“You cannot save time for future use. But you can invest it for the future you.”

~ Anonymous

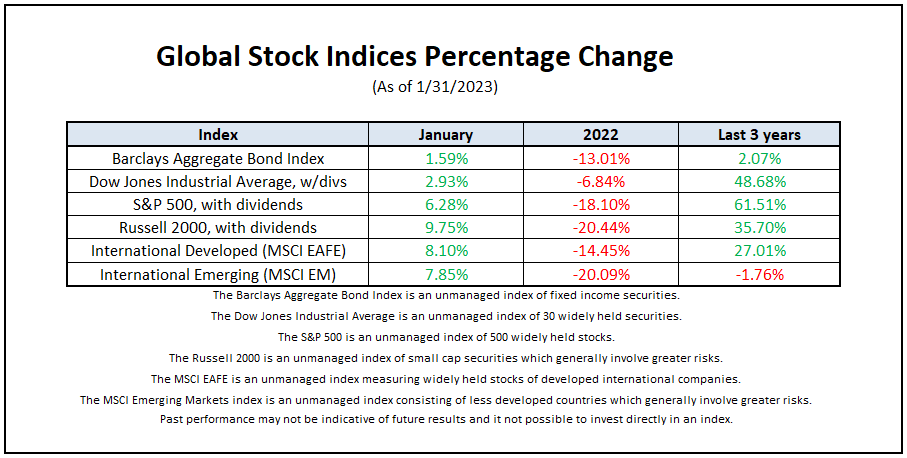

The wave of negativity that engulfed the markets last year was met with a ray of optimism in January as inflation decelerated, interest rates fell, China reopened, and earnings came in better than feared. The result: global equity markets rebounded strongly to start the year, highlighted by the S&P 500 having its second-best January over the past 25 years, the NASDAQ being up over 10%, and emerging markets technically entering a bull market by rallying 20% off of the lows.

So, you may wonder, with this good news, why are some of the largest companies in the economy laying off workers?

There are several reasons:

Overseas, there were sighs of relief as it now appears a looming global recession may be milder than suggested by the worst-case scenario. Despite challenging indicators similar to the US, financial markets appeared optimistic through January.

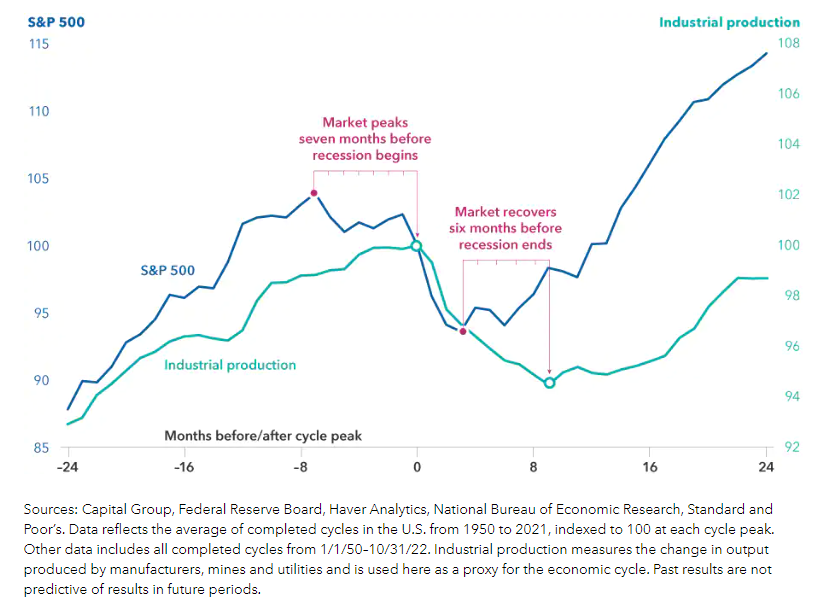

The takeaway? Don’t read too much into the S&P 500’s January gains; we live in interesting times. However, it’s safe to expect volatile conditions to continue, especially as recessionary concerns loom – but there are also plenty of reasons to be optimistic for the year.

Please reach out with questions.

–Paul

Noteworthy Links:

- Meb Faber Podcast: Interview with J.P. Morgan’s Dr. David Kelly

- Howard Marks: The Most Important Question Is Whether We’re Going to Have Stagflation

Chart of the Month

Article of the Month

When the Stock Market and Jay Powell Are Frenemies

By Jason Zweig

Published in WSJ on January 20th, 2023.

The market started hot this year, then suddenly cooled. The Fed is watching closely. What’s a long-term investor to do? Maybe bad news isn’t good news anymore.

For the first couple of weeks of 2023, financial markets were partying as if New Year’s Eve had never ended. Traders took every message from the Federal Reserve that it would keep raising interest rates until inflation was snuffed out as another signal that the worst was over.

This week, all that changed. After peaking on Jan. 13, stocks have stumbled, with the S&P 500 sinking nearly 3% in three days and many of January’s hottest stocks suffering severe losses.

If you’ve ever watched a flock of starlings or a shoal of fish, you know that enormous gatherings of creatures can mysteriously and suddenly shift course as if they share a single mind. For investors, as always, the challenge is to stay on your own track even when millions of traders and billions of dollars are flashing in different directions.

At the beginning of 2023, the market swarm collectively decided that the Fed was bound to retreat from raising rates later this year. Just like that, the biggest losers of 2021 took off. MicroStrategy Inc., the software company with a big bet on bitcoin, gained 67%. Bed Bath & Beyond Inc. shares more than doubled even though—or perhaps because— the company says it is on the brink of bankruptcy.

“We had pulled forward a whole year’s worth of gains into a couple of weeks,” says Katie Nixon, chief investment officer in the wealthmanagement business at Northern Trust Corp.

In the past few days, many of those gains have been erased in a swift change of sentiment. Big banks have set aside billions of dollars in reserves to shield against the effects of a possible recession, and the latest government report showed retail sales faltering. With the labor market remaining tight, the Fed is unlikely to waver anytime soon in its push to stifle inflation.

“The big question for this year,” says Michael Cembalest, chairman of market and investment strategy in JPMorgan Chase & Co,’s asset and wealth-management division, “is what will be the terminal fed-funds rate: around 5%, or more like 6%?”

That’s the interest rate—around 4.3% this week—that the central bank is using as its main weapon against inflation. Senior Fed officials have said repeatedly they expect to raise the rate to at least 5% this year.

How drastically the Fed moves will matter enormously to traders. An increase to something like 6% would smash speculative assets all over again.

And rapid shifts in sentiment could be combustible in this environment. After the Federal Reserve’s belief that inflation would be “transitory” turned out to be wildly wrong, the central bank has backed away from basing monetary policy on its forecasts.

It isn’t making decisions in a vacuum, though. In addition to guessing at the future, the Fed, led by Chairman Jerome “Jay” Powell, is looking more than ever at data from the present—and one key component of that is stock and bond prices.

That creates the possibility of an unusual feedback loop, says Torsten Slok, chief economist at Apollo Global Management Inc. in New York.

“When the Fed is hawkish and inflation goes down,” he says, “then the stock market will go up, and then inflation will go down slower.” Rising stock and bond prices are part of what the Fed calls easing financial conditions. Quick profits fill investors’ pockets, helping to flood the economy with money, potentially fueling inflation all over again.

“If financial conditions begin to ease, then the Fed says, ‘No, no, no, this is not what we want, we need inflation to get back to 2%,’” says Mr. Slok. “That’s why they will continue to be hawkish” until inflation is finally stifled.

In the meantime, any sharp jump in stock prices could provoke Fed officials into publicly threatening to raise rates unexpectedly high—thereby knocking stock prices right back down.

Such volatility always tends to crank up Wall Street’s propaganda machines, which are likely to advise investors to do something, anything, to sidestep all the turbulence.

If you invest for the long haul, though, you should be skeptical about any promptings that now is the time to make major changes to your portfolio.

Remember that although interest rates have risen sharply, they’re still moderate by historical standards—and still will be unless the Fed hikes rates far higher than anyone expects.

Bonds offer much greater income than they did only a year ago, so they should be able to provide a boost even to conservative portfolios. Inflation-protected bonds remain more attractive than they have been in more than a decade, enabling investors to lock in a stream of income sheltered from the rising cost of living.

U.S. stocks aren’t cheap, with the S&P 500 selling at almost 18 times what analysts expect its companies to earn over the next year. That’s almost exactly its average over the past quarter-century, according to Bianco Research—but well above the levels it tends to hit in recessions.

International stocks are outperforming the U.S. so far this year, and yet “the valuations are much lower, especially in Europe,” says Ms. Nixon of Northern Trust. “They have a long way to go to catch up to the U.S.”

Avoiding impetuous moves and patiently tilting toward attractive assets are always the keys to survival for long-term investors. This year, they’re more important than ever.

Here is a link to the full article: When the Stock Market and Jay Powell Are Frenemies

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery