“The stock market is filled with individuals who know the price of everything, but the value of nothing.”

~ Phillip Fisher”

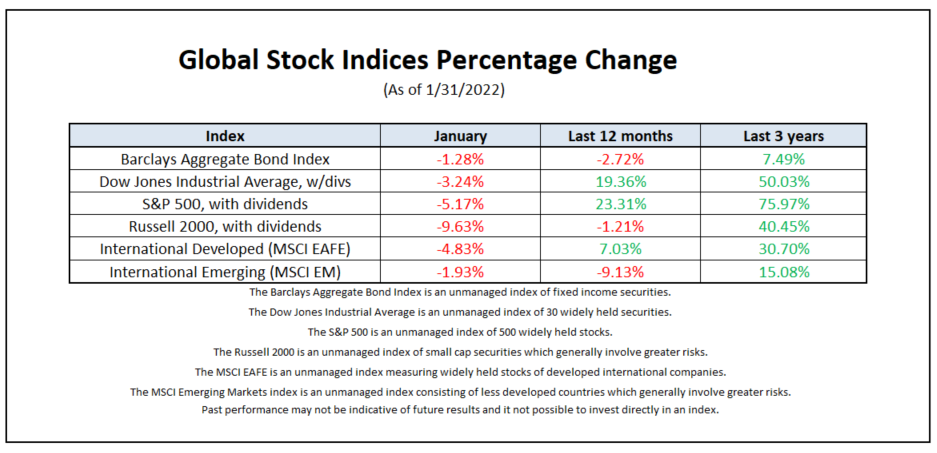

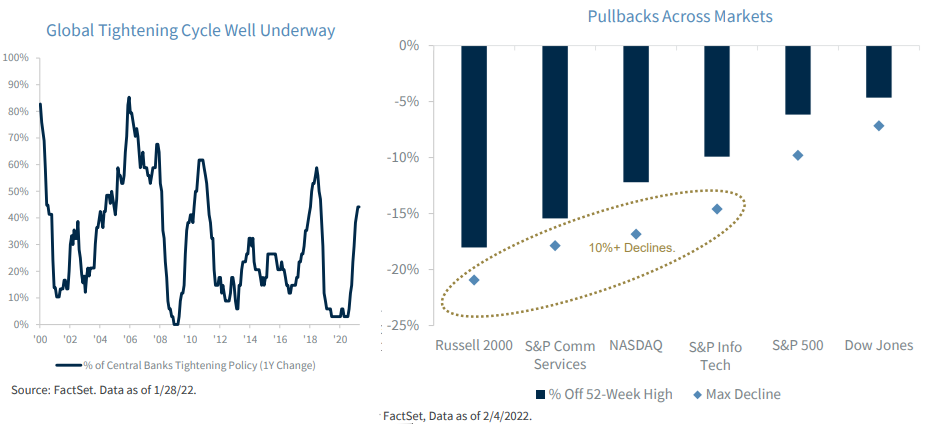

What a difference a few weeks can make in the equity market. The sharp, swift sell-off through the first month of 2022 is raising some difficult questions for investors, primarily: Are we just witnessing a long-overdue short-term correction in the more speculative areas of the market, or perhaps something more fundamental (and enduring) that could foreshadow a broader bear market is stocks?

I suspect the market is, in the midst of recalibrating to a new environment in which liquidity is going to be tighter and corporate profits a bigger driver of share prices. This potential regime change could show up in more volatility. More importantly it appears, at last in the short run, that investment fundamentals come back in focus. Over the last number of years investment flows have been trouncing any fundamental analysis. What do I mean by this??

Fundamentals – We have to remember the two major drivers of a stock’s price in the long run is their earnings per share (EPS) and it’s multiple – or what investors are willing to pay for those earnings (most often quoted is P/E). Publicly traded companies have to report and disclose an enormous amount of data and so analysts can typically get in the ‘ballpark’ on earnings estimates. While interest rates remain near zero, markets are free to justify lofty valuations on companies irrespective of their earnings or profitability. Interest rates this year have started to rise, prompting investors to revise their perspective on asset valuations.

Flows – On the flip side, we virtually never know what investors’ sentiment or appetite for stocks is going to be at any given time. If investors suddenly become fearful (be it for logical or irrational reasons), demand for stocks and risk assets can dry up and we could see valuations contract even if companies are delivering on profits. Investors have obviously also been known to become euphoric and speculative, causing multiple expansions and even bubbles (tech bubble, housing bubble, etc.).

No one can know if this time is different, but given today’s backdrop of higher and stickier inflation, policy tightening, and geopolitical risks, it makes sense to ensure your portfolio is appropriately allocated. Selectivity is going to be more important going forward as fundamentals return to focus.

Call me with questions.

-Paul

Chart of the Month

Article of the Month

Housing sector gets work-from-home boost

More Americans working from home has proved a game-changer for housing

Housing demand is expected to outstrip capacity in 2022 with home prices, rents, and mortgage rates forecast to rise. A major factor shaping housing dynamics is the shift to work from home (WFH) in response to the COVID-19 pandemic. Untethering workers from physical proximity to offices means more flexibility to choose where they live.

WFH a success

“From our perspective, the wildly successful mass social experiment in WFH is leading to a productivity boom, with lasting changes in both employment arrangements and housing preferences,” said Buck Horne, CFA, director of equity research at Raymond James.

- 83% of employers report WFH a success.*

- 91% of workers currently working at least partly remote are hoping to maintain WFH flexibility post-pandemic.**

- 49% of remote workers suggest losing WFH options would increase their likelihood of looking elsewhere for employment. 31% said it was “extremely likely” a loss of WFH options would cause them to look for new employment.**

Expect more Sun Belt migration

Given new options to live where they want, workers are now increasingly empowered to vote with their feet. High-cost, high-tax markets will see significant outmigration to Sun Belt states. “Looking ahead, we think the job growth and population shifts into the Sun Belt markets will keep coming. We see more pricing power available in markets with deepening housing shortages, particularly in Florida, Arizona, Nevada, Texas, and North Carolina,” Horne said.

Domestic outmigration from high-tax states has been a consistent trend for many years. What’s different now is that the inflow of young, talented workers has shifted, WFH flexibility will prove enduring, and employers have responded by moving jobs and offices to these lower-cost locations. Accordingly, the states with the deepest housing shortages are also the areas where homebuilders have the greatest ability to build new single-family homes.

WFH helps solve for affordability

The de-densification movement could also open up more land locations for potential development, helping solve the housing affordability dilemma. Home prices and effective rent levels, while decelerating from 2021 levels, will both grow above historical trends and likely outpace core inflation in the U.S. economy, according to Raymond James Equity Research.

The unprecedented fiscal response to the pandemic has also poured a record level of liquidity into U.S. households and businesses, which may help bolster housing trends. Mortgage rates will steadily rise in 2022, but at a controlled pace. Affordability will remain reasonably balanced at a local level, due to strong household income growth, sizeable down payment availability, and the disinflation effect of population migration.

Fueled by positive household demographics, economic growth, and the durability of WFH, Horne expects housing demand will outstrip industry production capacity well into the foreseeable future, providing a range of opportunities for investors. Investor home purchases typically account for 10-15% of total home sales. In September 2021, the monthly share of investor home purchases was over 26%, according to Raymond James Equity Research.

“The housing ‘supercycle’ is still in its early innings, with years of growth ahead,” said Horne.

*Source: PwC, 2021

**Source: Gallup, September 2021

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Insights & Discovery