“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

~ Benjamin Graham, economist, professor, investor, and author of “The Intelligent Investor”

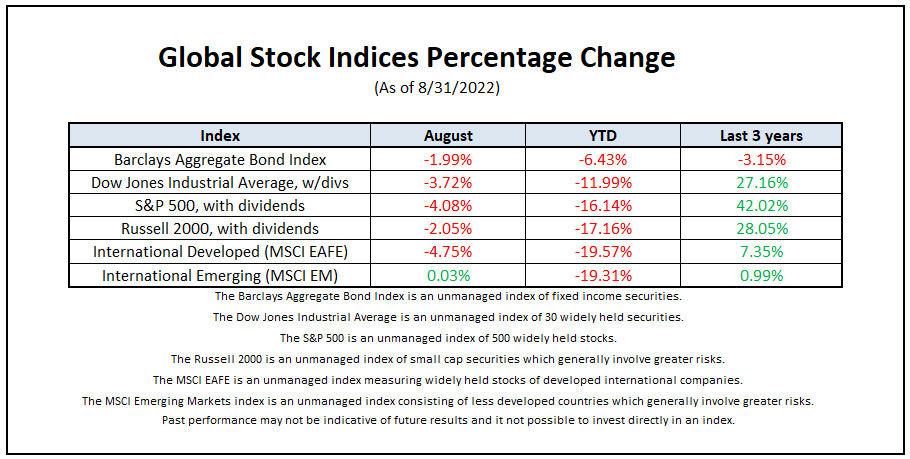

The Federal Reserve’s resolve, the end of a rally, trouble overseas and a strong jobs growth report were some of the ingredients of August’s strange brew of market news and events.

We entered August in the midst of an upswing for stocks that had provided consistent, broad gains since mid-June, likely bolstered in part on the belief that the Fed would cease its interest rate raising plan. The momentum faded mid-August. Then Federal Reserve Chairman Jerome Powell deflated the optimistic speculation. Powell’s blunter than usual statement may have added to volatility as we saw the markets decline and give up half of their summer gains.

To mix the signals further, the July jobs report indicated a surprising 528,000 non-farm hires – a number counter to expectations as the Fed tightens the money supply. We also saw second quarter gross domestic product estimates revised – still showing the economy shrank, but to a lesser degree than earlier reports.

Despite the drama at home, the larger global economic news is happening elsewhere, where the outlook is less mixed than in the U.S. Energy crises in Europe, the U.K. and China continue to hamper those economies, with drought and low water levels further complicating electricity supply in Europe. Europe and the U.K. remain on the brink of recession as their central banks try to rein in high inflation by raising key interest rates – which often produces economic slowing.

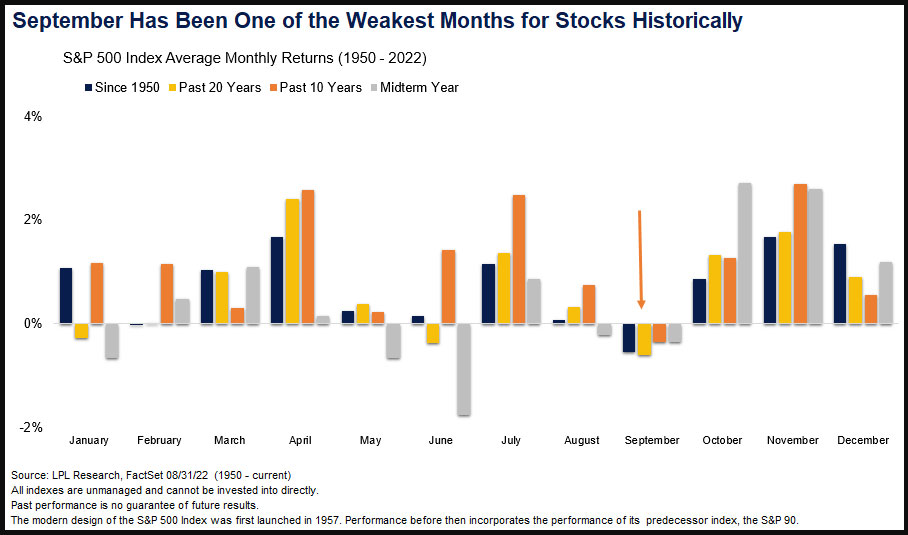

September has historically been one of the weakest months of the year for stocks, see Chart of the Month, below. With the many cross currents at play this is not very uplifting. However, during midterm election years, if history is a guide – the best three months of the year have been October, November and December.

We live in interesting times and volatility remains a constant companion. While the worst of this bear market may be behind us, don’t expect unbridled enthusiasm to follow. Expect setbacks and normal back-and-forth trading ahead, as investors gain more clarity on the path of inflation within the Fed’s tightening program.

Thank you for your continued confidence as we navigate the world and its markets together.

If you have a question, would like to discuss what’s going on or just want to check in, please reach out at your convenience.

Have an enjoyable Labor Day weekend ahead!

-Paul

Noteworthy links:

- Lyn Alden: August 2022 Newsletter

- RJ: Fed is once bitten, twice shy on inflation

- RBA: Charts for the Beach 2022

The Seasonality of Markets

Finding Your 'Why' for Your Desired Financial Behavior

By Dr. Joshua J. White

Published on the White Coat Investor Website on June 8th, 2022.

Who doesn’t like a burger and fries every once in a while? It turns out most people do. It is estimated that the average American spends $1,200 per year on fast food. Why do we spend so much money on fast food? Is it because we don’t know how bad it is for you? Likely not. In 2004, the Super Size Me documentary showed what happened to a man’s health after only eating at McDonald's for an extended period of time. It didn't go well for him. Did that change the habits of daily McDonald’s eaters? In 2017, McDonald's made a whopping $37.5 billion in sales in the US alone. That's almost three times as much as the runner-up in fast food—Starbucks. Clearly, knowledge of what we should do or what we are “supposed to do” is not enough to change behavior. We know more and more each year about health, and yet, the lines at McDonald's have never been longer.

If knowledge isn’t enough to change behavior, what is?

Knowing what you are supposed to do usually isn’t enough to create lasting change. People usually don’t drastically change their diet or lifestyle based on a simple recommendation from a physician or other professional.

Instead, they find the reason they want to change inside themselves. To effectively change financial behavior, each individual needs to dig deep and find their “why.” Finding a reason to change helps you remember motivation when hard decisions come and when you need to sacrifice for your priorities.

Will I allow things in my life to stay the same, or am I committed to, even desperate for, a change? Will I keep on waiting in line for a Big Mac and fries, or can I become a healthier person, at least on a financial level?

When I found my “why” for financial behavior, I wasn’t content to remain the same anymore. The desire grew within me and prompted me to make sacrifices. What made the difference? I found reasons that matter more to me than the sacrifices I had to make. Below are some of my reasons why. These include being inspired by others enjoying financial freedom, learning from my parents' mistakes, looking forward to eliminating my student loan burden, and more. Everyone has different reasons to change, but I invite you to deeply consider your financial “why.” Focusing on these personal reasons will make it easier to change.

Your financial “why” might include some of the following:

Seeing Other People Enjoy Financial Freedom

In 1954, medical student Roger Bannister redefined reality when he ran a mile in less than 4 minutes, something that had never been accomplished. Seeing what other people have accomplished has expanded my dreams. I didn’t even know it was possible to plan to retire early, pay off debt in only a couple of years, or realistically live off the interest of your investments. Because I’ve been surrounded by good financial mentors, I have a better idea of what’s possible, and I’ve adjusted my dreams. If you want to change, get inspired by the financial Roger Bannisters around you.

Avoiding Others’ Financial Mistakes

While it is good to learn from your mistakes, it is even better to learn from the mistakes of others. My parents are wonderful people, and I am very grateful for them. However, when it comes to finances, I have learned from their mistakes. They didn’t plan well for retirement (or even know how to do so), and they never learned how to invest their money.

Because of my close relationship with them, I've seen the results of their cumulative financial behavior. I know I desperately want different results, and so I know I need to live differently. It is natural to emulate the behavior of your parents or those who raised you; the default is to be similar. To be different, there needs to be intentional, consistent strategic effort.

