“As you get older, you realize, you need to deal with the world as it is and not as it should be.”

~ Justin Leverence

It appears that the rally in equities to start the year got a little ahead of itself. With the economic outlook still highly uncertain, one should expect higher volatility to remain.

Since the lows of mid-October of last year, we’ve seen the S&P 500 rally more than 10%. February saw a reversal of that positive trend.

The January Non-Farm Payroll job report, released the first Friday in February, was 3X stronger than expected (517k jobs compared to the 189k consensus forecast). Recent readings on consumer and producer prices and retail sales were higher than expected and unemployment claims drifted lower, contrary to expectations. The takeaway from these very important readings in February is that unemployment remains remarkably low, and consumers continue to spend.

The US 2-year Treasure note, a good proxy for the direction of the Fed Funds rate, has moved from 4.10% (at the start of February) to 4.82% at the end of the month. Interest rates currently are at, or just below 4%, across the yield curve, see chart of the month below.

With the Federal Reserve committed to slow inflation by cooling the economy via higher interest rates, the stronger economic data has provided support for the Fed to continue their path. It appears, the much talked about potential of a ‘Fed pivot’ has now given way to a theme of ‘higher for longer’. Higher rates are not great for bonds – they are even worse for stocks, just think back to 2022...

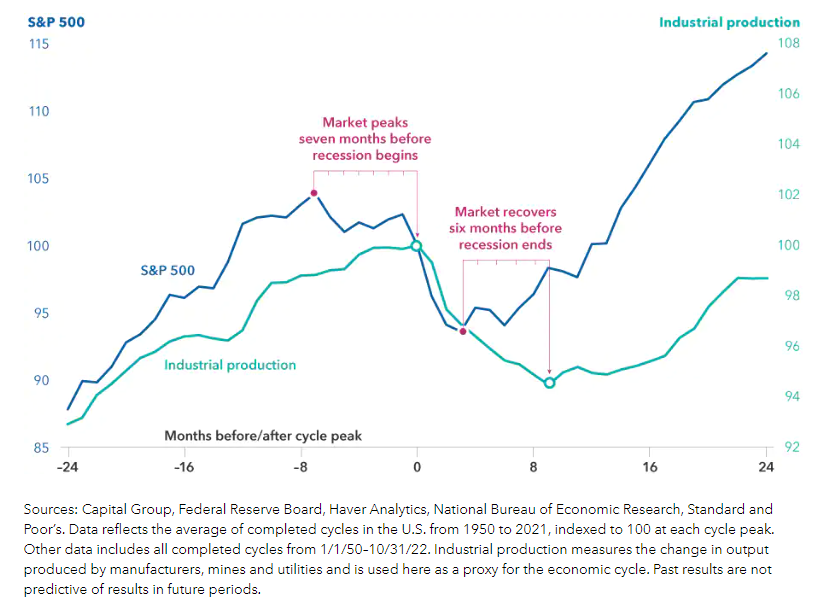

We’re likely to see more volatility in markets as investor sentiment oscillates between fears of inflation and recession. Investors get modestly optimistic pushing equity prices higher on the hopes that inflation is cooling enough for the Fed to signal that they’re comfortable with pausing, and fearful of recession when the Fed pushes up interest rates further.

Investors need to be aware that 2023’s outlook for equities is likely to remain challenging with more of the recent fits and starts that we’ve already witnessed in the first couple months of the year.

Navigating the world as it is and not as it should be makes great sense and having a thoughtful investment strategy is as important as ever.

Please reach out with questions.

–Paul

Noteworthy Links:

- WSJ: It’s a Richcession, Not a Recession. Here’s Your Investing Playbook.

- RBA: Don't Speculate on Speculation

- RJ: Which education expenses are considered qualified?

Chart of the Month

The increase in interest rates over the last 14 months is something to behold!

Article of the Month

People Have Memories. Markets Don’t.

By David Booth

Published January 13th, 2023.

One of the best things about markets is that they don’t have memories. They don’t remember what happened last week or last year. They don’t even remember what happened a minute ago. Prices change based on what’s happening right now and what people think will happen in the future.

People have memories. Markets don’t. And that’s a good thing.

So as you start 2023, take a lesson from the market. Don’t begin this new year bogged down by what happened last year. Give yourself the opportunity to start fresh.

Every day in publicly traded financial markets, buyers and sellers negotiate prices for every stock and bond. To agree, they have to find a price that they both think is a good deal. This happens over and over, millions of times a day. Then it starts all over again the next day.

Unlike people, markets don’t think about the past. It’s about today and expectations for the future.

Markets must be forward-looking to set prices that entice buyers to buy. But prices can't be too low or sellers won’t sell. Every piece of available information feeds into the decision-making process so everyone involved can agree on the price for a particular security at a particular moment.

Markets are smarter and faster than you and me. While you’ve been reading this, markets have probably factored in thousands of pieces of new information and adjusted the prices of thousands of different company securities.

That’s good news. Markets do the work so you don’t have to. You don’t need to believe in magic or be able to predict the future to have a good investment experience. Some people might think I’m giving the market too much credit. But over more than 50 years in finance I’ve come to realize that I’m just being realistic. Someone described it to me as “science-based hope.”

Academic research gives us insights into investing. Over the past century, markets have returned on average about 10% a year, although almost never that amount in any given year.1 And the annualized inflation-adjusted return on US stocks is 7.3% going back to 1926.2 Because of big swings year to year, trying to time markets is a losing game. So don’t try to outguess markets—go with them.

Come up with a plan, take no more risk than you can tolerate, and go spend some time with your loved ones.

Investing has inherent risks. And no matter what anyone tells you, there are no guarantees. But if you don’t have enough cash to live off for the rest of your life, what choice do you have but to invest? Control what you can control so you can set yourself up for success, and then give yourself some grace. Judge yourself by the quality of your decisions and not by their outcomes. There are so many factors outside your control that can impact investment returns.

I believe one of the worst things investors can do is to impose their memory on their view of markets. Because then they might “see” patterns that aren’t there and make choices that aren’t based on research or evidence.

It can feel daunting to develop an investment plan you can stick with and determine the level of risk that’s right for you. But few things are more important than how you invest your life savings. That’s why most people would probably benefit from a financial advisor to help them talk it all out.

When it comes to investing, the key is not to try to outsmart the market, but to understand how it works and use that knowledge to your advantage. The market is a great information processing machine. It runs on human ingenuity, which is why returns tend to grow over time as people work to innovate and improve the value of the companies they work for.

So start the new year off with a clean slate—just like markets do every day.

FOOTNOTES

1 In US dollars. S&P 500 Index annual returns 1926–2021. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

2 Based on non-seasonally adjusted 12-month percentage change in Consumer Price Index for All Urban Consumers (CPI-U). Source: US Bureau of Labor Statistics.

Here is a link to the full article: People Have Memories. Markets Don’t.

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Insights & Discovery