong direction, climbing at an annualized rate above 6.0% over the past six months. This is largely a function of solid wage growth due to a strong labor market. The U.S. unemployment rate has moved up slightly to 3.8%, but that’s still near a 50-year low.

One might think inflation in the range of 2.5% to 3.0% is close enough, but the Fed has repeatedly stressed the importance of that 2.0% goal. In the pre-pandemic era, when disinflationary pressures were the problem, Fed officials felt that inflation rates of 1.5% or 1.6% were too low. So we should probably assume that 40 or 50 basis points above target is, therefore, too high today.

Putting these factors together, I think inflation could continue to edge down somewhat, but it’s probably going to be a tough grind from here.

3. Financial markets are fine with the status quo

U.S. and international stock markets hit a series of record highs in the first quarter of 2024. April has been less enthusiastic, largely due to inflation worries and rising tensions in the Middle East. But still, it’s clear that stocks in aggregate have been able to overcome the fear that higher interest rates would kill the bull market that started early last year. While more interest rate sensitive fixed income investments have seen weaker returns this year as rate expectations have shifted, more credit-driven bond sectors have felt a tailwind as earnings and economic growth have surprised to the upside. And ultimately, bond investors benefit from higher yields as income returns to the fixed income markets.

A market rally in the wake of higher rates is not unusual. Looking back over the past 30 years, stocks and bonds have generally done well in periods following a Fed rate-hiking campaign. In fact, since 1994, both asset classes were significantly higher one year after the end of a Fed tightening cycle, with the exception of U.S. stocks from May 2000 to May 2002, a period marred by the dot-com implosion.

Over time, markets tend to adjust to the prevailing interest-rate environment. Markets can react violently at the beginning of a rate-hiking campaign, as we saw in 2022, when stocks and bonds both tumbled. But once we reach a new level of stability, as long as it is within a reasonable range, markets have often been able to resume their long-term growth trajectory, influenced more by corporate earnings and economic growth than monetary policy.

Given these conditions, I think it is increasingly likely that we won’t see any movement from the Fed this year. Could I be wrong? Of course. The bond market is currently pricing in one to two rate cuts before the end of December. And while my base case is for no cuts, recent Fed comments suggest one or two (of 25 basis points each) are certainly within the realm of possibility. It is also conceivable that the Fed could act even more aggressively if we start to see substantial negative impacts of tighter monetary policy on the economy.

We will learn more after the Fed’s upcoming policy meeting. I do think Fed officials want to cut rates. They have made it clear that they believe current policy is restrictive and, therefore, it’s a reasonable conclusion that they are leaning toward bringing rates down.

As investors, however, I think we need to question that assumption. We need to consider the possibility that, in light of recent healthy growth, maybe Fed policy isn’t restrictive. Maybe that’s why we haven’t had a recession. And maybe that’s why we won’t get a rate cut in 2024.

Rather than being a negative, however, the absence of a rate cut this year could simply reflect the fact that the U.S. economy is doing quite well — and that history suggests it could be an excellent time to be invested in both equities and credit-oriented fixed income for investors willing to take a long-term perspective.

Here is a link to the full article: What if the Fed doesn’t cut interest rates this year?

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Insights & Discovery