Although this situation can be less than ideal, it can provide powerful motivation to propel you to be successful. Some of the most lifechanging lessons we learn from others come from observing their mistakes. I am grateful to my parents for allowing me to see both their strengths and weaknesses intimately so I could have the gift of their experiences in learning who I want to be. These experiences have been essential to help me develop my personal motivation. Taking the time to think about and decide what you want to do differently can be an important part of finding your motivation to change.

Eliminating the Bondage of Debt

J. Reuben Clark, a corporate attorney and religious leader who lived through the Great Depression, said this about debt: “Interest never sleeps nor sickens nor dies; it never goes to the hospital; it works on Sundays and holidays; it never takes a vacation; it never visits nor travels; it takes no pleasure; it is never laid off work nor discharged from employment; it never works on reduced hours . . . Once in debt, interest is your companion every minute of the day and night; you cannot shun it or slip away from it; you cannot dismiss it; it yields neither to entreaties, demands, or orders; and whenever you get in its way or cross its course or fail to meet its demands, it crushes you.” Through the course of my medical training, I have acquired more than $400,000 in student debt. That amount sickens me, and it is a companion I want to eliminate as soon as possible. While some may argue that debt can be good, this debt isn’t tied to a tangible asset—just to my medical training. There is enough in life to worry about; I don’t want my student loans to add to them. However, because of the astronomical amount of student loans I carry, it has motivated me to learn how to become free. I am determined to do so. Developing a financial plan has turned my student debt from an oppressive burden to an incentive to fight for financial freedom. Instead of ignoring it, I invite you to let the hope of eliminating debt add to your financial motivation.

I Have a Dream

If you have seen the Disney movie Tangled, you know that a dream Rapunzel had motivated her to leave her tower and her comfort zone behind. I have found that taking time to dream has dramatically increased my motivation to improve my financial behavior. I’ve got a dream, do you?

What would you do if you had an additional $5 million in your bank account, tax-free? How would this change your behavior?

These are questions I like to ask because it allows you to dream. Listening to both the Physician on Fire and the White Coat Investor talk about what they did when they became financially free is really intriguing. I love being in medicine, but I have a lot of other interests and dreams, too. When I become financially independent, I plan on working less and chasing down some of my dreams. These include teaching, serving another mission for my church, starting a health and wellness center, and maybe even living in another country for a period of time. The possibilities are exciting! Is it worth living like a resident for a few more years to achieve some of these dreams? Definitely.

If you were financially independent, what dreams would you pursue?

Desire to Improve Relationships

In my time with people near death, I never hear regrets that they wished they would have worked more, made more money, or purchased that nice car. The things that seem to make the biggest difference in a person’s life are their relationships. Becoming financially free allows you to create more time with those you love, and as one of my favorite speakers and religious leaders Dieter F. Uchtdorf says, “Love is really spelled T-I-M-E.” Is this a motivation for you to become financially free?

Additionally, research shows that spending money on experiences with loved ones influences your happiness to a much greater degree than spending money on possessions. When status symbols fall into their proper place in your priorities (far below relationships), it is easier to avoid superfluous purchases and instead use your money to create lasting memories. What can you do today to change financial behavior to improve your relationships?

Be Happier

If nothing else motivates you to change your behavior, do it to be happier. At the end of the day, if your financial behavior isn’t maximizing your happiness (both short-term and long-term), I encourage you to re-evaluate your financial priorities. The goal is to enable you to be happier now and happier later. In some cases, that might involve spending more, and that's OK. Sometimes you make sacrifices now to ensure you have more freedom later in life. Maybe you’ve decided to work a few more years so you can spend quality time with your family in the present. Whatever you decide, I have found when my focus is on maximizing my happiness, my desire to change my financial behavior increases.

Focusing on my financial financial “whys” has increased my desire to make real changes today. Instead of wishing I wanted to be more frugal, keeping the “why” in mind has focused me to do so. If you find yourself wishing you had more desire to make financial changes, I invite you to find your “why.”

Here is a link to the full article: Finding Your ‘Why’ for Your Desired Financial Behavior

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery