More than income alone: Annuities for investing and risk management

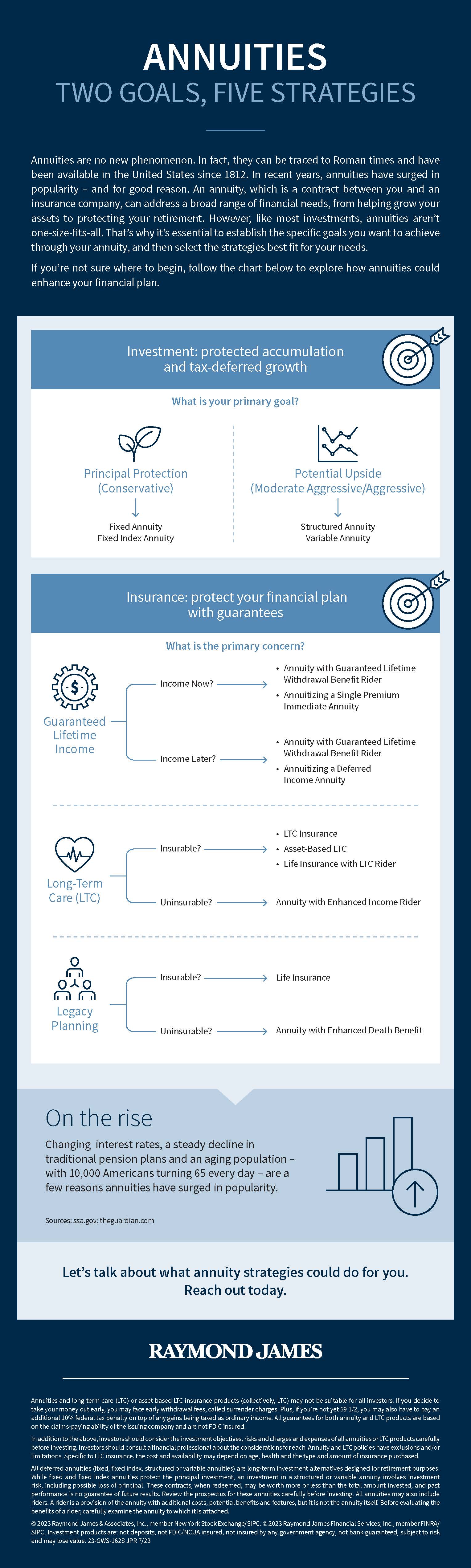

Annuities are multifaceted, sophisticated tools that can serve goals beyond income generation, the role for which they are best known. This series of videos shows how annuities can support investors’ goals two ways, as an investment vehicle providing protected or tax-deferred growth opportunities, or as insurance, long-term healthcare insurance, estate planning and life.

Annuity strategies aren’t one-size-fits-all

RETIREMENT & LONGEVITY

These versatile contracts can help address a broad range of financial needs.

Explore strategies

Insurance and annuities offered through Raymond James Insurance Group. Raymond James & Associates, Inc., and Raymond James Financial Services, Inc., are affiliated with the Raymond James Insurance Group.

These policies have exclusions and/or limitations. The cost and availability of life insurance depend on factors such as age, health and the type and amount of insurance purchased. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition if a policy is surrendered prematurely, there may be surrender charges and income tax implications. Guarantees are based on the claims paying ability of the insurance company.

With variable annuities, any withdrawals may be subject to income taxes and, prior to age 59 1/2, a 10% federal penalty tax may apply. Withdrawals from annuities will affect both the account value and the death benefit. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. An annual contingent deferred sales charge (CDSC) may apply.

A fixed annuity is a long-term, tax-deferred insurance contract designed for retirement. It allows you to create a fixed stream of income through a process called annuitization and also provides a fixed rate of return based on the terms of the contract. Fixed annuities have limitations. If you decide to take your money out early, you may face fees called surrender charges. Plus, if you’re not yet 59½, you may also have to pay an additional 10% tax penalty on top of ordinary income taxes. You should also know that a fixed annuity contains guarantees and protections that are subject to the issuing insurance company’s ability to pay for them.