Paul Jesinskis, CFP®

Financial Advisor

“The market is a pendulum that swings between unsustainable optimism and unjustified pessimism.” ~ Benjamin Graham

Prologue

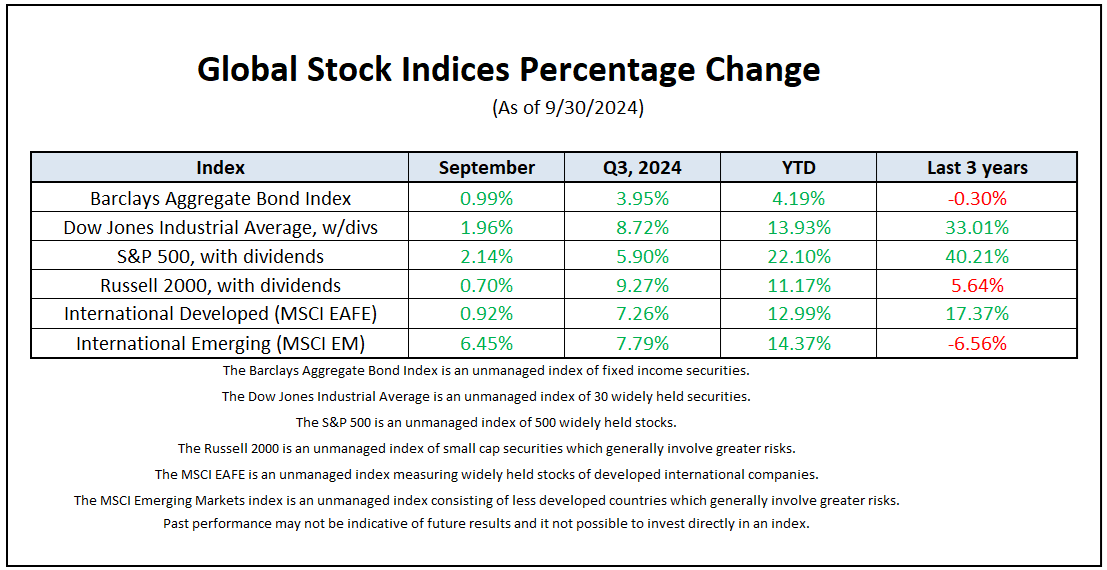

Markets performed strongly over the third quarter, with global equities and bonds advancing. Despite some volatility during the summer due to recession fears, the unwind of the Yen carry trade, and tech valuation concerns, markets recovered thanks to central banks’ dovish pivot, strong US economic data, and China’s stimulus announcement.

September is typically the weakest month of the year for stocks, but thanks to the much-anticipated federal funds rate cut, the S&P 500 turned in its first positive performance in a September since 2019, achieving its 43rd record high of the year! Another development out of China, the announcement of a significant stimulus package boosted Chinese equities. This jolt of news spurred a frantic rally in Emerging Markets, leaving it the best performing major asset class for the month of September.

A theme has developed over the last quarter has been a noticeable shift away from US tech stocks, with defensive and cyclical sectors such as utilities, industrials and financials serving as beneficiaries of the move. Additionally, with the anticipation of rate cuts, we’ve seen the rate sensitive US small-cap stocks stage an impressive rally over the last quarter, the Russell 2000 advanced 9.27%. While large companies continued to gain in value, small- and mid-size companies are starting to participate along with Developed International and Emerging Markets, underscoring the importance of maintaining in a diversified portfolio.

While it’s good to see the broadening of the market and the lowering of interest rates excites investors, plenty of variables could spark volatility in the weeks and months ahead, including the health of the economy, employment, volatility in the middle east, the US election and Fed messaging.

Please reach out with questions.

-Paul

Noteworthy links:

- Howard Marks: Shall We Repeal the Laws of Economics?

