“Uncertainty actually is the friend of the buyer of long-term values.”

~ Warren Buffet”

It’s only natural that when there’s volatility in the markets that we may feel a sense of anxiety in relation to our investments. Even the most diligent of savers and planners are not immune to panic. When markets decline suddenly and slip into bear markets, where markets are subject to prolonged declines, an investor will naturally be concerned wondering whether or not the markets will bounce back like they’ve always done before. No one knows exactly how long the decline will last or it’s severity. However, there are a few core principals to keep in mind during the kind of uncertainty we’re experiencing right now.

Control what you can control –

You cannot control the markets. You can however, control what level of exposure you want in the markets and ensure that is thoughtful and in line with your goals. Asset allocation is critical in these decisions. For example, you don’t want market exposure for money you will need soon. We approach this process by first partnering with you to complete a financial plan, then using your personalized plan to help steer the investment strategy.

Focus on the decades on the days –

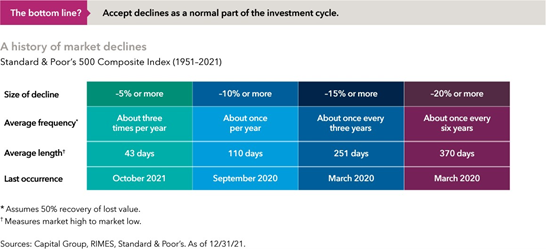

Most investors time horizon spans into the decades. It’s important to realize that headlines only focus on the day that’s in it. Your real focus should be on decades, not days. Planning for the long term means that you inevitably have to maneuver over markets ups and downs and not lose sight of the bigger picture. Market risk also decreases the longer you invest and declines are part of the economic cycle. Historically, recoveries have followed downturns.

Some risk is necessary –

It’s inevitable that you might feel more nervous about the markets at some times more than others. However, it is more important to keep focused on your goals. There is no point checking the bottom line daily when you’re playing the long game. Think of volatility as opportunity even if does involve a bumpy ride in the short term. Remember some risk is necessary in the pursuit of growth.

It’s always best to focus on the things you can control and try not to stress over the things you can’t.

Thank you for your continued confidence as we navigate the world and its markets together. If you have a question, would like to discuss what’s going on or just want to check in, please reach out at your convenience.

-Paul

Noteworthy links:

Howards Marks: Bull Market Rhymes

Vanguard: Perspective in a time of heightened volatility

Capital Group: International outlook: What's old is new again

Declines have been common and temporary occurrences

The Fed has kept monetary policy too loose for too long

By Sonal Desai, Ph.D., Chief Investment Officer, Franklin Templeton Fixed Income First published in The Economist on May 23, 2022.

Inflation at 40-year highs poses the toughest of policy challenges. Yet America’s Federal Reserve (Fed) still hopes to meet it with an easy solution: bring the policy rate close to 3%, and as adverse supply shocks fade inflation will revert to the Fed’s 2% target. No need for a sharp monetary tightening à la Paul Volcker. No need to risk a recession or to trigger a significant rise in unemployment.

Its hope rests on two shaky assumptions. First, it insists that the neutral rate of interest stands between 2% and 3%. (The neutral rate is defined as the rate at which monetary policy would be neither expansionary nor contractionary, when inflation is at the Fed’s 2% target and the economy is at full employment.) This implies that in real terms—subtracting inflation—the neutral rate is at 0-1%.

Yet this assumption might be well off the mark. Economists Thomas Laubach and John C. Williams have estimated that the real neutral rate of interest averaged around 2.5% during the 1990s and 2000s, before dropping to a 0-1% range after the financial crisis of 2007-

09.1 A drop in America’s productivity growth and higher demand for safe financial assets may explain the decline. Productivity growth, however, has rebounded and averaged 2.4% during 2019-21—the same as the average of 1991-2007.2

Quantitative easing, by the Fed’s own admission, is on its way out. This reduces demand for safe assets. So the real neutral rate of interest might be significantly higher than the Fed assumes—closer to a 2-3% range than 0-1%. Once inflation drops back to 2%, the nominal neutral interest rate should then be in a 4-5% range, not the 2-3% the Fed is aiming for. (And inflation is still a long way from 2%.) If that is the case, the Fed’s targeted long-term policy setting would still be expansionary. The current inflation problem has been caused partly by the Fed keeping monetary policy too loose for too long. Maintaining an expansionary policy seems more likely to entrench high inflation than to bring it back to target.

The second of the Fed’s shaky assumptions is that inflation expectations are still well anchored and that there is no sign of a wage-price spiral. In this telling, price growth reverts to a “healthy” pace once exogenous shocks have dissipated. But much evidence already points in the opposite direction. Although wages have not kept up with surging inflation, they are growing at the fastest pace in 40 years, about 4-5%.3 Employers face persistent labour shortages in an extremely tight market; new employees can secure substantial wage premiums. Companies in turn respond to rising wage and input costs by exercising their pricing power more aggressively.

Increasingly, surveys indicate that inflation expectations have moved up. Consumers and businesses do recognise that recent inflation has been charged by temporary supply shocks, and they do not expect inflation to stay at 8-9%. But they reckon that on a three-year horizon, it is more likely to run at around 4% than 2%. Inflation expectations, in other words, are already lodged on a higher plateau. The longer inflation remains elevated, the more firmly these will become entrenched and self-sustaining. The demise of supply shocks, then, will not suffice to bring inflation back to 2%.

If these premises are correct, the Fed’s current stance and messaging could damage its credibility—which could affect inflation expectations in turn. Financial markets already expect this hiking cycle to be moderate and short. They anticipate that as soon as economic growth flags, the Fed will promptly ease policy again, following the playbook of recent decades. This might have seemed relatively costless when inflation remained subdued. No longer. The Fed kept policy too loose as America’s economy roared back from COVID-19 shutdowns and enjoyed massive fiscal stimulus.

The Fed needs to tighten decisively both because the equilibrium interest rate is most likely higher than it thinks, and because the policy rate will need to rise above this level in order to bring inflation, and inflation expectations, back to target. The Fed must explain all this openly and rebuild credibility by pushing monetary policy to a truly restrictive setting. Failure to do so will cause high inflation to persist and inflation expectations to drift higher, meaning a deeper recession would become the only viable path to price stability.

ENDNOTES

- Source: Federal Reserve Bank of New York, Laubach and 2003. “Measuring the Natural Rate of Interest,” Review of Economics and Statistics 85, no.4 (November): 1063-70.

- Source: Bureau of Labor Quarterly percent change at annual rate, seasonally adjusted. As of Q1 2022.

- Source: Bureau of Labor As of Q1 2022.

Here is a link to the full article: The Fed has kept monetary policy too loose for too long

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Insights & Discovery