“A wealth of information creates a poverty of attention.”

~ Herbert A. Simon”

One of the great disconnects when it comes to investing is that, while we all know results are optimized when you adopt a patient long-term approach, we are constantly nudged to make short-term decisions by the way the industry is organized. Financial markets operate nearly continuously, you’ll notice that the market will never be closed for more than 2 weekdays in a row, despite a holiday. This consistency provides the environment to promote objective price discovery and instant liquidity when you need access to your investment. This in turn drives the incessant pace of the news cycle, priming millions of market participants to buy or sell in response to the headlines.

Thanks to technology, today Investors can track prices and view performance at any time. The downside of the constant information firehose coupled with the ability to respond instantly, for investors, is how easy it is to be tempted to respond to noise. The challenge will always remain identifying the few signals that are relevant to your long-term objectives. The news flow has become much harder to ignore when well established positive market trends break down in response to unsettling events. April is a case in point…

April saw rising COVID cases in China prompt the shutdown of some of its biggest cities, causing global supply-chain issues. The ongoing war in Ukraine continues to exacerbate pressure on food and energy prices. While first-quarter earnings data was moderately favorable overall, several major companies reported disappointing results. Added to this, inflation continued to rise, leading to the much anticipated 50-basis point (0.50%) interest rate increase from the Federal Reserve this week.

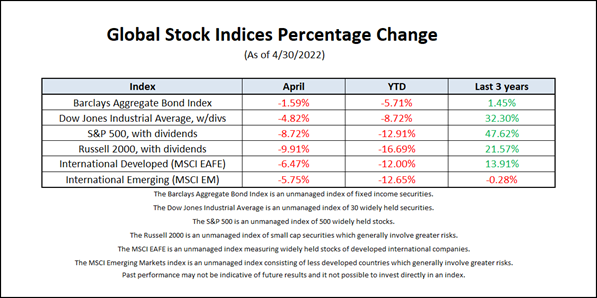

April was a rather difficult month for Wall Street, capping the worst four-month start to a year in decades. In the near term, volatility will likely remain elevated, are we in a bear market or is this simply a correction within an ongoing bull market? That fact is yet to be determined.

Remember, the market is forward looking, many of the concerns highlighted may be fully priced into the market already. There is evidence suggesting some of the largest headwinds will ease this year, presenting opportunities to long-term investors. It’s times like these where having a thoughtful financial plan coupled with a complimentary investment strategy is paramount.

Call me with questions.-Paul

Noteworthy links:

Raymond James: Prevailing pessimism masks market resilience

Capital Group: Is the era of easy money coming to an end?

GMO: Putin’s Invasion Reminds Us That We Live in a Finite World

Richard Bernstein Advisors: The biggest risk to portfolios today

The correction so far in 2022 is in line with an average correction

How to Adjust Your Brain for 8.5% Inflation

By Julia Carpenter. Published in Wall Street Journal on April 12th, 2022

Inflation turns money into a foreign language.

The rising cost of gas, food and hundreds of other things is pushing Americans to rethink how they read every price tag. Whether in the produce aisle or the used-car lot, our definition of cheap or expensive has changed, researchers on consumer psychology say.

Americans trimmed spending and adjusted their monthly budgets as the annual inflation rate rose to a four-decade high of 8.5% in March, the Bureau of Labor Statistics said Tuesday. Financial advisers say this recalibration can’t be a one-time effort. Knowing exactly what you are willing to pay for something and examining what is a necessity should be a constant effort.

“There’s no going back to the way things were,” said Scott Rick, associate professor of marketing at the University of Michigan, who studies financial decision making. “You have to update and roll with it.”

The sudden inability to know how to read price tags is especially disorienting to those under age 40, who have never experienced anything like today’s inflation rate. Understanding how we think about prices can help us adapt to inflation, Mr. Rick said.

What we judge to be a good, or fair, price is influenced by our individual background, income and our mental transaction histories, Mr. Rick said. The prices we pay over and over again like gas or rent are better defined than more occasional purchases, which is why politicians so often trip up when asked to recall the price of a gallon of milk, or older people are still anchored to the prices they paid in younger days.

Inflation moves faster than our mind is sometimes willing to adapt.

Our understanding of price tags is disproportionately shaped by the items that make up our daily budget. Researchers found that when it comes to gauging inflation expectations, shoppers typically look at the usual items they buy. This small number of items are the ones we use as “mental benchmarks,” said David Wessel, director of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution. This process is known as anchoring.

For some people, that benchmark might be the price at the gas pump or how much they pay for a dozen eggs. Others find themselves adjusting their understanding of prices when they spot a price change in their monthly utility bill or their usual coffee order, “and they totally extrapolate that to the economy at large,” Mr. Wessel said.

Ida Byrd-Hill, a 55-year-old founder and chief executive officer of a cybersecurity reskilling firm in Detroit, said she has noticed price creeps affecting the usual latitude she affords herself in her everyday budget. She said she considered her Netflix subscription her individual inflation marker. When the price increased by $5, she had to make a difficult decision and cut the expense.

“I look at my budget, and I budget to the penny,” she said. “I’m eagle-eyed to price changes because I have that budget.”

With prices so fluid, Mr. Wessel recommends people research prices online or talk to friends and peers about what they’ve been paying for a certain item.

The legwork “really pays off for big-ticket items,” Mr. Wessel said. Without doing this work, people are more likely to accept the first price that comes along, he said.

Farrell Goldman, a 45-year-old enforcement supervisor in New York, said he used to consider $1,800 for rent a very reasonable price to pay. Now that he is looking to move for the first time in years, he has noticed rents have skyrocketed. He might have once recoiled at the priciness of some of the places he’s browsing, but he said now he’s trying to accept that these higher rents are here to stay, and his $1,800 benchmark is no longer the norm.

“No one likes reaching into their pocket for more money, but now, I’d be willing to do it,” he said.

Our once-stable vocabulary of “cheap” and “expensive” has probably changed for good, and we need to learn to speak this new language, Mr. Rick said.

“It’s like getting over a breakup,” he said. “Shake off these memories as best you can and readjust your eyes.” Here is a link to the full article: How to Adjust Your Brain for 8.5% Inflation

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Insights & Discovery