Paul Jesinskis, CFP®

Financial Advisor

“In the long run, it’s not just how much money you make that will determine your future prosperity. It’s how much of that money you put to work by saving it and investing it.” ~ Peter Lynch

Prologue

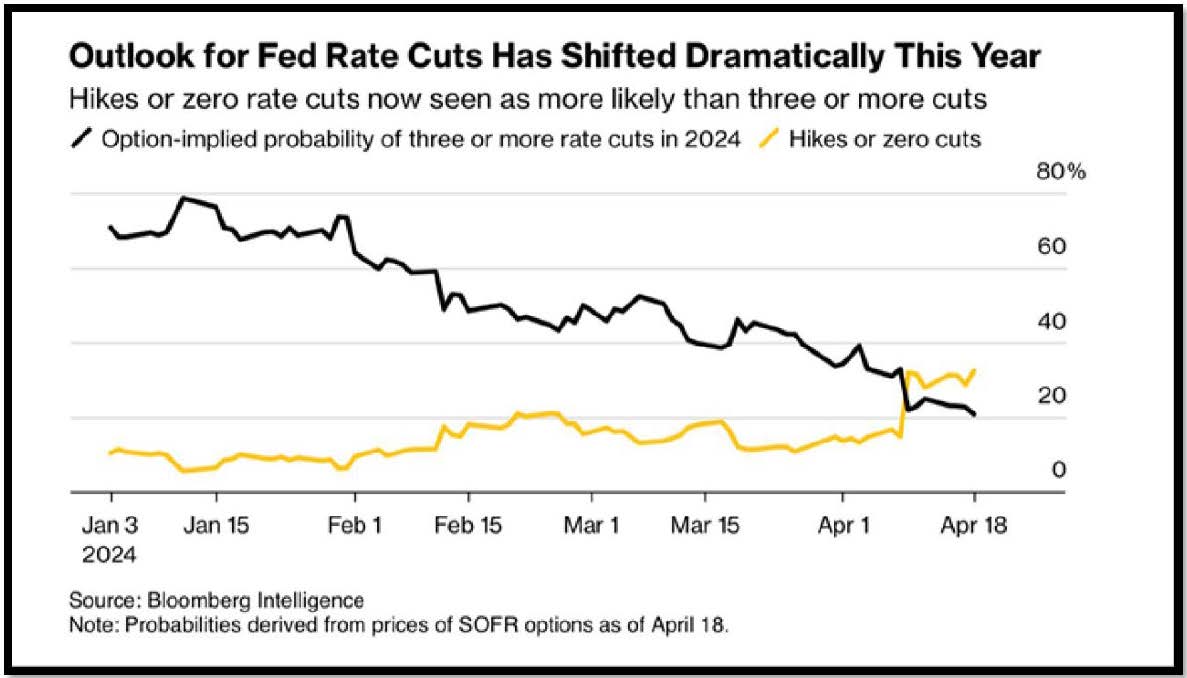

The month of April saw the S&P 500 index encounter its first pullback since October 2023. This correction wasn’t entirely unexpected, given the market’s robust 25% advance since then. Investor optimism had been riding high, but now attention is shifting to corporate earnings results as a potential driver for the market’s next move. The negative catalyst has been “sticky” inflation, resulting in a reset of Fed expectations.

The rise in bond yields to year-to-date highs due to delayed expectations for Federal Reserve rate cuts is another significant development. The role of persistent inflation and stronger-than-expected economic growth in this shift cannot be overlooked. It’s also worth noting how central banks in Europe and the U.K. are responding to rising unemployment by considering potential interest rate cuts.

As investors refocus their attention on inflation and Fed policy, incoming data will indeed be highly influential. The market now pricing in only one rate cut this year, down from six expected in January, is a significant shift. The upcoming April jobs report will certainly be closely watched for updates on employment and wages.

The regained inverse influence of bond yields to equities over the past several weeks and their likely continued uptrend could indeed pose a headwind to stocks. However, from a contrarian standpoint, the current bearish sentiment and low Fed cut expectations could indeed leave potential upside on positive surprises. With uncertainty regarding inflation, the Fed and international conflicts, there are significant risk factors at play. However, statistics seem to point toward a positive upswing in the markets over the course of the next 12 months. Let’s not forget, it is an election year.

Please reach out with questions.

-Paul

Noteworthy links:

- Howard Marks: The Indispensability of Risk

- RBA: What goes around comes around

- RJ: The pledged-securities mortgage explained

Chart of the Month

Market adjustments to Fed rate policy outlook

Article of the Month

Why 60/40 looks attractive again

The classic investment portfolio of 60% stocks and 40% bonds is doing very well at the moment — it's risen 17% in the past year.

Why it matters: After more than a decade when interest rates were at or near zero, bonds provide real income again — without the volatility inherent to stocks. What's more, the capital losses involved when rates rise are now well in the past.

The big picture: Historically, one of the main reasons for a 60/40 portfolio was that stocks and bonds would provide natural hedges for each other. Stocks generally rise over time, but when they fall, that's because investors are "risk off" and seek safety — which is to say, they buy bonds.

The catch: The negative correlation between stocks and bonds — the reason why the 60/40 portfolio is considered well diversified — has been obliterated in recent years.

- Bonds and stocks both went down during the initial COVID crash, then both went up during the subsequent market rally, then both fell again when the Fed started hiking interest rates, and then both rose again when hopes were rekindled that inflation was tamed and rates would come back down.

- Effectively, stocks are increasingly being priced like bonds, with the present value of a stock calculated as its future cash flows, discounted at prevailing interest rates. When those rates go down, the value of a stock rises; when rates rise, it falls.

The other side: Just because the two asset classes are increasingly correlated, doesn't mean they don't still taste great together.

- Because rates are now high, bonds provide a healthy internal return in terms of their current yield. On top of that, if and when rates start to fall again, bonds have the capacity to generate significant capital gains.

- Meanwhile, stock-market valuations are looking stretched, which naturally reduces the rate at which stocks are going to be able to rise from here over the long term.

By the numbers: Add it all up, and U.S. bonds are expected to yield somewhere between 4.8% and 5.8% over the next decade, per Vanguard, compared to a range of 4.2% to 6.2% for stocks.

If both bonds and stocks end up returning about 5.25% per year over the next decade, then finance theory says that bonds are the better option, because they're lower risk and therefore provide a higher risk-adjusted return.

The bottom line: Bonds won't always be this attractive, but no one is suggesting that investors move out of stocks entirely and into bonds. Instead, the idea is that a decent 40% allocation to bonds will make portfolios significantly less volatile — while still generating a healthy return.

Here is a link to the full article: Why 60/40 looks attractive again

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery