Biden Blues

“How far will the market decline if Biden wins?” This has been the question that I’ve been receiving lately. I have received it for a while, but it’s starting to happen with more frequency. I do understand where the question is coming from, discussions of higher taxes, more regulation, and weaker international trade agreements can easily lead one to believe that the future is bleak.

I think the uptick in the receipt of this question is probably due to the polls. Since recent debates, the gap seems to have widened for Biden, and democratic sweep percentages have increased. However, if you didn’t learn anything from last time around, then we should re-name you Dory from Finding Nemo. Polls give an indication of current sentiment but are not good predictors of election outcomes.

So rather than drag you around with a bunch of statistics that are mostly meaningless, I will tell you the tried and true measure of any potential market moving event. IF IT’S COMMONLY KNOWN, THEN THE MARKET HAS ALREADY PRICED IT IN. Millions of data sets, including earnings, news, facts, and rumors move the market each and every second.

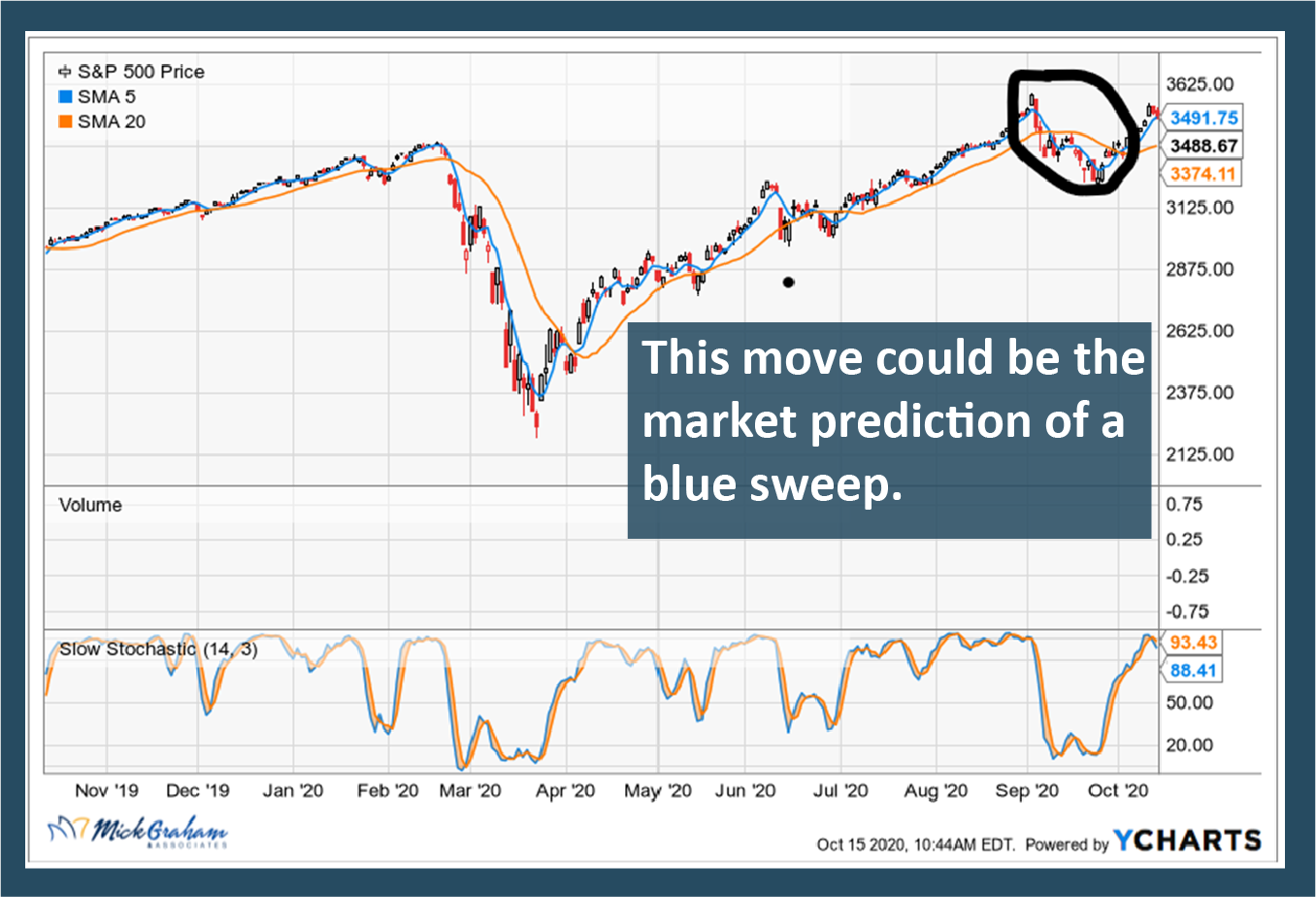

I think the question should be re-phrased to, “How much volatility will we likely get if Biden wins?” As we get closer to the election and the polls are measuring sentiment on the election day, you will find the market has already priced in that outcome. Sure, I believe we may get some volatility, especially if we get an unexpected event, such as a drawn out declared winner, however from a longer-term perspective, that ship has sailed.

