A full scope of services to meet each client’s needs

We provide disciplined financial planning for the professionals, executives, families, foundations and retirees we serve. We derive a great degree of satisfaction from helping such a diverse range of people and their families plan and prepare for the many milestones in their lives. The comprehensive services we offer are designed to address all important and relevant financial matters, among them asset management, estate planning, retirement planning and college planning.

-

We employ a disciplined and coordinated approach to address the complexities that often accompany the accumulation of wealth. It is customized to your needs and preferences and often involves collaboration with other professionals such as your CPA and attorney – all designed to help bring total cohesiveness to your financial life.

Our components of wealth management include:

- Financial planning

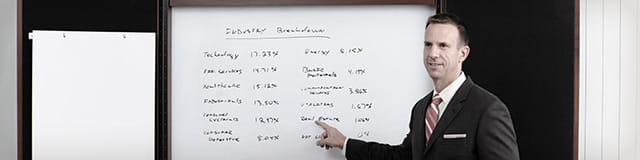

- Investment management

- Asset allocation

- Estate planning

- Trust services

- Retirement planning

- Risk management

- Tax planning

- Insurance planning

- Business succession planning

- Multigenerational planning

- Wealth transfer

- Charitable giving strategies

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

-

Foundations and endowments seek an investment approach that is conservative in nature and designed to carefully create growth while preserving assets. We work with investment committees and boards to help them fulfill their obligations to their foundations by assisting with the development of spending plans, determining the most appropriate asset allocation, and helping select and review investment choices.

-

We work with employees of our businesses clients to provide group education and one-on-one guidance on using their employee retirement benefits including 401(k) programs, health savings accounts and other perks of employment. We work to demystify financial concepts so employees can pursue retirement with more confidence and control. In addition to helping employees pursue their financial goals, it can also help the business retain talent and remain competitive amid the tight competition for skilled associates.

We also support businesses in helping establish and manage their company retirement plans, helping select fund options and third-party specialists to help meet their fiduciary responsibilities, as well as a host of other related services.

There is no assurance any investment strategy will be successful. Investing involves risk including the possible loss of capital. Asset allocation and diversification do not guarantee a profit nor protect against loss. Raymond James does not provide tax or legal advice. Please discuss these matters with the appropriate professional.