Tax Efficient Rollovers

Tax-Efficient Rollovers: How to Transfer Your Retirement Money Without Triggering Taxes

Managing your retirement savings effectively often involves transferring funds from one retirement account to another. However, the way you handle this transfer—whether through a tax-efficient rollover or a taxable distribution—can have a significant impact on your financial future. Understanding the difference between these options is crucial to preserving your savings and avoiding unwanted tax burdens. Let’s break down the process step by step.

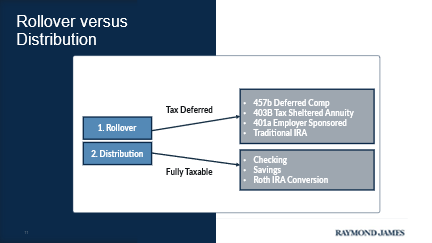

Step 1: Understand the Basics—Rollover vs. Taxable Distribution

Before making any moves, it’s important to know the difference between a rollover and a taxable distribution:

- Rollover: A rollover involves moving funds from one retirement account to another without triggering immediate taxes or penalties. This transfer can be done directly (from one account to another) or indirectly (where the funds are given to you first, but you have 60 days to deposit them into another retirement account).

- Taxable Distribution: A taxable distribution occurs when you withdraw money from your retirement account and do not roll it over into another account within the allowed timeframe. The withdrawn amount is added to your taxable income for the year, and if you’re under age 59½, you may also face a 10% early withdrawal penalty.

Case Study: The Costly Mistake of a Taxable Distribution

Consider the case of Mark, a 57-year-old retiree who decided to take a $60,000 taxable distribution from his 401(k) to pay off his mortgage. While this seemed like a good idea to become debt-free, Mark didn’t anticipate the tax consequences.

The $60,000 was added to his income for the year, pushing him into a higher tax bracket. This increase in income not only resulted in a hefty tax bill but also bumped up his Medicare premiums. To make matters worse, because Mark was under 59½, he was hit with a 10% early withdrawal penalty, adding another $6,000 to his tax liability. In total, Mark ended up paying a significant portion of his distribution in taxes and penalties, severely diminishing his retirement savings.

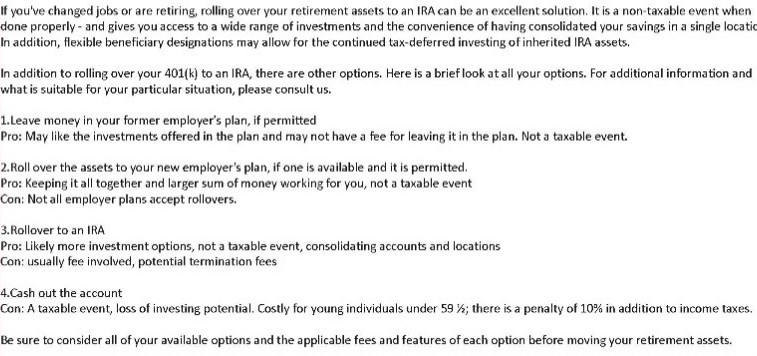

Step 2: Evaluate the Benefits of Consolidating Your Retirement Accounts

A rollover is an excellent opportunity to consolidate multiple retirement accounts, which can simplify your financial life and potentially reduce costs:

- Simplified Account Management: By consolidating your retirement savings into one account, you can more easily track your investments and maintain a consistent strategy.

- Expanded Investment Options: Some retirement accounts, like IRAs, may offer more diverse investment choices compared to employer-sponsored plans, giving you greater control over your retirement portfolio.

Step 3: Plan for Taxes If You Opt for a Taxable Distribution

If you’re considering a taxable distribution instead of a rollover, it’s vital to plan for the tax implications:

- Understand the Tax Impact: The withdrawn amount will be added to your taxable income for the year, potentially pushing you into a higher tax bracket and increasing your overall tax liability.

- Early Withdrawal Penalty: If you’re under age 59½, be prepared for a 10% penalty on top of income taxes, which can significantly erode your retirement savings.

- Consider Alternatives: Before taking a taxable distribution, explore other options, such as borrowing from a 401(k) (if allowed by your plan) or using non-retirement savings to meet your financial needs. These alternatives might help you avoid the costly consequences of a taxable distribution.

Conclusion

Making informed decisions about how to transfer your retirement funds is crucial for protecting your savings and avoiding unnecessary tax burdens. As Mark’s case demonstrates, a poorly planned taxable distribution can have significant financial consequences. By understanding the difference between a rollover and a taxable distribution, evaluating the benefits of consolidating accounts, and planning for potential tax impacts, you can ensure a smoother path to financial security in retirement.

Opinions expressed in the attached article are those of the author speaker and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. Raymond James and its advisers do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Prior to making an investment decision, please consult with your financial advisor about your individual situation