- RJ: Investment Strategy Quarterly

- RBA: Fade the election

Chart of the Month

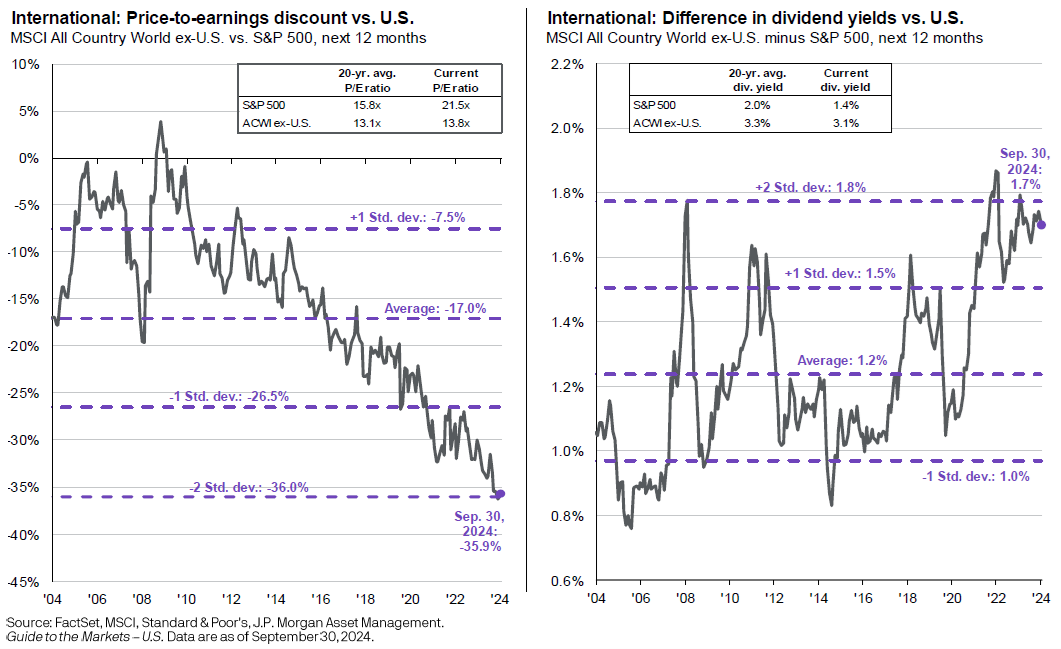

International equities are trading at a significant discount and offer an attractive yield pickup relative to U.S. equities on average

Article of the Month

What a lower interest rate means to the market

More than two years after first taking steps to contain swelling inflation, the Federal Reserve (the Fed) has taken a step back, suggesting monetary policy decision-makers have confidence that inflation will continue to move closer to the Fed’s target, allowing them to turn some attention to economic growth.

At its September meeting, the bank’s Federal Open Market Committee (FOMC) trimmed the target range of the federal funds rate – effectively the baseline interest rate across the U.S. economy – a half of a percentage point to 4.75% – 5.00%, down from 5.25% – 5.50%. The Fed is expected to make additional reductions in time, with decisions informed by data on inflation, the rate of unemployment, consumer spending, labor productivity and other key metrics.

The Federal Reserve, the independent authority over U.S. monetary policy, is charged with two distinct and often competing mandates: to support price stability – understood as a steady, low rate of inflation – and full employment. After roughly two years trying to slow the economy with higher interest rates to dampen inflation, this action is expected to bolster the economy and prevent a further slowdown.

What this means for your financial plan

The U.S. has a high-trust, credit-driven economy, so changes in interest rates have far-reaching effects. Investors and consumers may expect changes to:

Retail credit: Interest rates on new loans are likely to come down, including rates on mortgages, auto loans, securities based lending and home equity loans. Interest rates on existing variable rate loans, such as adjustable-rate mortgages and credit cards, may also decrease.

For those who took on a new traditional loan during this period of elevated interest rates, it probably won’t be worth the cost in fees to refinance, at least not yet, but the current consensus is that the Federal Reserve will continue lowering rates. However, don’t expect the near-zero interest rates of the early 2010s or 2020/2021 to return. They were a historical anomaly the Fed was slowly addressing before the pandemic forced a new tack.

Stocks: Lower interest rates are understood to support economic activity, so one would expect stock prices to increase. However, the market is forward looking – since this rate cut has been long expected, the potential gains from it may already be represented in current stock pricing.

What will likely be more evident is how lower interest rates help parts of the stock market bounce back from challenging conditions. Small- and medium-sized companies are seen as more reliant on cheap credit than large companies, so their stock prices have struggled compared to the mega-performant, mega-sized stocks at the top. Credit-sensitive sectors like real estate and utilities may also see a boost.

Bonds: Similar to interest rates in the retail credit market, bond yields will likely go down, but the slide may already be priced into the forward-looking market. Lower interest rates are a boon to institutional borrowers, but also to those who own bonds issued when yields were higher. The value of those higher-yield assets on the secondary market goes up as yields on newly issued bonds go down.

The economy: In the post-pandemic period, the U.S. economy has been unparalleled in its strength and resilience in the developed world. However, by the middle of this year, economic data started showing signs of a slowdown. Concurrently, the inflation rate continued to decrease after a first-quarter hiccup.

This gave Fed leaders the go-ahead to lower interest rates. By lowering interest rates now, the Federal Reserve is saying it’s confident inflation will continue to subside and they will attempt to cushion the slowdown in economic activity. This is meant to mitigate effects like slower job creation, slower wage growth and a loss in consumer confidence.

As we continue, we’ll see how the balance of these forces plays out. Despite the boost from lower interest rates, it’s likely the economy will continue to slow down, as monetary policy works with long and variable lags. However, currently, a dip into recession – a period of shrinking economic output – only seems like a narrow possibility.

Adjusting to new conditions

Changes in inflation and interest rates have the power to upend seemingly bedrock assumptions about the market, risk and opportunity cost. For example, changes in interest rates can change the math behind decisions to pay off debt ahead of schedule versus expanding an investment portfolio. Inflation and interest rates can also change the risk profiles of different types of investments, and left unchecked, can leave investors in a position far outside their comfort zone, with either too much or too little risk.

If it’s been a while since you’ve checked in, now might be a good time to sit down with your financial advisor and review your financial plan, particularly where it pertains to debt, risk and retirement timing.

Here is a link to the full article: What a lower interest rate means to the market

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery