Lessons from the Past

Back in 1999, I remember very vividly an investment climate that reminds me somewhat of what I see today in certain areas of the equity market. Any company with a “.com” on the end of its name was going public and these stocks were zooming upward. “Business Week” was a popular magazine back then and they had a cover with a monkey at a desktop computer (looking like he was trading stocks) with the cover headline, “WHO NEEDS A BROKER?” Needless to say, not long after that, the mania died a dramatic death…on March 31, 2000, the NASDAQ closed at 4,397.84 (-6.5% off the recent high earlier that week) and went on to bottom out in October of 2002 at 1,108.49 (-76.4% off that earlier referenced high). The NASDAQ did not again cross the 4,397 level again until August of 2014. It took 14+ years for the NASDAQ to leisurely climb back to even!

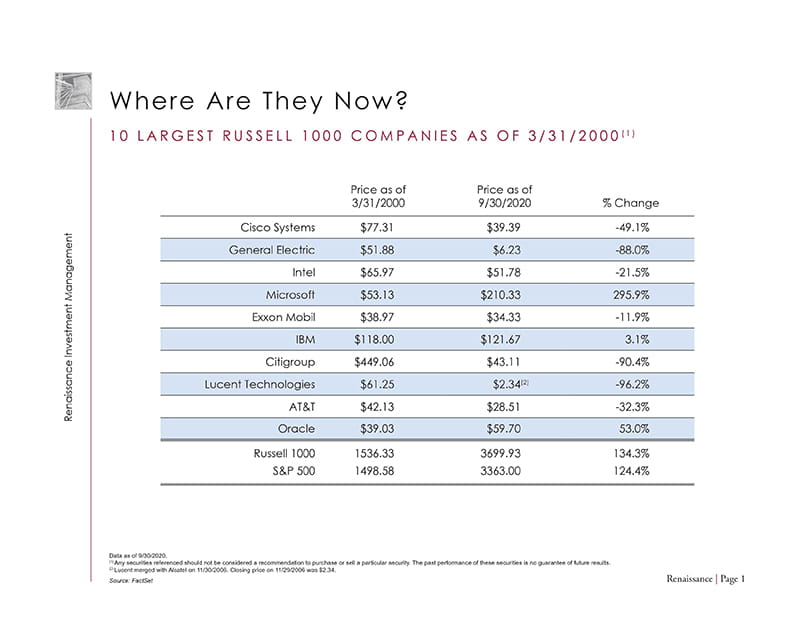

Linked at the bottom of this page is a research piece which shows the 10 largest stocks in the Russell 1000 Growth Index as of 3/31/2000…and each company’s corresponding performance over the next 20+ years. I find the chart fascinating as I worked for company #7 and remember the sentiment of infallibility we advisors had about our employer. We felt that nothing could take our stock down…we were all becoming wealthier participating to the maximum allowable limit in our stock purchase plan. The feeling that investors who owned these companies had was primarily one of “these big companies are not going anywhere but up.” Cisco Systems was the largest company on the chart and remains a strong company today. Despite the quality of the company however, if you bought the stock on 3/31/2000, as of March 2021, you are still down more than 35% over 20+ years. Sometimes, there is a large disconnect between what is a good company and what is a good stock. Stocks, like any other asset, can often be overvalued (sometimes wildly). And investors, no matter the size, should always be cognizant of the price they pay to own a share of a public company.

Only three of the top ten stocks of 3/31/2000 were positive AT ALL over the next 20+ years. And, of the three that were positive, they each suffered massive declines of their own before recovering into positive territory from prior highs.

As of 1/31/2021, the following are the 10 largest companies in the Russell 1000:

- Apple

- Microsoft

- Amazon

- Tesla

- Alphabet (Class A)

- Alphabet (Class C)

- Johnson & Johnson

- Berkshire Hathaway

- JPMorgan Chase

–Gary Weiss, April 2021

I think it will be very interesting to revisit this list in 2041!

The information enclosed has been obtained from sources considered to be reliable (such as the company itself and/or third-party independent research companies such as S&P, ValueLine, DLJ, etc.). We do not, however, guarantee the accuracy or completeness of the material nor that the material provides a complete description of the security, markets or developments referred to in the material. Raymond James & Associates has not performed due diligence or provided research coverage on this company. Investors should perform thorough investigation of any company before investing funds. Raymond James & Associates, Inc., its affiliates or its officers and directors may, in the normal course of business, have a position in the security mentioned in the enclosed material.