“The big money is not made in the buying and selling, but in the waiting.”

~ Charlie Munger

Prologue

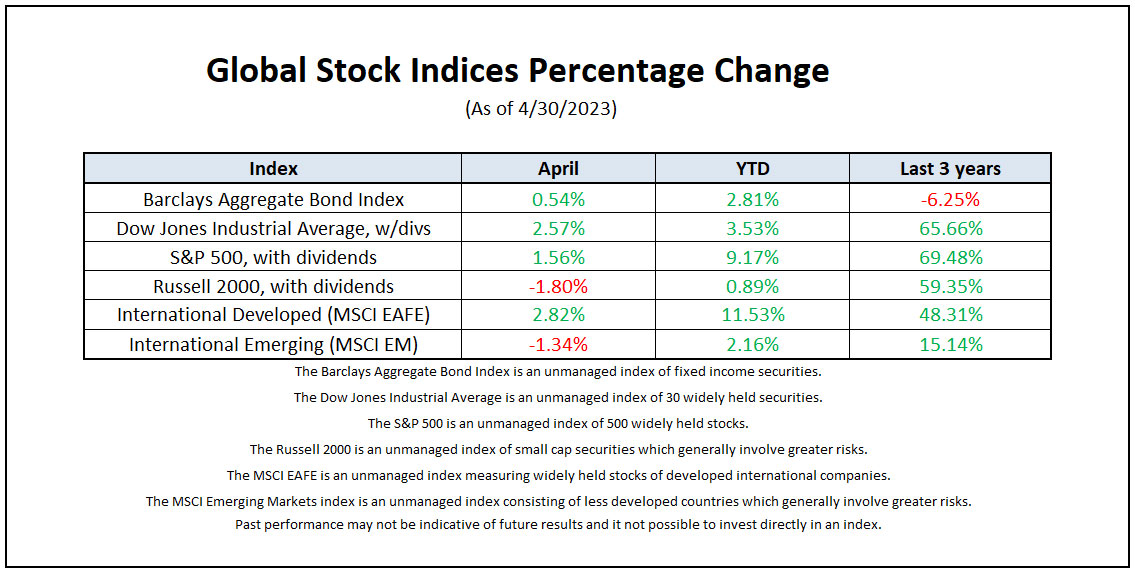

Markets are off to a strong start to the year with the rally driven by a variety of factors. Most notably we’ve seen the labor market remain resilient adding roughly 1 million new jobs since the start of the year thanks largely to an improved labor participation data. Inflation remains high, CPI inflation stands at 5%, down from its high of 9% in June 2022 and does appear to be trending lower. Most importantly, the Federal Reserve appears to be nearing an end of their rate hikes. The market is pricing in one additional 25bps rate hike this month. The market continues to expect that the Fed will cut rates by the end of the year. My expectation is that the Fed pause and keep rates where they are.

A question I’ve been grappling with is whether this recent market rally can be trusted or is this simply a bear market rally?

Reasons to be bullish:

Current valuations – Valuations remain just above the 25-year average. Measured by the forward P/E (price to earnings ratio), the S&P 500 forward P/E is 18.8x. This is slightly above the 25-year average of 16.8x.

Corporate earnings remain strong – As of the end of April, roughly 79% of the S&P 500 companies that reported earnings exceeded analysts’ estimates.

Labor and demand remain healthy – The US economy grew by 1.1% (quarter-over-quarter, annualized) driven by strong consumer spending (+3.7%) which grew at the fastest pace in almost two years. Although there have been layoffs in certain sectors, consumer demand remains strong.

Slowing inflation – As inflation continues to trend lower, one could expect to see market sentiment and valuations improve.

Reasons to be bearish:

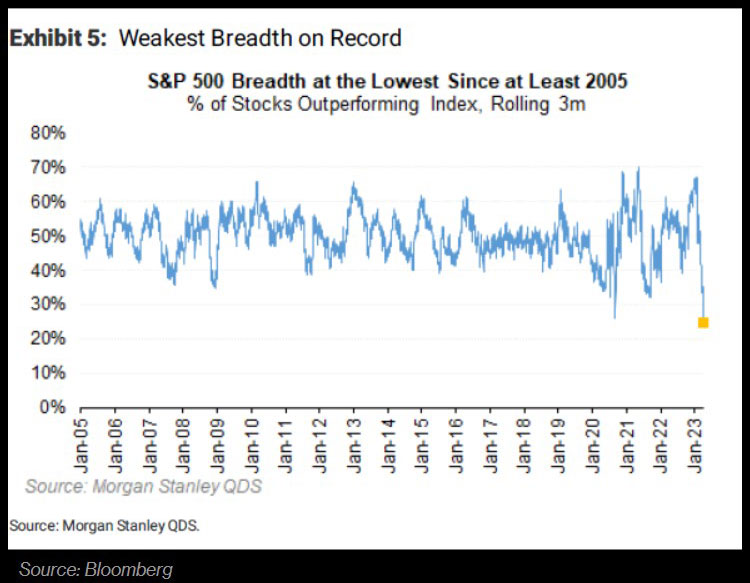

The market breadth is narrow – The rally in the S&P 500 has been driven by only a handful of mega cap tech stocks. Markets are strongest when they are broad and weakest when they are narrow. See chart of the month below.

Leading economic indicators continue to point down – Leading economic indicators have been negative for the last 12 months and consumer sentiment remains low.

The US yield curve remains inverted – Since October 2022, the yield on the 3 month US bill has been greater than that on a 10-year Treasury. Historically an inversion of the yield curve has been a predictive precursor to a recession.

