What is mental accounting?

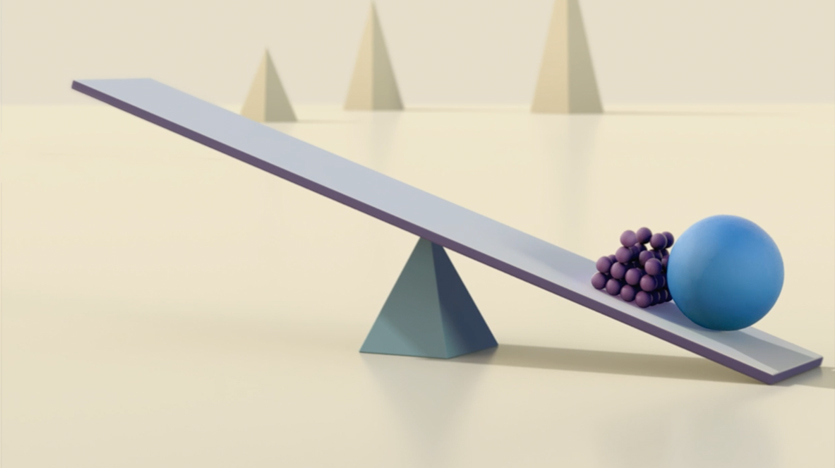

Mental accounting is the tendency to treat the same thing – money, in particular – differently depending on where it came from or what we intend to do with it.

This behavior can also cause people to hyperfocus on one account without considering the full scope of their finances.

Mental accounting = missed opportunity?

All money is interchangeable, but mental accounting keeps us from treating it that way, leading us to sort assets into distinct “accounts” both figuratively and literally. The tendency to “sort” a windfall, for example, into a different mental account from other income sources can pose a huge threat to your finances. You see it in the incredible rates at which lottery winners end up bankrupt, or how 80% of professional athletes deplete their fortunes within just three years of retiring.

For most, mental accounting operates on a smaller scale, like spending an unexpected inheritance on a luxury item instead of saving it.

When mental accounting factors into your financial decisions, you might:

- Undercut your financial progress by treating certain inflows (bonuses, tax refunds) as more “spendable” than others (like your regular paycheck).

- Lock in losses if you’re saving in low-risk vehicles but paying higher interest rates on debt.

- Miss out on gains if you’re liquidating investments to pay off low-rate debt faster than necessary.

- Trigger the wash sale rule if you sell a security for the tax benefit in one account but unwittingly repurchase a substantially identical security in another.

Mental accounting is one of the surest ways to keep a financial plan from reaching its full potential. Fortunately, it doesn’t have to keep you from seeing the big picture of yours.

Break out of mental accounting

- 1. Treat money with the same careful consideration no matter where it comes from or how you plan to use it.

- 2. Take a step back to look at your overall financial picture. Leverage tools from your financial institutions that provide a comprehensive view of your various accounts.

- 3. Don’t interrupt your financial progress by changing spending habits based on one “bucket’s” short-term performance.

- 4. Talk with your children and heirs about what it took to build your wealth and what your wishes are for its future so they don’t see it as a “lottery win” and misspend.

- 5. Look for help. In the case of your financial future, it helps to work with an objective third party – like an experienced financial advisor – who can offer perspective in addition to wealth planning and investment support.

While it’s important to pay attention to the little things when it comes to your finances, don’t let the pieces make you lose sight of the whole. Sometimes the most important step toward achieving your long-term financial goals is taking a step back.