What the stimulus package means for you? How can Mustard Seed Advisors help?

Are you aware of the new IRS filing deadlines?

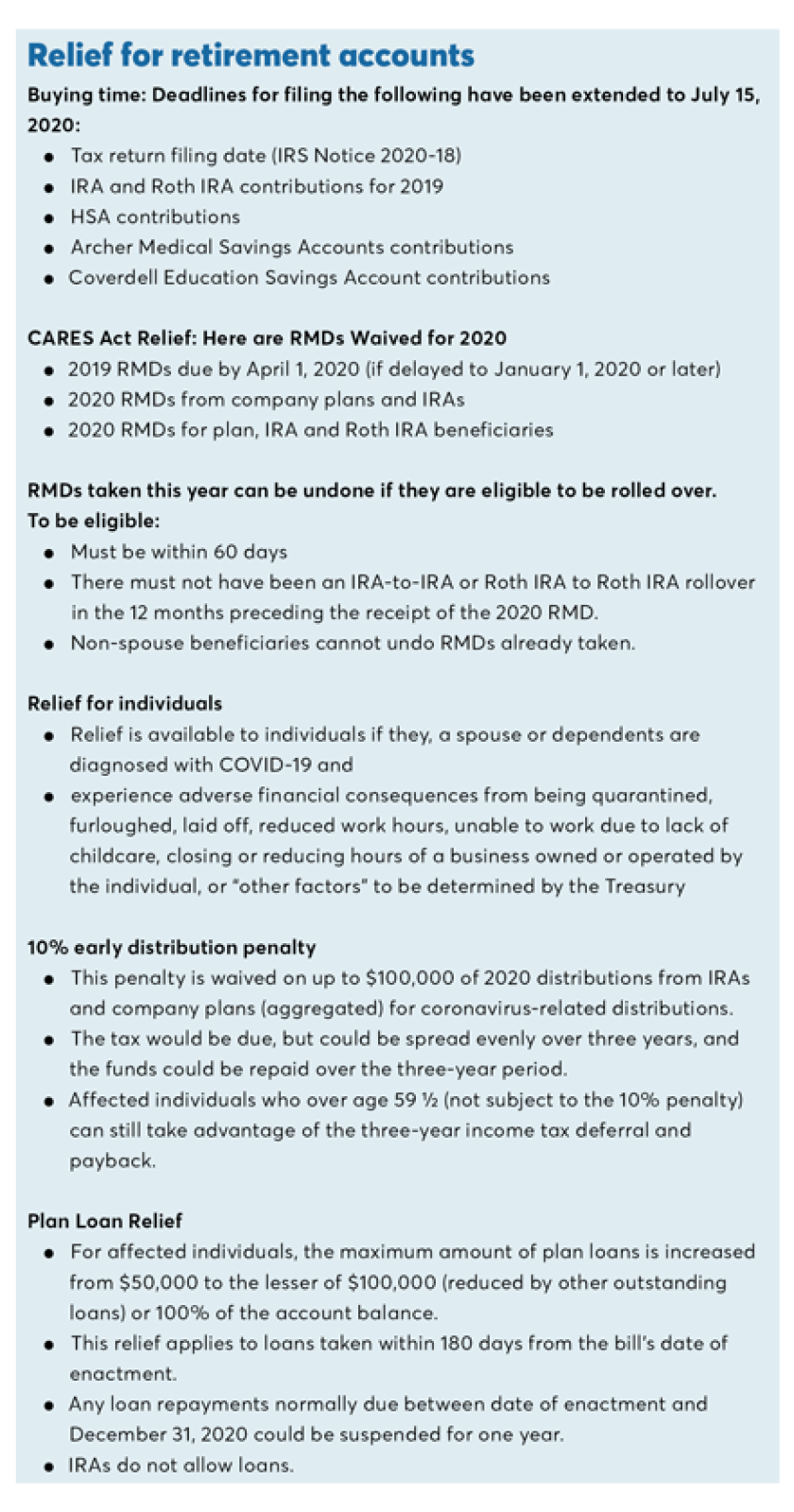

If you owe money to the IRS for 2019 taxes, a delay in filing your taxes would likely be advantageous as you now have until July 15 to file your 2019 return. However, should you be due a refund, you should file as soon as you have all the information required to file.

Are you a retiree, or phasing into age when you are required to take distributions (RMDs)?

You should consider not taking your 2020 RMD, and opt to restart it in January 2021. We have contacted many of you have already, encouraging you to put your 2020 RMD on hold until later in the year to allow the market to recover some. And, for those who agreed with that strategy, it has been put in place. Because the recently passed relief legislation allows you to legally delay RMDs until 2021, we believe this to be a smart strategy for our clients who have ample cash reserves, taxable accounts, lines of credit, and/or the ability to borrow a portion of the value of their taxable account holdings rather than selling positions at deflated prices, adding more time for the market to recover. Contact us and we will discuss your specific situation if we have not already.

Are you one of our small- business owners, or small-business employees?

If you are, financial institutions don’t have relief money yet from the Fed Govt. but are quickly and fervently working on it. Your local banks will have access to funds and loans that the legislation provides within 1-2 weeks (the target is this Friday; time will tell). The banks are working hard at this. Because small-businesses are the backbone of our economy, you can rest assured relief is coming. We realize the significant impact this crisis is having on businesses of all sizes. A number of provisions have been made, including: delaying retirement account contributions from April 15 to July 15 for both personal and business tax filings; 401k provisions/credits; and making small business loans available with flexible terms and low interest rates.

Are you uncertain about job and income stability?

We are very sensitive to those who might be or have risk of being furloughed, receive a reduction in pay, or being laid off. Unemployment insurance is available to all who have lost jobs, even if temporarily so. The stimulus includes an increase in unemployment benefits of $600 a week. Taking the average unemployment check to $975 a week.

Will I receive a $1200 check?

Depending on your income level (AGI of up to $75,000 per individual or $150,000 per couple), you’ll be receiving a lump-sum check from the stimulus, $1,200 for each individual and $2,400 for each couple. If you have been furloughed or feel at risk of losing your job or having a reduction in income during this recession, the money you receive from the government’s stimulus package should be used to help pay bills or to buffer your savings, not for investment.

Are you saving, accumulating toward college, house, retirement and other goals?

This is a great buying opportunity for 529s and other accounts earmarked for kids’ college, as well as your own retirement accounts. As such, it’s great time to increase your contributions to these types of accounts as you are able. For cash you may have been harboring on the sidelines, high-quality stock prices are significantly more attractive than they were a month ago. Feel free to contact us to determine if any buying opportunities are prudent for your situation. Keep in mind, liquidity is key during a recession. Regardless of your age, your goal should be to have enough cash on hand to cover 6-12 months of expenses in case you have interruption of income or unforeseen expenses.

We are here for you, to figure out the best strategy for your own situation, whatever it might be. There is no such thing as a dumb question, especially during a time like this. We are staying on top of legislative changes. If we don’t know the answer, we will help you get answers from a competent CPA or from your local bank, during this time.

Most importantly, stay well. To our front-line workers, we appreciate you and honor you by staying home.

On Wall Street article about the CARES Act

Source: www.onwallstreet.financial-planning.com

Sincerely,

Mustard Seed Advisors