Passionately building A legacy of strength

Throughout history, financial markets have created periods of uncertainty for investors. The rise and fall of the latest investment trends can change like the weather.

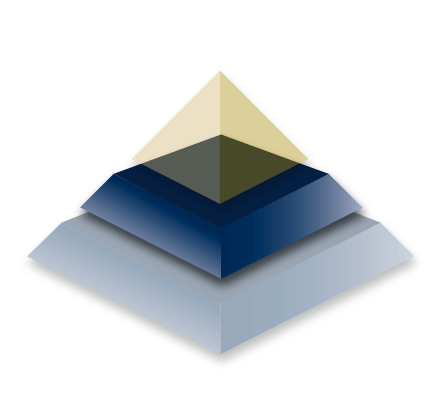

Just as the strength and stability of the ancient pyramids have stood the test of time for more than 5,000 years, our P3 Investment Process strives to provide confidence that your wealth management plan can weather any storm.

With its equilateral triangles, the pyramid has proven to be the most structurally stable shape in history. The Egyptians and Mayans understood the importance of its interlocking components, emanating from a strong base.

It inspired us to design our P3 Investment Process around the same elements – a sturdy base with vital interlocking elements. Our team members stand ready to apply more than 250 years of combined experience to build a well-designed path to your financial future.

The Brechnitz Group

The Brechnitz Group P3 Investment Process

Our proprietary P3 Investment Process helps us fulfill our mission – passionately helping to clarify your goals, conducting a personalized implementation of your customized plan, and monitoring and refining your progress along the way.

-

Passionately clarifying your goals and legacy.

Our team members stand ready to apply more than 250 years of combined experience to build a well-designed path to your financial future. We’ll listen carefully to your goals and concerns, using what you share with us to guide every decision we make. The better we know you and what you want to accomplish, the more we can help.

-

Implementing your personalized wealth plan.

We’ll assist in designing a plan based on your objectives, time horizon and risk tolerance, using Raymond James Freedom Portfolios, institutional money managers, and our proprietary CorePlus strategies. One of our distinguishing skills is our ability and commitment to manage fixed-income portfolios, which can help provide calm in the midst of market volatility.

-

Monitoring your plan’s progress and adjusting it accordingly.

Change is part of life and must be considered in the management of your portfolio. We will inquire about your family and any life events that can alter your objectives or time horizon. We also give consideration to current market conditions, addressing the economic issues at hand and ascertaining the prudent, timely actions they necessitate.

All investments are subject to risk, including loss. Advisory fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically re-evaluate whether the use of an asset-based fee continues to be appropriate in servicing their needs. A list of additional considerations, as well as the fee schedule, is available in the firm’s Form ADV (Part 2A) as well as the client agreement.