The tools you need to reach your savings goals

As a financial services firm committed to helping individuals and institutions plan for their financial futures, we’re passionate about supporting our associates as they work toward their goals for their retirement. Our 401(k) Plan is an important vehicle for reaching your personal savings objectives, with an opportunity to earn additional contributions from Raymond James through a match.

Through the 401(k) Plan, you can elect to make pre- and/or post-tax contributions up to the annual IRS limits, and select from a wide array of investment choices for your account. For eligible employees, Raymond James will match 75% of the first $1,000 you contribute to your account, followed by a 25% match of the next $1,000 you contribute. So, if you contribute a total of $2,000 to your 401(k), you will maximize the match and earn $1,000 from Raymond James toward your retirement. Generally, an associate must be employed on the last day of the calendar year to receive a matching employer contribution for that year.

How it adds up

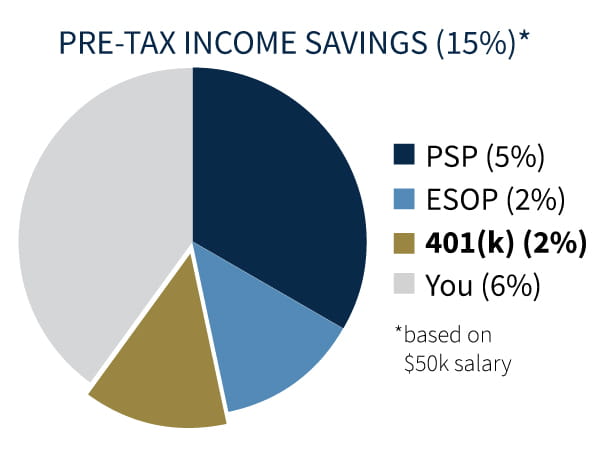

The retirement rule of thumb is to save at least 15% of your pre-tax income1 each year, assuming you save for retirement from age 25 to age 67. And this comprehensive package makes it easier to do just that by helping you save in more ways than one.

1Based on past years’ contributions and a compensation of $50,000. Based on most people needing between 55% and 80% of their preretirement income to maintain their lifestyle in retirement.

Enrollment and eligibility

All associates are immediately eligible to begin contributing into the 401(k) Plan when they begin their career at Raymond James. If you do not enroll 30 days after your hire date, you will be automatically enrolled to contribute 3% of your pre-tax pay. Participants who were auto-enrolled and are deferring 3% or less will have their pre-tax contributions increased by 1% annually until they reach a 6% contribution rate.

At any point, you can update or set your preferred contribution rate by logging into your Principal account. You can also change your investment elections at any time.

Contributions

Associates can elect either a percent or flat dollar amount to contribute each pay period. Our plan offers two kinds of accounts:

- A traditional 401(k), where you can make pre-tax contributions

- A Roth 401(k), where you can make post-tax contributions

The main difference between a traditional 401(k) and Roth 401(k) is when the money is taxed. With a traditional 401(k), your contributions are made with pre-tax dollars so you get an immediate tax break but when you take the money out, the amounts are fully taxed. With the Roth 401(k), your contributions are made with after-tax dollars, so instead of an immediate tax break, you will receive your future distributions tax free. To help you weigh the advantages and disadvantages of traditional versus Roth 401(k)s, assistance is available through Associate Financial Services and your financial advisor, with additional resources available through our retirement plan administrator, Principal.

Associate contributions are limited to 75% of compensation up to IRS limits below. This limit applies to the aggregate of your traditional and/or Roth contributions. There is an additional catch-up contribution allowed for associates age 50 or older. To learn more about the IRS limitations on elective deferrals and see current contribution limits, visit IRS.gov.

|

Contribution Limits |

2021 |

|---|---|

|

Regular Contributions |

$19,500 |

|

Additional catch-up for ages 50* and older |

$6,500 |

*The full catch-up contribution is permissible beginning in the calendar year you turn 50.

Vesting

Our 401(k) Plan uses a five-year graded vesting schedule as illustrated in the chart below. You will attain full vesting in the event of disability, death or reaching age 65. Your own contributions are always 100% vested.

|

Less than one year |

0% |

|

1 year |

20% |

|

2 years |

40% |

|

3 years |

60% |

|

4 years |

80% |

|

5 or more years |

100% |

New ways to save for your future

Raymond James is adding new features to the Raymond James Financial, Inc. 401(k) Plan to add more flexibility to your retirement savings. Beginning Jan.1, 2021, associates will be able to make voluntary after-tax contributions and in-plan Roth conversions. For the 2021 Plan Year, you may be able to contribute up to an additional $15,000 annually as voluntary after-tax contributions.1

Introducing the Super Roth strategy

When you make after-tax contributions, you can choose to leave them as-is, or you can convert them to Roth. This is often known as a Super Roth strategy and can be used to potentially save money on the taxes you’ll owe in retirement.

The Super Roth strategy allows potential earnings to grow tax-free. And they won’t be taxable when you’re ready to retire—as long as you take a qualified distribution.2 Earnings on the voluntary after-tax contribution account balance are taxable for the tax year in which the Roth conversion happens.

Getting started

Check out this flyer to learn more.

You can also log into your account at principal.com or give Principal® a call at 800-547-7754. Retirement specialists are available from 7 a.m. to 9 p.m. CT, Monday through Friday.

Note: It's important to consult with your tax advisor or financial professional before deciding if this strategy is right for you.

1 This amount is determined annually by Raymond James. To ensure the 401(k) plan continues to meet IRS rules, participants who contribute after-tax contributions may receive a refund if the plan does not meet its testing requirements.

2 A qualified distribution is one that is made after a participant reaches age 59 ½, death, or disability and must be taken at least five years after the first Roth contribution was made.

You should consider the differences in investment options and risks, fees and expenses, tax implications, services and penalty-free withdrawals for your various options. There may be other factors to consider due to your specific needs and situation. You may wish to consult your tax advisor or legal counsel.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, investment advice or tax advice. You should consult with the appropriate counsel or other advisors on all matters pertaining to legal, tax, investment or accounting obligations and requirements.

Insurance products and plan administrative services provided through Principal Life Insurance Co., a member of the Principal Financial Group®, Des Moines, IA 50392.

Principal, Principal and symbol design, and Principal Financial Group are trademarks and service marks of Principal Financial Services, Inc., a member of the Principal Financial Group.

CP9868HHHH | © 2020 Principal Financial Services, Inc. | 1099303-102020 | 11/2020

Learn more

For more information, reach out to Retirement and Equity Plan Services at 800.248.8863 or email CorporateBenefits@raymondjames.com.