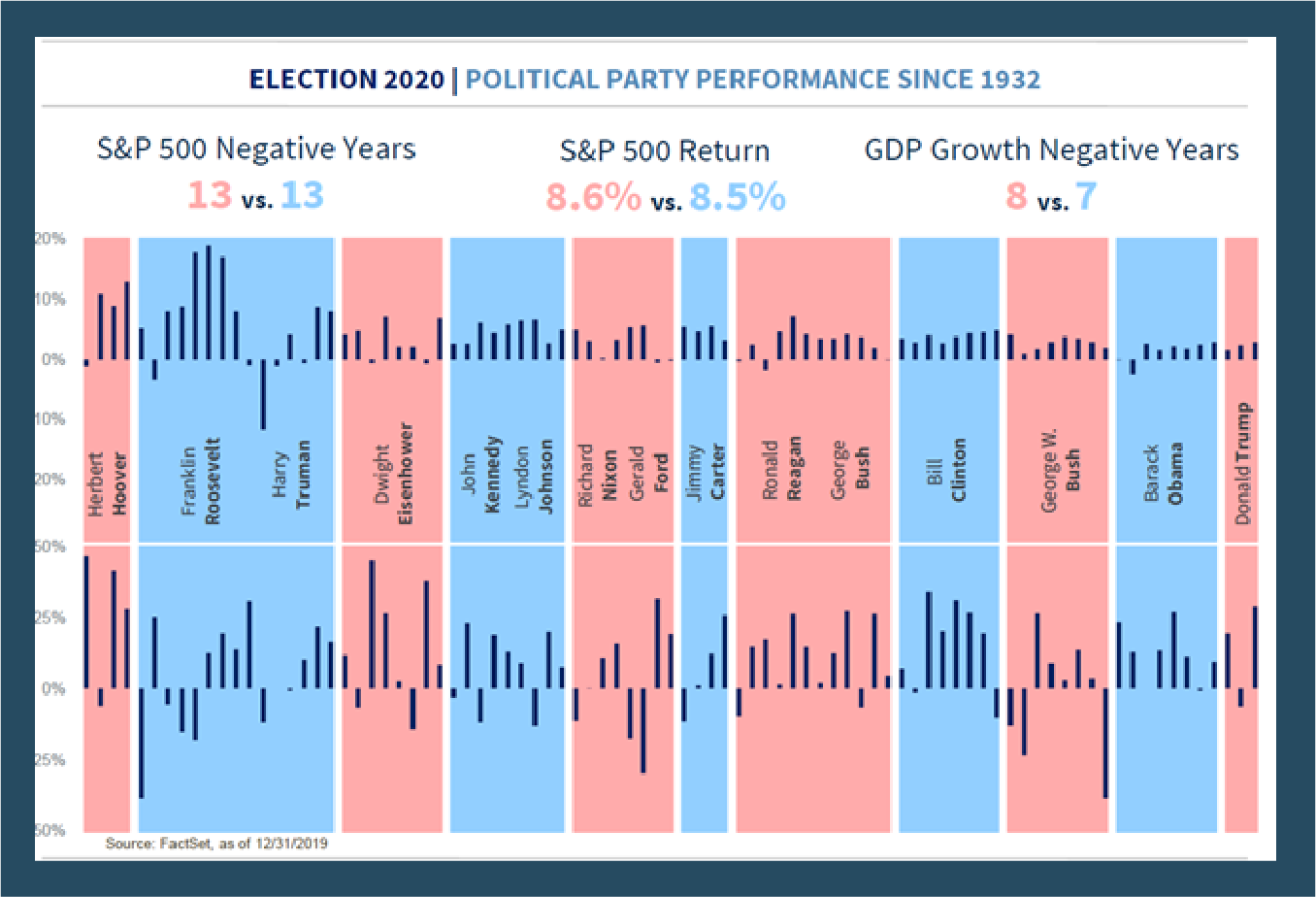

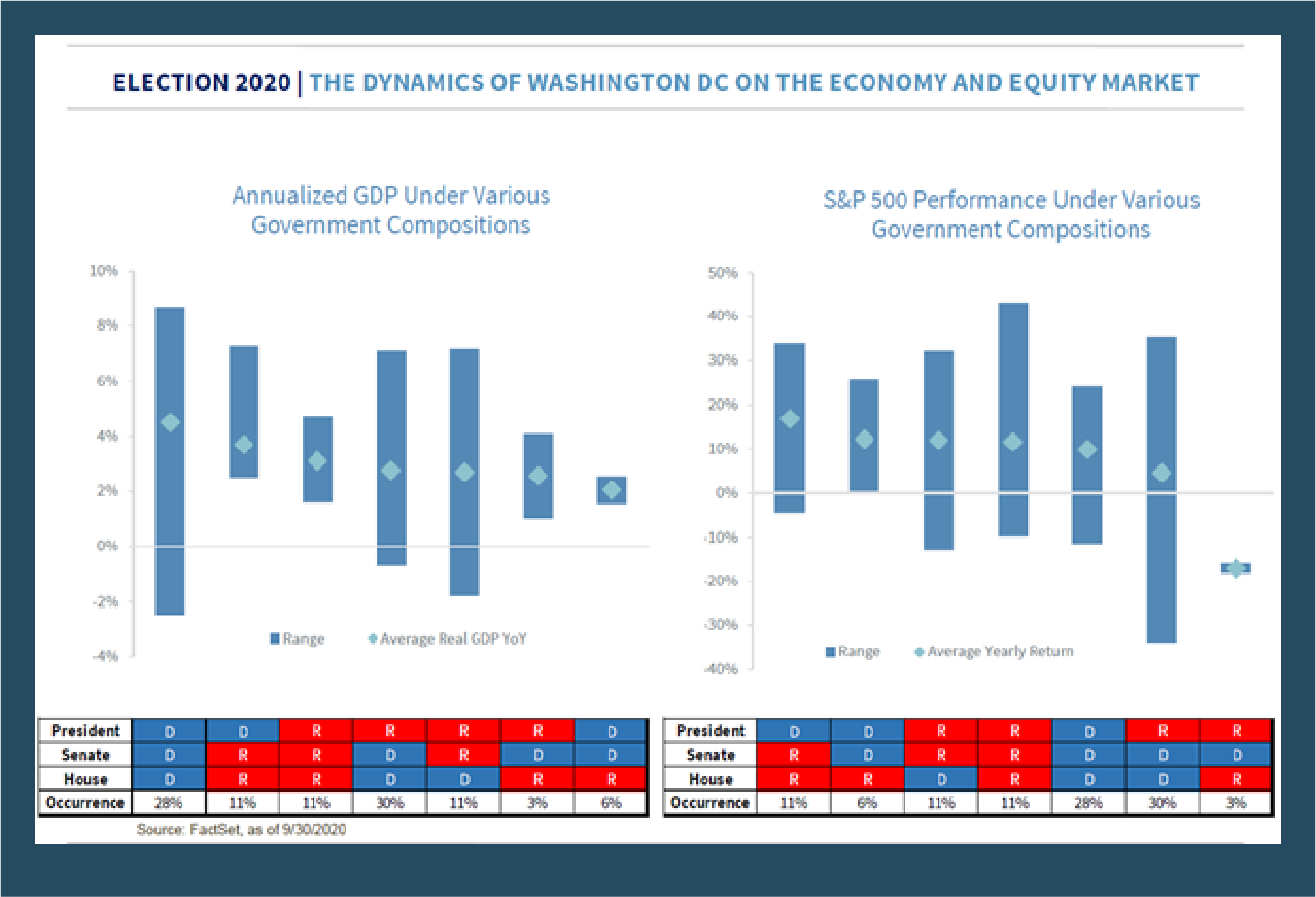

Now let’s take a quick look at history and you’ll find that since Herbert Hoover, things are actually pretty close. A 0.1% difference in S&P 500 returns, both parties have had the same amount of negative years and GDP negative growth years are within 1. A deeper dive may surprise you. The graph below breaks it down further to the composition of the 3 legislative branches. I’ll leave you to look at the numbers.

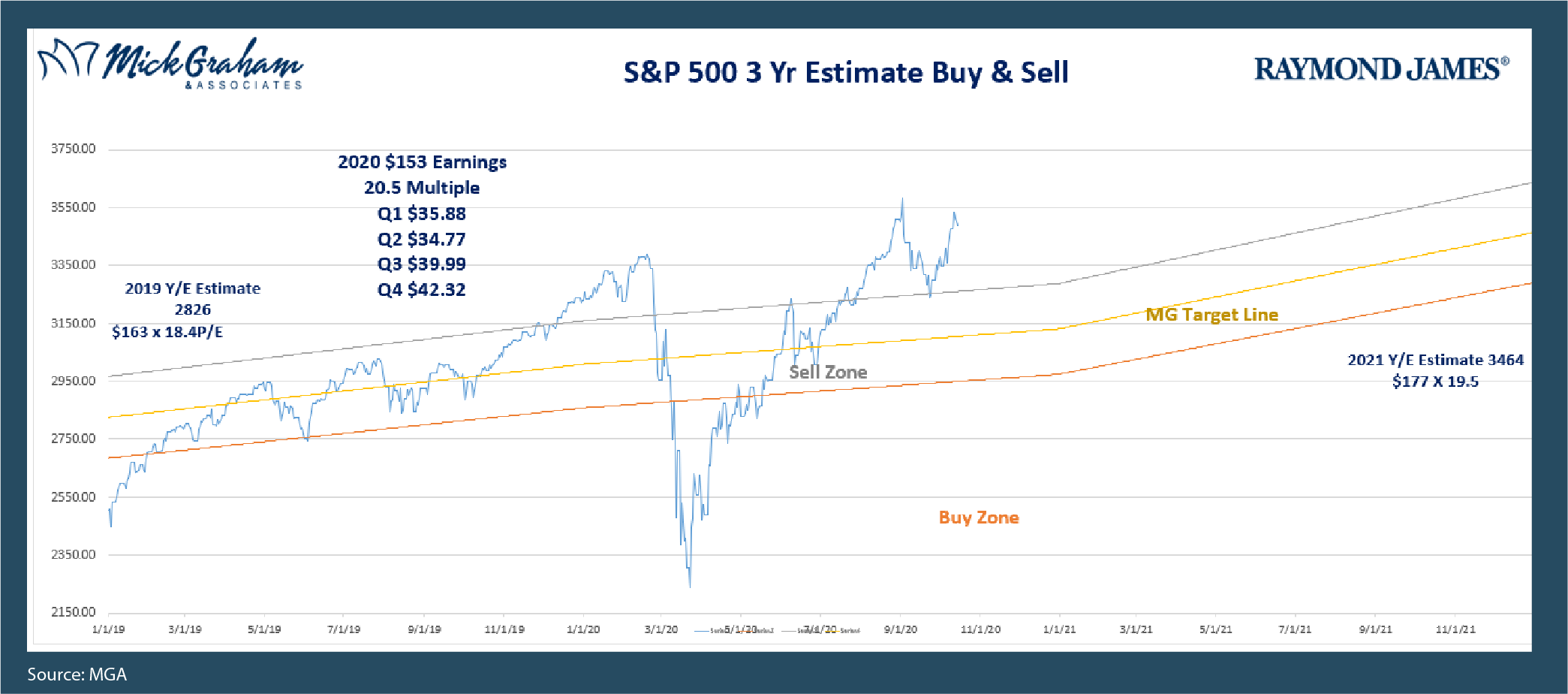

Now it’s not to say that the unexpected will not happen, or we will not experience any type of volatility if the polls are correct. I believe it’s prudent when markets are nearing all time highs to keep a little cash on the sideline and look to trim from the names you own that get massive intraday pops. The stored cash can be deployed to take advantage of any volatility to the downside we may get.

No matter who gets in, the sun will rise the next day and I truly believe the heart and soul of capitalism will shine through. A shift from what has worked over the past few years, to what has not may be in the cards, and the ability to maneuver within a market is a far superior strategy than trying to time it.

With that said. Here is the Buy/Sell

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Mick Graham, CPM®, AIF Branch Manager Raymond James. Office in Suntree, Florida.