“Interest rates are to asset prices, you know, sort of like gravity is to the apple” ~ Warren Buffett

Prologue

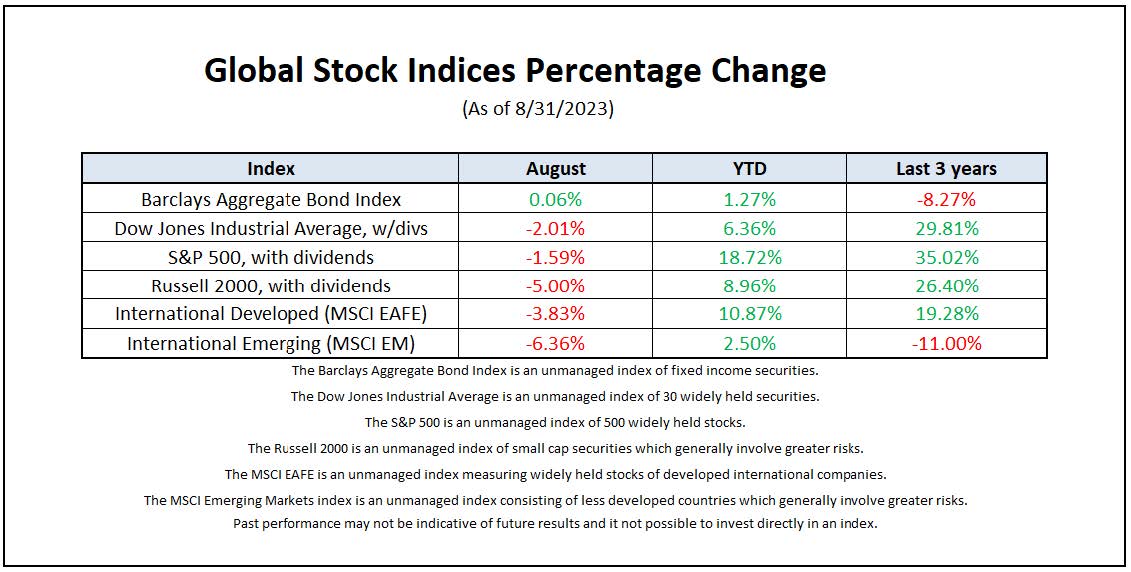

Stock markets have been on a charge in 2023 but August proved to be a tough month, snapping a five-month growth streak. Equity benchmark indexes ended the month lower. During August we saw oil prices rise, as did bond yields. The Federal Reserve (Fed) Chairman Jerome Powell reiterated the Fed’s commitment to lowering inflation with higher interest rates. Fitch Ratings downgraded the U.S.’s sovereign credit rating one notch from AAA to AA+. And cracks in China’s economy highlighted structural challenges in the world’s second largest economy.

Investors are apt to get bullish when things are going well, causing them to have less concern about surrounding conditions. The volatility of August seemed to jolt that confidence, giving everyone a reason to reassess.

