Comprehensive guidance to support your needs

Learn More About The Two Sides of Money

At Wealth Wellness Group, we acknowledge that the personal side of managing your money (hopes and dreams, challenges and opportunities) is just as important as the technical side (kinds of investments, how much, etc.).

We also know things change, and each change goes through four stages. We teach you how to manage those stages and provide tools and knowledge to help keep you in control and productive.

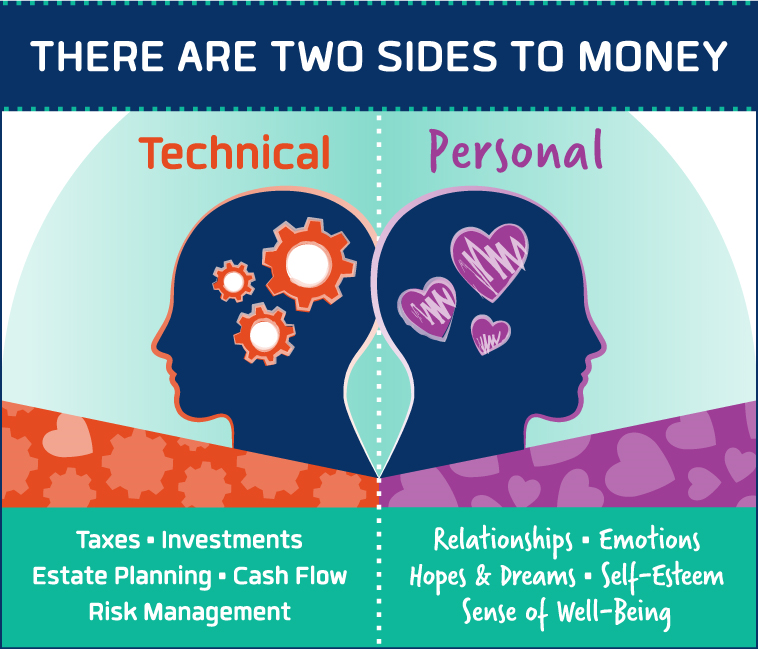

Technical and Personal Sides to Money

- There is the technical side of taxes, investments, estate planning, retirement, cash flow, risk management, etc. This involves deep technical knowledge in a variety of areas. This is the part most people need help with and the one most financial advisors have largely focused on.

- There is the personal side of relationships, emotions, hopes and dreams, self-esteem, sense of well-being, etc. These factors affect all human thinking, despite how logical people believe they are

Both sides are equally important and complex. It’s the personal side, however, that drives money decisions.

Transitions are important points (positive and negative) at which life pivots in a serious way: divorce or death, sale of a business, retirement from a job, family inheritance.

- Anticipation: A change is coming. It creates expectations. The person may change behavior based on those expectations, putting them at risk when the expected doesn’t happen.

- Ending: What was has ended.

- Passage: This is a time of uncertainty, possibilities, fear, and sometimes even chaos.

- New Normal: The results are a different life, varying from smaller changes like a child heading off to college to putting life back together again after the loss of a spouse or partner.

Transitions affect how we think, feel, and act about moneyin those situations. We may become numb and withdraw; experience serious fatigue; have a short attention span; behave inconsistently.

Transitions create new challenges and struggles: short-term versus long-term thinking; loss of self and status quo; lack of direction; inability to make connections; new choices to be made. These can complicate decision-making.

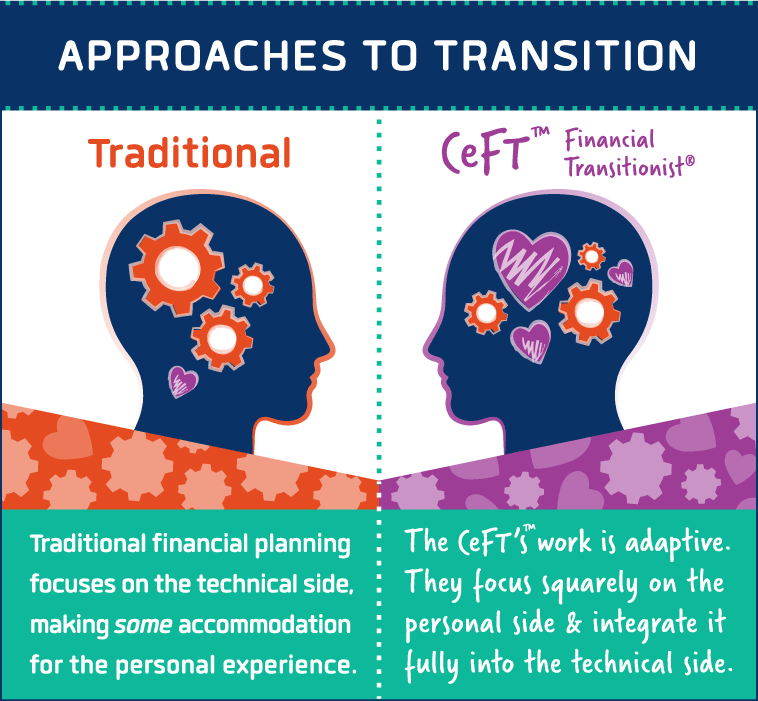

Our Point: At Wealth Wellness Group, we make a point to focus on the personal side to integrate it with the technical decisions to be made. We are trained to help you address the challenges of all four transition stages. We have the tools and knowledge to help keep you in control and productive through the changes.