A Harsh Dose of Mortality

Dear Clients and Friends:

“If you look into an abyss, the abyss looks into you.” Friedrich Nietzsche, the often-quoted philosopher, is the originator of this comment. Hal Holbrook’s character in the movie Wall Street, however, used this as his comeuppance comment to Bud Fox upon his arrest.

Apologies to those who are now suffering flashbacks to their Intro to Philosophy classes, but I feel like I have recently looked too deep into this vast darkness.

Nietzsche proposed that the abyss expresses our deepest and darkest fears. My fear is being ill. I don’t think I’m alone in this, but I’m the guy who thinks that every headache I have could be a tumor and every time I misplace my keys it’s the start of extreme cognitive decline. Yes, a hypochondriac.

Very recently, I was hospitalized for a twisted bowel. A malady that seems to be random but can be result of scar tissue. In my case, an appendectomy over 20 years ago. I will not terrorize you with the symptoms, but I will instead focus on the cure.

Those unfortunates that had to have a Nasogastric (NG) tube inserted will know what I mean. Simply put this is a tube inserted through the nose, down the throat, and into the stomach. This is a surprisingly a long distance and the application can often require a strong attendant to hold you down. Yes, I was awake!

I think we can all agree that the greatest wealth is your health. And when that health is challenged, you are willing to negotiate everything in exchange to get healthy. I believe in G-d, as I hope he believes in me, and thus my negotiation began. We have all had this conversation and I believe they all go the same way. Eventually, the mind turns toward the abyss. If negotiations fail (I’m reminded of the gospel song “Your Arms Too Short to Box with G-d”), am I prepared?

At this time in my life, I’ve already lost that feeling of invincibility, but I’ve never seriously considered the alternative. The abyss challenged me to think about “What Happens If?” I wish I could lay out invaluable words of philosophical wisdom that will be quoted years from now. Instead, I focused on things I can control. Pardon the transition to the Estate Planning conversation, but that is what we can control.

Let my story be an opportunity for you to update and check on Wills, Trusts, Powers of Attorney, Health Care Proxies, Beneficiaries, and Transfer on Death Accounts. These are some of the things we can control in our lives and that will allow you to have a few less things to worry over. We can help and stand ready to review these essential matters with you.

The rest of the story is happy for me. After two days in the hospital, my abdomen corrected itself. I stared into the abyss, and it told me I have a lot more work to do before I’m done. My passion for helping others has never been stronger and I cherish every moment I spend with my family and friends. My name is Jonathan Cohen and I approve this message.

Now on to your regularly scheduled program…

Quarterly Insights – October 2024

Fed Rate Cuts and Solid Earnings Overcome Rising Economic Anxiety

Markets were volatile in the third quarter as investors faced political turmoil and increased uncertainty about future economic growth, but the return of Fed rate cuts and solid corporate earnings helped to offset those political and economic anxieties, and the S&P 500 hit another new all-time high and finished the quarter with strong gains.

Markets started the third quarter with a continuation of the first-half rally thanks to good Q2 earnings results and generally solid economic data. However, while the S&P 500 hit a new all-time high in mid-July, the second half of the month proved more volatile. That volatility was driven by an intense rotation within the S&P 500 from the heavily weighted tech sector (more than 30% of the S&P 500) to other, smaller market sectors such as utilities, financials, and industrials. The impetus for this dramatic rotation was a combination of profit taking following the substantial AI-driven tech stock rally and a larger-than-expected decline in inflation which caused Treasury bond yields to fall sharply as investors anticipated imminent rate cuts by the Fed. That expectation boosted the economic outlook and caused investors to rotate towards market sectors that benefit more directly from a strong economy. So, while investors didn’t exit the market entirely, the decline in the tech sector weighed on the S&P 500 and was not fully offset by gains in other, smaller market sectors. The S&P 500 finished July well off the mid-month highs and with just a small gain, up 1.1%.

The late-July volatility continued in early August as a much-weaker-than-expected July jobs report, released on August 2nd, added to economic concerns. The unemployment rate rose to the highest level since November 2021 and investors’ fear of an economic hard landing triggered a sharp, intense decline that saw the S&P 500 fall 3% on Monday, August 5th, the worst one-day selloff in nearly two years. However, that decline proved brief as economic data over the next few weeks was generally solid and that helped calm investors’ anxieties. Then, on August 23rd, at the Kansas City Fed’s Jackson Hole Economic Symposium, Fed Chair Powell told markets the “time had come” for the Fed to cut rates. That all but guaranteed a rate cut at the September meeting. That message further fueled the rebound in stocks and the S&P 500 finished August with a 2.3% gain, completing an impressive rebound from early-month weakness.

The rally continued in September thanks to growing expectations for a large Fed rate cut that offset lackluster economic data. The August jobs report, released in early September, was another disappointment and again increased concerns about an economic slowdown and stocks were modestly volatile to start the month. However, following that report, numerous financial journalists and ex-Fed officials made public calls for the Fed to cut interest rates by 50 basis points at the September meeting and expectations for a larger-than-expected rate cut helped offset underwhelming economic data and the S&P 500 hit a new all-time high ahead of the Fed decision. Then, on September 18th, the Fed met market expectations and cut rates for the first time in four years and promised additional rate cuts between now and year-end. Investors welcomed this news and the S&P 500 surged to a new high and finished the month and quarter with more solid gains, adding to the strong year-to-date return.

Finally, politics and the looming presidential election did impact markets during the third quarter. Investors started the quarter expecting a Trump victory and Republican control of Congress, based on polling following President Biden’s struggles at the June debate and after the failed assassination attempt on the former president. However, those expectations changed rapidly following Biden’s withdrawal from the race and nomination of Vice President Kamala Harris. As the third quarter ended, national polls slightly favored Harris while the outlook for the control of Congress remained uncertain.

Third Quarter Performance Review

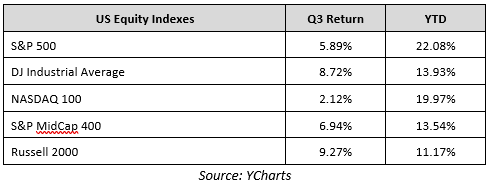

Investor expectations for falling interest rates and bond yields were the major influences on index, sector and factor performance during the third quarter, as markets were broadly positive but with some notable changes in leadership.

Starting with market capitalization, small caps outperformed large caps for the first time in 2024 as investors rotated out of large-cap stocks and into more economically sensitive small caps, as they historically have received the most benefit from lower borrowing costs that come with falling interest rates.

From an investment style standpoint, value handily outperformed growth, although both investment styles posted positive returns for the third quarter. The outperformance of value was evidence of the significant rotation we saw from the tech sector (which dominates most growth funds) to lower P/E and more economically sensitive parts of the market such as financials, industrials, utilities, and others.

On a sector level, nine of the 11 S&P 500 sectors finished the third quarter with a positive return and that continued the broad year-to-date rally we’ve all enjoyed. Evidence of the influence of lower yields on returns can be seen in the sector outperformers, as utilities and real estate, two sectors that have relatively large dividends and benefit when bond yields are falling, handily outperformed the remaining nine S&P 500 sectors.

Looking at sector laggards, the tech and energy sectors were the only sectors to finish the third quarter with negative returns, as investors rotated out of tech and towards those higher dividend and more cyclically sensitive sectors. Energy, meanwhile, was the worst performing sector in the quarter as concerns about global growth (especially in China) weighed on oil demand expectations.

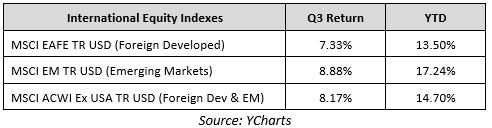

Internationally, foreign markets outperformed the S&P 500 in the third quarter as the relative underperformance of the tech sector was a headwind on S&P 500 returns. Foreign developed markets saw a solid rally in the third quarter as investors anticipated additional rate cuts from the European Central Bank and other major global central banks. Emerging markets also outperformed the S&P 500 and foreign developed markets as the Chinese government announced numerous stimulus measures late in September and that boosted Chinese stocks and emerging market indices and ETFs.

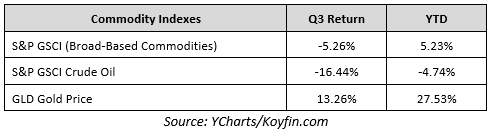

Commodities were mixed, but in aggregate saw moderate losses in the third quarter thanks mostly to weakness in oil prices. Oil declined sharply in Q3 as global demand expectations were reduced courtesy of soft Chinese economic data early in the quarter and on generalized global growth concerns. Gold, however, staged a strong rally thanks to elevated geopolitical uncertainty and the weaker dollar, as gold hit a new all-time high in Q3.

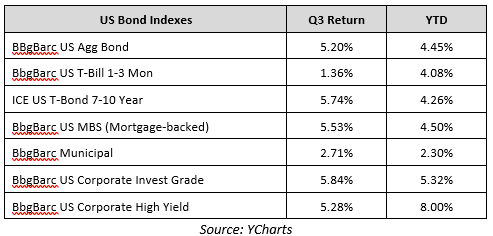

Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) saw a very strong quarterly return thanks to a combination of falling inflation, mixed U.S. economic data and as investor’s anticipation of an aggressive rate cutting cycle from the Fed.

Looking deeper into the bond markets, longer duration bonds handily outperformed those with shorter durations as investors reached for longer-term yield amidst falling inflation and underwhelming labor market data. Shorter duration bonds also saw a positive return, however, as investors anticipated the start of an aggressive rate-cutting cycle by the Fed.

Turning to the corporate bond market, investment grade bonds outperformed lower quality “junk” bonds although both saw strong quarterly gains. For the first time in 2024, investors favored investment-grade bonds amidst increased economic uncertainty, as investors sought the safety of higher-rated bonds over increased yield.

Fourth Quarter Market Outlook

With the start of the Fed’s rate cutting cycle now behind us and the general pace of future cuts now broadly known, focus for the final quarter of 2024 will turn towards economic growth and politics. Given the volatile nature of both, it’s reasonable to expect periods of elevated volatility over the coming months (but, as we saw in the third quarter, markets can still move higher even amidst increased volatility).

Starting with economic growth, expectations for aggressive Fed rate cuts helped investors look past some soft economic reports in Q3, especially in the labor market. However, with those rate cuts now behind us, we should expect markets to be more sensitive to any disappointing economic data, especially in the labor market. Bottom line, with the S&P 500 just off record highs, the market has priced in a soft economic landing, so if the economic data in Q4 is weaker than expected and recession fears grow, that will increase market volatility between now and year-end.

Politics, meanwhile, will become a more direct market influence as we approach the November 5th election. Depending on the expected and actual outcome, we could see an increase in macro and microeconomic volatility that could impact the broader markets as well as specific industries and sectors (e.g. oil and gas, renewables, financials and others). That volatility will stem from the uncertainty surrounding potential future policy changes (or lack thereof) towards important financial and economic issues such as taxes, global trade and the long-term fiscal health of the United States.

Finally, geopolitical risks remain elevated and while the war between Russia and Ukraine and the ongoing conflict between Israel, Hamas and now Hezbollah hasn’t negatively impacted global markets this year, that’s always a possibility and these situations must be consistently monitored as the spread of these conflicts would impact markets, regardless of any Fed rate cuts or election outcomes.

In sum, as we start the fourth quarter the market does face economic, political and geopolitical uncertainties. But market performance has been very strong in 2024; momentum remains decidedly positive, and this market has proven resilient throughout the year. Additionally, current economic data is still pointing to a soft economic landing. Finally, while political headlines may cause short-term investor anxiety and volatility, market history is extremely clear: Over time, the S&P 500 has consistently advanced regardless of which party controls the government and the average annual performance of the S&P 500 is solidly positive in both Republican and Democratic administrations.

So, while there is elevated uncertainty between now and year-end and it’s reasonable to expect an increase in short-term volatility, the fundamental underpinnings of this market remain broadly positive.

At Cohen & Son Wealth Management of Raymond James, we understand the risks facing both the markets and the economy, and we are committed to helping you effectively navigate this investment environment. Successful investing is a marathon, not a sprint, and even bouts of intense volatility are unlikely to alter a diversified approach set up to meet your long-term investment goals. Therefore, it’s critical for you to stay invested, remain patient, and stick to the plan, as we’ve worked with you to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline.

We thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you accomplish your financial goals.

Please do not hesitate to contact us with any questions, comments, or to schedule a portfolio review.

Sincerely,

JONATHAN B. COHEN, AWMA

Managing Director / Branch Manager

Material created by Jon Cohen and Sevens, an independent third party as of October 1, 2024. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. Holding investments for the long term does not insure a profitable outcome. Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss. Investing involves risk and investors may incur a profit or a loss.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. The S&P MidCap 400® provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500®, measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. The MSCI ACWI ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. With 6,211 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI Emerging Markets is designed to measure equity market performance in 25 emerging market indices. The index's three largest industries are materials, energy, and banks.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value. In addition, the securities must be denominated in U.S. dollars and must be fixed rate and non-convertible. The ICE U.S. Treasury 7-10 Year Bond Index is part of a series of indices intended to assess the U.S. Treasury market. The Index is market value weighted and is designed to measure the performance of U.S. dollar-denominated, fixed rate securities with minimum term to maturity greater than seven years and less than or equal to ten years. The ICE U.S. Treasury Bond Index Series has an inception date of December 31, 2015. Index history is available back to December 31, 2004.

The Barclays Capital Municipal Bond is an unmanaged index of all investment grade municipal securities with at least 1 year to maturity. The Bloomberg Barclays US Mortgage-Backed Securities (MBS) Index tracks agency mortgage-backed pass-through securities (both fixed-rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage. The Bloomberg Barclays U.S. Corporate High Yield Bond Index is composed of fixed rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested, and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility and Finance, which include both U.S. and non-U.S. corporations. The Bloomberg Barclays U.S. A Corporate Bond Index measures the investment-grade, fixed rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated. The LBMA Gold Price and LBMA Silver Price are the global benchmark prices for unallocated gold and silver delivered in London. SS&P GSCI Crude Oil is an index tracking changes in the spot price for crude oil. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. One cannot invest directly in an index. Past Performance does not guarantee future results.

Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. Bond prices and yields are subject to change based upon market conditions and availability. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

California Insurance Lic. #0H35606