US debt ceiling standoff – This obscure headline risk, which is gaining attention is difficult to prepare for. Investors trying to price in the potential outcome and impact of a such a risk is challenging. If anything we’re likely to see an increase in volatility we approach this issue. The sheer size of the current debt and the level of political division surrounding it provides added concern. Our base case is that a last-minute resolution is the most likely scenario. See article of the month below.

Bottom line –

The Fed’s goal of reducing inflation by slowing the economy has been expected to induce a recession, though its arrival has been delayed thanks to a strong market, resilient economy and tight labor market. Investors should continue to be mindful of the risks they’re taking. Investing is not a game of perfect. Be patient and most importantly focus on what you can control.

Please reach out with questions.

-Paul

Noteworthy links:

- RJ: Effects of the Fed's interest rate hikes starting to show

- Lyn Alden: Navigating the Debt Ceiling Impasse

- Howard Marks: Lessons from Silicon Valley Bank

Chart of the Month

The rally in the S&P 500 has been driven by only a handful of stocks

Article of the Month

Debt ceiling showdown: Should investors worry?

Stop us if you’ve heard this one before: U.S. lawmakers are clashing over a legislative action to raise the federal debt ceiling. The issue has been percolating for months but could come to a head this summer as the U.S. Treasury starts running out of money to pay its bills.

The decision to increase the nation’s debt limit is often a routine one — except in years when Congress is divided, like it is now. With Republicans controlling the House of Representatives and Democrats in command of the Senate, the scene is set for what could be one of the most contentious debt ceiling showdowns in recent history.

So far, Democrats have said they won’t negotiate on the issue, while many Republicans have said they won’t vote to lift the debt limit without some additional agreements to curb federal spending.

“This could be the worst standoff we’ve ever witnessed,” says Capital Group political economist Matt Miller. “It certainly has the potential to be at least as bad as 2011.”

That’s the year Standard & Poor’s cut the United States’ prized AAA credit rating to AA-plus (where it remains) amid concerns about the government’s budget deficit, a growing long-term debt burden and political conflicts over raising the debt limit. The move unnerved U.S. financial markets for a time, but they quickly recovered.

In fact, not long after the 2011 credit rating action, U.S. stocks embarked on one of the longest bull markets in history — a virtually uninterrupted run from 2011 until the start of the COVID-19 pandemic.

“I think the lesson from 2011, and a subsequent debt ceiling impasse in 2013, is that these events can disrupt markets for a while — sometimes even weeks or months — but if we look at history, they don’t tend to have a lasting impact on investors,” Miller says. “That’s assuming we get a reasonable resolution.”

On Wednesday, House Speaker Kevin McCarthy unveiled legislation that would raise the debt limit by $1.5 trillion. The bill also includes several other provisions to curtail federal spending. It remained unclear whether there were enough votes to pass the bill in its current form.

What happens if the U.S. defaults on its debt?

Of course, the worry is that the U.S. could — in the middle of a particularly nasty debt ceiling impasse — wind up in technical default on its many debt obligations, including payments to bond holders. It’s hard to predict what might happen next, but there are many who say it would roil the financial markets and jeopardize the U.S. dollar’s status as the world’s reserve currency.

The chances of a technical default — which would occur should a bond payment be missed or even delayed — are very low but not zero, according to Tom Hollenberg, a Capital Group fixed income portfolio manager.

“It's important to make a distinction between the situation we are facing in the U.S. and something much worse, like an Argentina-style default, where investors lose their savings. Nobody seriously believes that will happen here,” Hollenberg says. “In the U.S., the probability of even a technical default, or a delayed payment, is between 5% and 10%, in my view. It’s certainly not my base case, but it’s something I can’t ignore either.”

If the U.S. missed a payment on a short-term note due in June, for example, it would spark an outcry in the markets, accompanied by extreme volatility for a day or two, Hollenberg explains, and then the debt ceiling impasse would likely come to an end.

“When you reach a crisis, that tends to put the political gears in motion,” he adds. “If that happened, I think Congress would very quickly come together and raise the debt limit, and investors would be made whole.”

The law of unintended consequences

That doesn’t mean there would be no consequences for a technical default. The rating agencies could slash the U.S. credit rating again. Investors could drive up the cost of future U.S. debt issuances. And, perhaps worst of all, some investors may no longer regard U.S. Treasuries as the safest investment in the world.

“We don’t really know whatthe downstream implications would be,” Hollenberg says. “For example, there are banks whose ratings are somewhat linked to U.S. sovereign ratings. There are insurance companies in the same situation, as well as agencies like Fannie and Freddie. It’s difficult to know what would happen to them if one or more of the rating agencies were to downgrade the U.S. again.

“We could wind up with cascading downgrades, and that would be a real problem for some financial institutions,” he warns. “It’s not something we can just gloss over, and it’s why we need a timely resolution. I do think we will get one, I just hope it comes before we encounter any unintended consequences.”

How much debt is too much?

From the point of view of an equity investor, the U.S. debt ceiling debate makes for interesting political theater, but it’s not something that weighs too heavily on investment decisions, says Steve Watson, a portfolio manager with New Perspective Fund®.

“At the same time, I don’t think it’s necessarily a bad idea to have an occasional reminder that the United States is more than $30 trillion in debt,” Watson notes. “Maybe it’s time to engage in a serious discussion about long-term fiscal responsibility.”

Here is a link to the full article: Debt ceiling showdown: Should investors worry?

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery