The 411 on Your 401k: Meet Tina

As we roll through October, it’s been anything but a normal first three quarters of the year. What started as a big start to the year in January, certainly took a turn south as the Covid -19 outbreak took its toll. While we wished we could have bypassed the pandemic, and all of its volatility, it’s clear that we as investors should look at the road ahead, rather than the rearview mirror.

The fear indicator (called the VIX index in the investing world), hit highs not seen since the financial crisis (see chart above). Even the most casual 401k investor felt this 30%+ move south from February 19th to March 23rd. The quickest retreat of that size in history.

Since that time, the volatility index has continued to stay above 20, commonly referred to as a highly volatile period of time for investing. However, you need to remember that volatility is measured in two directions…both up and down. As since we have hit the market lows in March, we’ve had days that have swung more than 1% on the S&P 500 at a historic level, according to Y Charts.

Volatility in investing creates opportunity. Think about it like this…If you didn’t get volatility, then that would mean you are getting a consistent return every day. That’s called a savings account, and it pays near zero. Long term investors have the potential for greater returns for taking risk and handling volatility.

I put this chart in every quarterly 401k participant message. It still shows that in the short term the market is a crap shoot, but in the long run, historically it’s fairly predictable. Just look at the green bar for each of the years. If you invested your money in the S&P 500, in any one year you can expect a return of -39% to positive 47%...HUGE disparity. No one knows when that year, either good or bad will be. However, you look out 20 years and the differential between good and bad was much less, it is getting more predictable. In the hypothetical example above, the least amount you would have made in any 20-year period is 6% per year and the most was 17%.

Now that does not mean invest blindly, but it does mean invest. Your 401k by nature, creates one of the best wealth creation mechanisms I know. AUTOMATION. Your check gets deducted every pay period, it’s then sent to the 401k provider automatically, and is then automatically invested in your selected funds. It doesn’t rely on you to do anything after you’ve set it up. Aside from the beauty of automation, by nature you can take advantage of dollar cost averaging. If the market goes down, you automatically buy more at a cheaper price.

So, what do I mean by “don’t invest blindly”? To me, it means both ends of the scale. One end being I don’t care what I invest in and the other meaning being so concerned what you’re invested in that you try to outsmart the market by getting in and out based on the news cycle. Believe me when I tell you the middle of the road is where you want to be. The one concern I do have for the next cycle (meaning 3-5 years) is the bond market. By nature, most, if not all of you will only have access to a select amount of funds. A lot of you are invested in what is commonly called target date funds. They are funds that generally end with a number, which is the year the plan thinks you will retire (to the closest 5 years). An example of how a target fund may be labeled is the Mick Graham Lifetime Fund 2030. If this is what you are invested in rebalancing happens for you automatically. You can take what I’m about to say with a grain of salt. Please always refer to the fund prospectus to confirm the fund type.*

Bond funds are a collection of individual bonds that fit a certain parameter. For instance, a short-term bond fund, or an intermediate term bond fund. Bond yields and bond prices work inversely, meaning when yields on bonds rise the price of the bond drops. I’ve made a quick video for you on this on my website if you want me to explain it, click here. Now, it’s my opinion that bond yields have a greater potential to rise from this level than go down. This would mean the bond prices go down, meaning your bond fund price will go down. Because funds follow a mandate short term, medium term and long term, the manager of the bond will adjust his/her portfolio to ensure they meet the mandate of that fund. And if we see a sustained interest rate rise at some point then you could potentially see negative returns in bonds for a sustained period. For those of you holding intermediate and or long-term bond funds, research the effects of owning these funds and then make your decision on any adjustments you deem necessary.

Overall, I like stocks for the long term mainly because of Tina. Yes, Tina was a girlfriend I had in school, but I’m not talking about that Tina. Tina stands for There Is No Alternative, in my opinion, because right now bonds pay little (and have added risk as I’ve explained above), cash is paying basically zero, real estate is tough as it’s only the suburban residential houses that are showing sprouts and we will leave currencies and commodities to the pros. Thanks a lot, Tina.

Overall, stick with your game plan, considering the areas I’ve told you I’m concerned about. I’m always happy to answer an email or a call should you have any further questions. Believe it or not, I’m a nerd and like doing this. Probably why Tina dumped me…

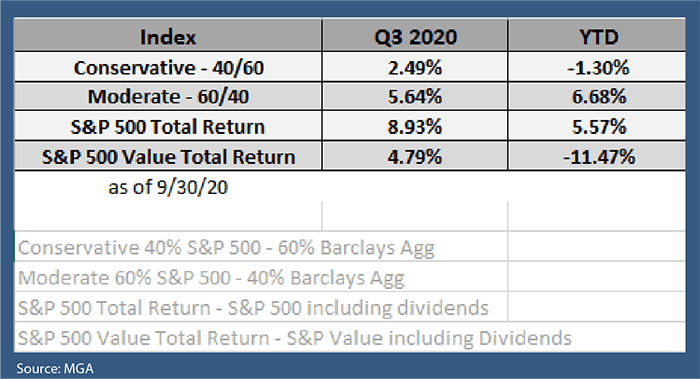

I always want you to compare how you performed against the indexes. If you drift too far from your benchmark, let us know and we’ll get to the bottom of it.

All investments are subject to risk, including loss. Asset allocation and diversification does not ensure a profit or protect a loss. There is no assurance that any investment strategy will be successful. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. This should not be considered forward looking, and does not guarantee the performance of any investment. Past performance doesn't guarantee future results. Opinions are those of the author and are subject to change. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The S&P 500 is an unmanaged index of 500 widely held stocks that's generally considered representative of the U.S. stock market. You cannot invest directly in any index.

The CBOE Volatility Index® (VIX® Index®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices

*Target Retirement Date Investment Options

Investors should consider the investment objective, risks, charges, and expenses carefully before investing. The prospectus, which contains this and any other important information, is available from your Financial Advisor and should be read carefully before investing.

Generally, target retirement date (lifestyle) investment options are designed to be held beyond the presumed retirement date or offer a continuing investment option for the investor in retirement. The year in the investment option name refers to the approximate year an investor in the option would plan to retire and likely would stop making new contributions to the investment option. However, investors may choose a date other than their presumed retirement date to be more conservative or aggressive depending on their own risk tolerance.

Target retirement date (lifestyle) investment options are designed for participants who plan to withdraw the value of their accounts gradually after retirement. Each of these options follows its own asset allocation path ("glidepath') to progressively reduce its equity exposure and become more conservative over time. Options may not reach their most conservative allocation until after their target date. Investors should consider their own personal risk tolerance, circumstances and financial situation.

These options should not be selected solely on a single factor such as age or retirement date. Please consult the fact sheet pertaining to the options to determine if their glide path is consistent with your long-term financial plan. Target retirement date investment options' stated asset allocation may be subject to change.

Additionally, there is no guarantee that the options will provide adequate income at and through retirement.