The Debacle

To watch/listen to this week’s article please click here or copy the following link: https://youtu.be/CS0lmU3vi0Y

The day after the Presidential Debacle the equity markets (judged by the S&P 500) was up near 1%. At some stage through the day the indexes were pushing the 2% mark. At first glance, this leaves you thinking that the market is totally irrational, moving more in line with an aircraft experiencing turbulence than an efficient platform for the exchange of capital.

A second look gets you closer to where I live. Long term capital market returns have little to do with who occupies the White House, and more about providing some clarity around long term monetary and fiscal policy. Despite the ridiculousness of Tuesday night, I believe the market has an understanding of what either party wants to accomplish from a fiscal standpoint. The question is, will they be able to get their wish list through both houses?

One concern that I have after what I saw Tuesday, is the increase of the likelihood of a drawn-out legal battle for the Presidency. I’ve stated before that market hates uncertainty, as it restricts the ability of CEOs and investors to make long term decisions. The increase of mail-in voters this year could easily leave the count to not be completed till days after the election. Add on the days for recounts and legal disputes, and it’s easy to see how this could drag on for a month or more.

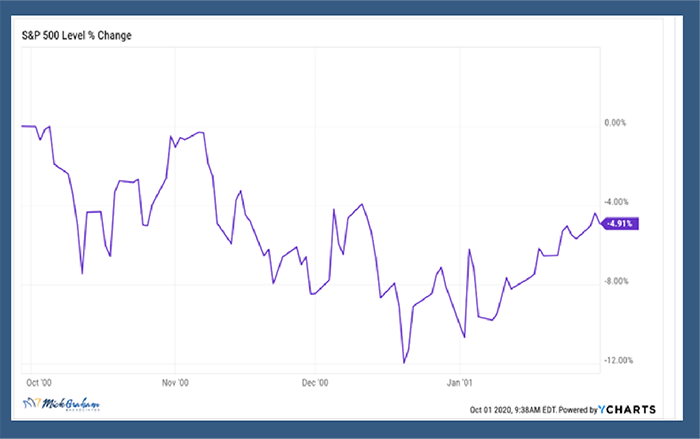

How the markets will react to that is a fair question. We don’t have to look too far back to get some stats. 2000 was my third year living in the U.S., and at that stage I was totally bamboozled by an election not being decided on election day. You’ll remember that the Supreme Court ultimately decided the outcome of the election on December 12th, 2000, over a month after the day of the election on November 7th.

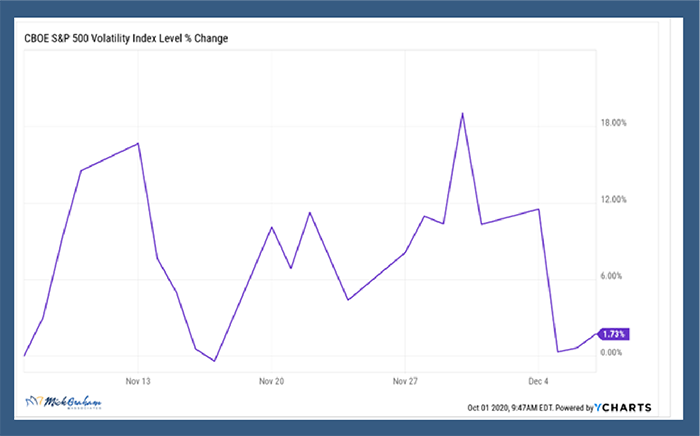

The chart above shows roughly an 8% decline in the markets between election day and the ultimate Supreme Court decision. Officially the market was down a little over 4% between the election and decision, however, is was not a straight line to that decline. Volatility spiked through that time. (See chart below.)

So, I think we can all agree that the possibility of increased volatility through this election period is likely. Does that mean we should pack up, sell out, and hunker down? Or as I’ve heard it said, sit back and see how it plays out? Well, here’s where I’m going to throw the preverbal wrench in the works. The market has already priced in all commonly known things. The fact that we are talking about this, means that the market is already pricing it in. What we should be concerned about are the things that are not commonly known.

There is a whole investing technique designed around going against the grain, labeled “Contrarian Investing”. Contrarian investing is a style in which investors purposely go against prevailing market trends, by selling when others are buying and buying when others are selling. Sounds eerily similar to the famous Buffett quote, “Be fearful when others are greedy and greedy when others are fearful”. Contrarian investors would argue that another name for this style is value investing or simply looking for bargains.

So, let’s look at where we are now. I’d argue the market is now expecting a drawn-out battle, a highly contested, negative election cycle. Both candidates will sell on fear, highlighting the negatives of their opponent rather than the positives of their candidacy. This, by human nature will create doubt, concern, alarm, dread, angst, unease or any other word that doubles as fear. However, as the GOAT (greatest of all time) Buffett has told you, that’s the time to be rapacious, covetous, yearning, avaricious, or yes, greedy.

I’ll leave you with this, there is a lot underpinning a stock market for a long time. Low rates, MASSIVE stimulus, and TINA (there is no alternative) to get an average return than equities. The way to reduce risk, (in my view), is to do it on a security by security basis. Not an all or nothing. This is what will take up my time through year end.

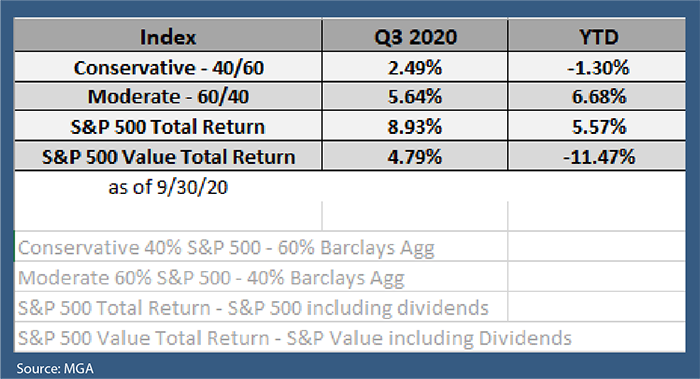

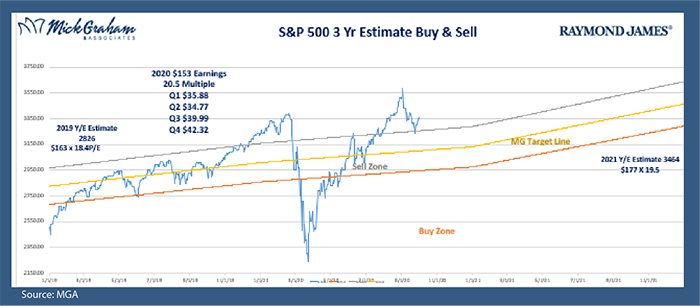

With that, welcome to the 4th quarter, and here’s the buy sell, along with the returns of the 3rd quarter indexes. Can’t wait to be too busy reading earnings reports to watch any news. As always, if you have any questions or concerns, dread, or angst………..you know where to find me.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance does not guarantee future results.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The CBOE Volatility Index® (VIX® Index®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. Inclusion of these indexes is for illustrative purposes only.