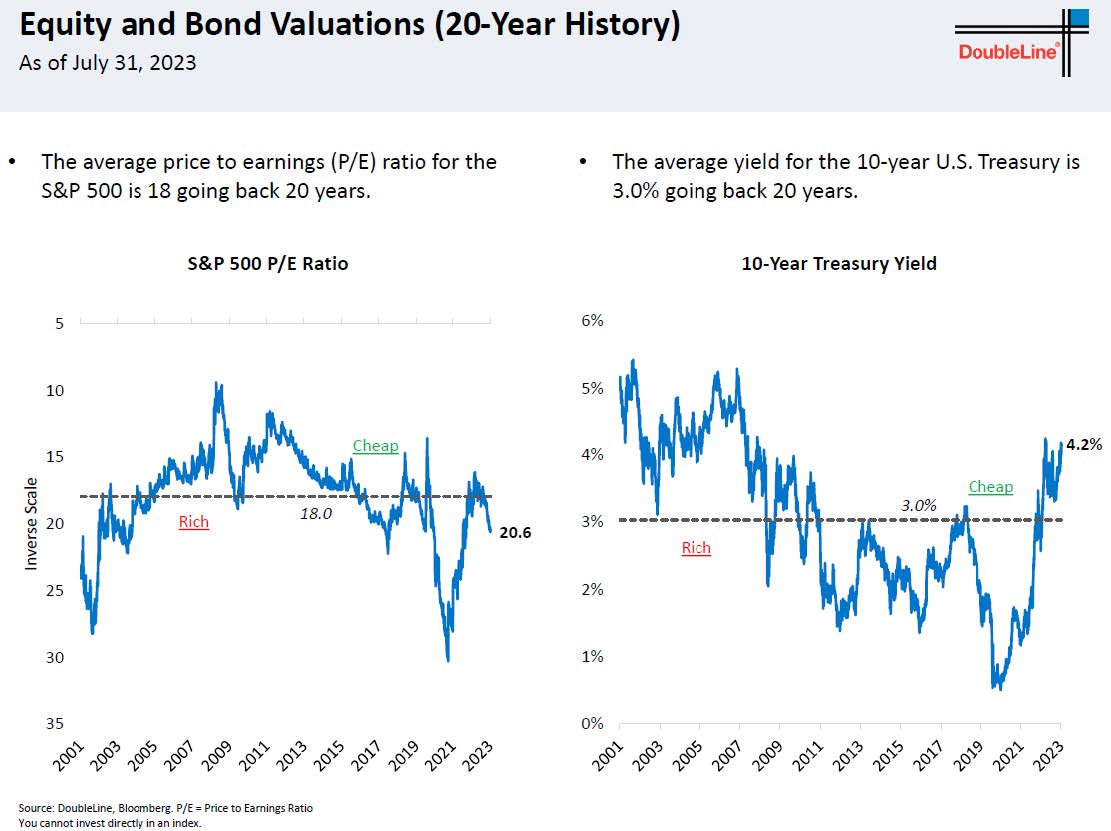

What is interesting to note is that US 10 year Treasury yields are back to the levels they were last October. Since October of last year stock markets have staged an impressive rally. The Fed meets again this month and it looks likely that we’ll see another 25 basis point hike. The question remains as to when interest rates give the stock market indigestion.

Check out the chart of the month – on a relative basis bond valuations are cheap relative to stocks looking back over the last 20 years. Worthy food for thought.

Please reach out with questions.

- Paul

Noteworthy links:

- RJ: What time is the right time for retirement?

- Lazard: PM Conversations: Is China Too Big to Ignore?

- Gavekal: Making Sense Of The China Meltdown Story

Chart of the Month

Article of the Month

Make your files findable when you leave them to your heirs

Living life and facing death can be liberating – and it doesn’t have to be hard.

Depending on the source, about half of Americans know they should have a will but don’t. And a National Library of Medicine study found that in 2017 only a third of us had completed end-of-life forms that outline our wishes for comfort and care during that final transition. Not surprising, maybe, since the process can be confusing and perhaps distressing when considering our own mortality. What may be surprising is the fact that the unpredictable pandemic may have shifted Americans’ attitudes toward codifying our wishes in a very practical sense.

The Why

It seems, despite living through a once-in-a-century pandemic, our interest in actually completing the task still wavers. However, top of the list of benefits is peace of mind – saving cost, time and heartache. Doing the work to have everything in place means medical professionals will be guided by your voice, your loved ones won’t have to bear the burden of guessing what you would want, and you’ll know that your heirs will receive the accounts and assets that you intended for them. It may not make it easier to say goodbye but should make the aftermath a lot easier.

Another beautiful potential benefit, perhaps even the most important one? Quelling the potential for intra-family strife during an already stressful time. Proper planning could help protect sibling and family relationships, which can get ugly when it comes to medical and financial matters. Experts recommend making your wishes clear and communicating them well before your passing, particularly if you’re part of a blended family.

The What

You’ll want to put some strong safeguards in place. Ask your medical and financial professionals if you need any or all of these documents. Don’t be intimidated. You don’t have to codify everything at once, and many are fairly straightforward. The more emotional tasks like writing letters of love or an ethical will, which outlines your values, may actually be the hardest.

Financial power of attorney. Durable powers of attorney give someone permission to make decisions on your behalf – anything from communicating with your cable company to dealing with banking, real estate, business and legal matters.

POLST forms outline physician orders for life-sustaining treatment for those with serious conditions, indicating things like whether you’d like CPR, mechanical ventilation, feeding tubes or ICU treatment.

Medical power of attorney. Sometimes called a living will or advanced directive, this outlines medical treatments you want and those you don’t and authorizes a proxy to make decisions for you.

A last will and testament.

Beneficiary forms. For insurance policies, retirement accounts and some other assets, the beneficiary form prevails over the will.

A declaration of guardian appoints someone to look after your minor children.

A trust. In many states, a living trust can be used to transfer assets and personal property in an orderly and more private manner than a will and can even stipulate special provisions such as age-based distribution so young adults don’t inherit all at once.

The Where and How

If you need help getting started, first get organized.

Discover what you already have. For example, you may already have a healthcare proxy. From there, make an appointment with an attorney who specializes in estate or elder care law to review what you have and help you fill any gaps. Include your financial advisor to ensure you’ve made a plan for all relevant assets.

You may want to also make an advanced care planning appointment with your doctor. Often this can be done remotely (two 30-minute appointments are covered by Medicare, as is advanced planning for a cognitively impaired patient). Be sure to ask so you’ll know what your financial liability may be. Once gathered, store all relevant paperwork in one place. Some prefer a binder in a safe deposit box, but another secure way may be an online vault that allows you to grant differing levels of access to those you trust most. Just make sure your family members and righthand professionals know where to find these important documents and how to access them.

The Who

Last, but certainly not least, make time to share your decisions with those they’ll affect. Talk to your loved ones about your healthcare and financial plans and preferences, where important documents live and how to access them. Your advisor can help you set up regular family meetings to address who inherits what and why, as well as other details. Of course, the most important thing is to take the time to tell your family just how much you love them.

Raymond James is not affiliated with any organizations mentioned. Raymond James does not provide legal services. Please discuss these matters with the appropriate professional. Sources: vox.com; theatlantic.com; compassionandchoices.org; Centers for Disease Control and Prevention; Health Affairs; nytimes.com; time.com

Here is a link to the full article: Make your files findable when you leave them to your heirs

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery