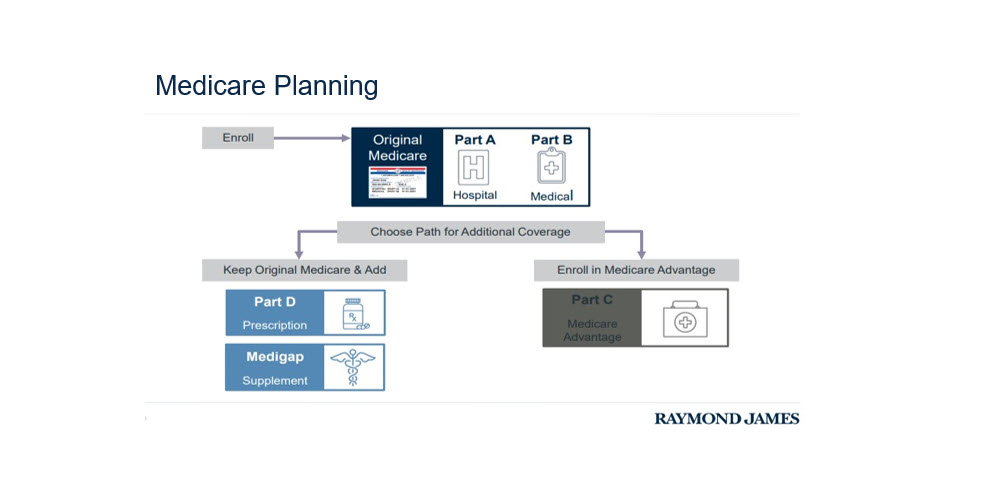

Medicare

Weighing Your Medicare Health Insurance Options

Retiring involves many important decisions, and choosing the right health insurance is one of the most critical. As you approach Medicare eligibility, you’ll need to decide between Traditional Government Medicare and Medicare Advantage. Each option has distinct pros and cons that can significantly impact your healthcare experience.

Understanding Florida Statutes, Section 112.0801

Florida Statutes, Section 112.0801, allows state retirees to continue participating in their employer’s group health insurance plan by paying the full premium. This ensures continuity of coverage, which can be crucial when transitioning to Medicare.

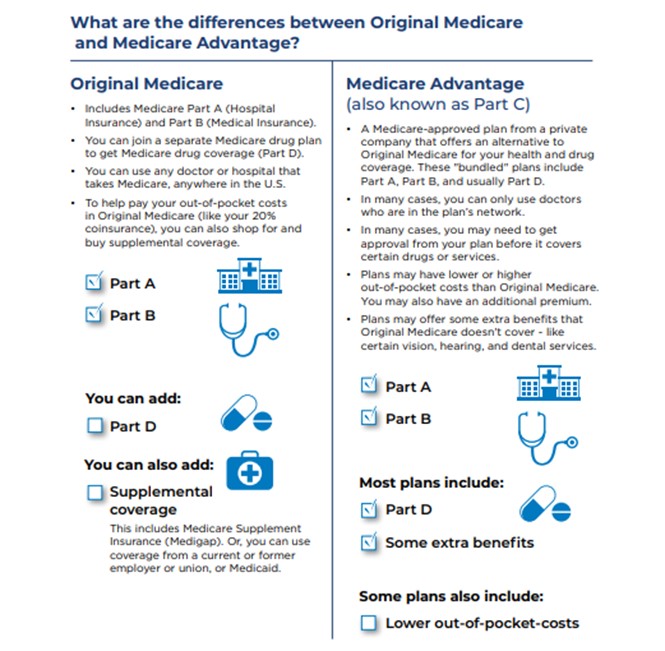

Medicare Options: Traditional vs. Medicare Advantage

Traditional Medicare Pros:

- Flexibility: See any doctor or specialist who accepts Medicare without network restrictions.

- Consistent Coverage: Uniform benefits nationwide, helpful if you relocate.

- Medigap Plans: Available to cover out-of-pocket costs like deductibles.

Traditional Medicare Cons:

- Limited Benefits: Doesn’t cover dental, vision, or hearing.

- Separate Prescription Plan: Requires a separate Part D plan for drug coverage.

Medicare Advantage Pros:

- All-in-One: Combines Part A, B, and D, often with extra benefits like dental and vision.

- Extra Perks: Includes benefits like gym memberships and transportation.

Medicare Advantage Cons:

- Network Restrictions: Requires staying within a network of providers.

- Referrals Needed: Often requires referrals to see specialists.

- Regional Variability: Plan details can change depending on your location.

Case Study: Linda’s Medicare Advantage Dilemma

Linda, a 68-year-old retiree, chose a Medicare Advantage HMO for its low cost and added benefits. However, when she needed specialized care for a rare condition, she found that her plan wouldn’t cover the out-of-network specialist she required. This forced her to either pay out of pocket or wait until the next enrollment period to switch plans.

Conclusion

Choosing between Medicare Advantage and Traditional Medicare depends on your healthcare needs, budget, and lifestyle. If you prioritize flexibility and access to specialists, Traditional Medicare with a Medigap plan might be best. If you prefer bundled benefits and lower costs, Medicare Advantage could be the right choice. Consider your specific needs to make the best decision for your retirement.

Opinions expressed in the attached article are those of the author speaker and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. Prior to making an investment decision, please consult with your financial advisor about your individual situation.