Investing in those who invest in us

As a Raymond James associate, you invest your time, energy and intellect to help the firm, our advisors and our clients thrive. The Employee Stock Ownership Plan (ESOP) is our way of ensuring you see and benefit from your hard work firsthand by giving you shares of Raymond James stock. These shares are held in an account until you reach retirement age, providing a boost to your long-term savings goals. Better still, your participation in this program is automatically effective the day you start working with us, requiring no action or contribution on your part.

How it adds up

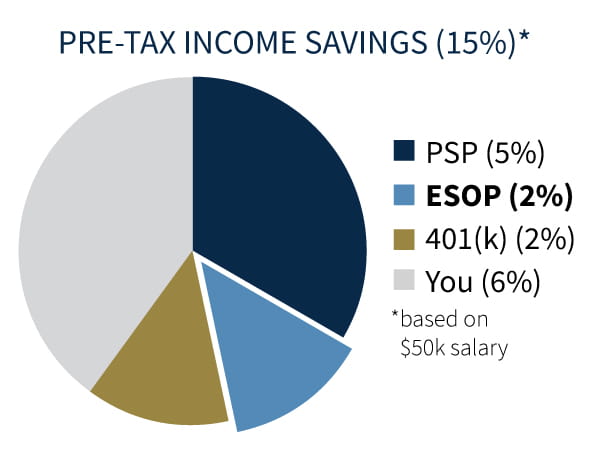

The retirement rule of thumb is to save at least 15% of your pre-tax income1 each year, assuming you save for retirement from age 25 to age 67. And this comprehensive package makes it easier to do just that by helping you save in more ways than one.

1Based on past years’ contributions and a compensation of $50,000. Based on most people needing between 55% and 80% of their preretirement income to maintain their lifestyle in retirement.

Enrollment and eligibility

As an associate, you are automatically enrolled in ESOP on your first day of employment. Participation and contribution accruals begin upon hire date. For more information on eligibility requirements, please review the benefits guide.

Contributions

Contributions are based on eligible fiscal year compensation and an approved contribution percentage, which is determined by the Board of Directors at the end of each fiscal year. Eligible compensation includes most W-2 fiscal year compensation capped at the IRS annual compensation limit. Contributions will be posted in the first fiscal quarter of the year.

Diversification

When you reach age 55 or older and have participated in the plan for 10 years, you can diversify a percentage of your account by transferring it to your 401(k) plan.

Vesting

ESOP uses a five-year graded vesting schedule as illustrated in the chart below. You will attain full vesting in the event of disability, death or reaching age 65.

|

Less than one year |

0% |

|

1 year |

20% |

|

2 years |

40% |

|

3 years |

60% |

|

4 years |

80% |

|

5 years |

100% |

Learn more

For more information, reach out to Retirement and Equity Plan Services at 800.248.8863 or email CorporateBenefits@raymondjames.com.