No News Sell Off Shifts to Macro

To watch/listen to this week’s article please click here

The “no news sell off” that started on September 9th, is now turning into a sell off concerned about the Macro. Although this pull back is probably one of the most anticipated I remember in recent history, the extent of the correction is the million-dollar question.

Since my last note, we have an empty seat on the Supreme Court, a Fed speech (that I feel was directed straight towards the legislators), a spike in Covid cases (specifically UK) and some contradictory economic data, all creating some uncertainty in the overall equity indexes. Let’s touch on each of them.

Supreme Court…Justice Ruth Bader Ginsburg’s passing has opened the door for President Trump to nominate a conservative to the bench. If successful, the bench could lean to a 6-3 conservative majority and play a pivotal role in some long-fought issues. For the markets, the health care sector has felt the brunt of the pull back, as investors have viewed this as a possibility of the Affordable Care Act (Obamacare) being rolled back. In recent years, the Supreme Court has blocked attempts to gut Obamacare, however a new Supreme Court justice may tilt the balance the other way if the case should be brought back. The latest legal challenge (brought on by 20 states, led by Texas) is set to be heard on November 10th, just one week after the election. This particular fight is related to the penalties for individuals lacking insurance. Congress eliminated the tax penalties in 2017, however Republicans are arguing its constitutionality and want the entire law scrapped.

For the most part, my view for health care stocks are to accumulate on dips. I feel that there could be a sell first, do analysis later approach on some big names in the index, and that to me could spell an opportunity.

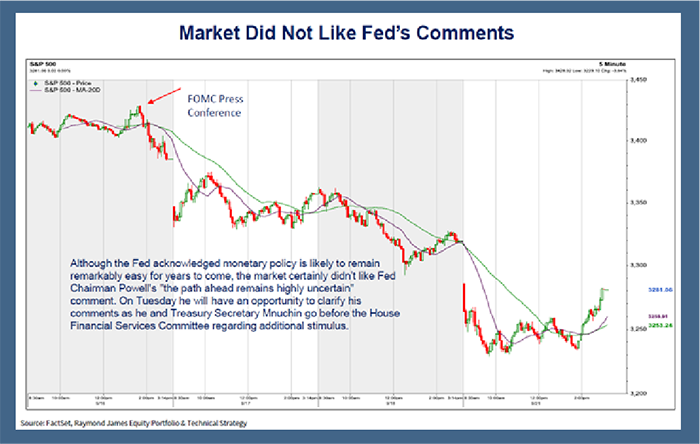

The Fed… Ahhh the Fed. If you read anything I’ve written on the subject, I argue against FOMC press conferences, however you got to play in the sand box you’re in. The indexes seemingly trades on hints of stimulus and or indications of movement on Fed Funds.

My takeaway from both the press conference and the appearance of the Fed Chair at the Financial Services Oversight Committee was, “We’ve (the Fed) have done all we can do, it’s now your turn”, signaling the importance for both political parties to come together to formalize the next round of stimulus. He did signal that rates will be low for the foreseeable future, which can provide confidence to the market, however most of that should already be priced in. These days I believe the legislators view a major decline in the stock market as a political hand grenade. The pressure for regulators to get something done will be greater when 401k balances are declining. Time will tell whether this 9% decline from highs set at the start of September are enough to get something done. My view is that we will get some form pf package that will be a little more targeted to those that need it, rather than a blanket package, like the last one.

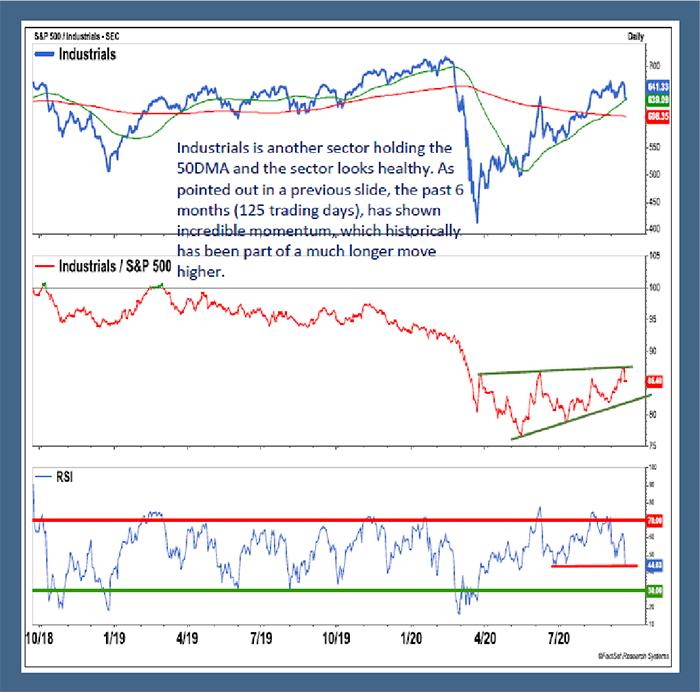

Covid Cases…The recent spike in Covid cases, both in the U.S. and overseas stopped the rotation that had just started to the more “cyclical” sectors. Industrials/S&P 500 has been trending higher since late June, and more recently looked like it was going to break through levels from March but have retreated on this pullback.

What this shows is that the Covid trade (work from home) grabbed strength from the cyclicals again. This seems to happen when cases spike, and the reverse when new cases are declining.

Our “Covid” analyst points out that seeing surges 2-3 weeks after holidays (Labor Day being our most recent) are not surprising. A return to school has also exacerbated new cases. This can leave one to believe a continued increase in new cases would go against the grain. In my opinion, market interpretation again for “buy the dip”.

Economic Data… we received some conflicting economic data last week. PMI (Purchasing Managers Index) is a measure of the prevailing direction of economic trends in manufacturing, based on a monthly survey of supply chain managers, came in a little weaker than expected on Wednesday. Although the number was above 50 (Numbers above 50 represents an expansion), the data showed some weakness in the service side.

Overseas we received the Taiwanese exports numbers, and it showed that the index hit a 2.5 year high. This is important as Asia is considered the center of global trade. This can be taken by investors as an improvement in global trade, specifically manufacturing.

My Take…Global inventory levels (due to a self-imposed closure) are at extreme lows, according to FactSet. I expect an improvement in Global Trade resulting in a pickup consumption. I recently visited a friend that sells HVAC systems wholesale, and his warehouse is empty. His orders are backlogged due to the closure of the manufacturer, and now has pent up demand from his customers. I believe this is typical of what’s happening in most manufacturing, ultimately providing another buy the dip signal.

Summary…although I fully expect more volatility especially through the election, and maybe even lower lows, adding to the names you love long term when opportunities present themselves can be prudent in certain situations. With that said, here’s the buy/sell.

The information contained in this communication does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.