401k Update: Dive and Thrive?

Your faith has been rocked, but I hope not broken…

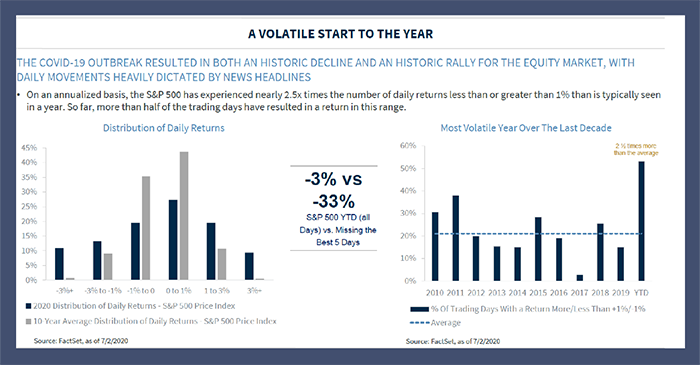

The first half of the year is behind us, and perhaps if you live under a really big rock, you might have thought it to be uneventful. The S&P 500 index (the index that tracks the biggest 500 U.S. based companies) was down around 3% for the first 6 months. That’s enough to make you say “bummer”, but not enough to make you want to sell everything and hide. However, we all know that it was not uneventful, in fact, it was record breaking.

The first quarter had the worst quarter performance since 2008 and the second quarter was the best since 1998. Down 20% and then up 20% respectively. (Insert whiplash here).

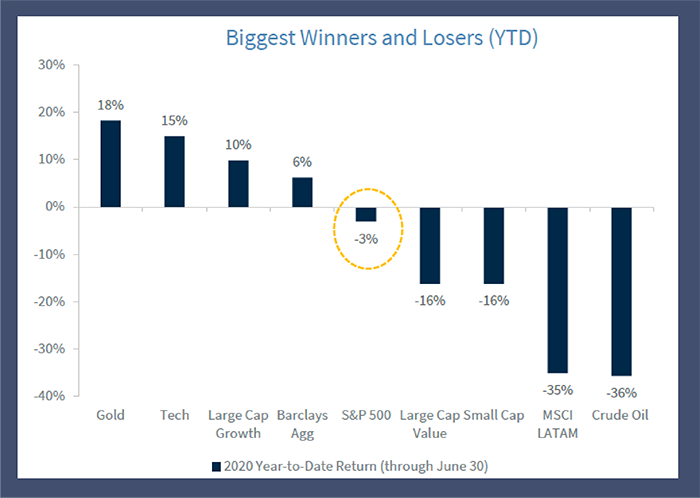

Delving deeper you can see where there were real winners and losers. Gold was the big winner, for the first time since 2011, closely followed by technology companies. The energy sector was rocked by a brief but very loud decline of oil futures to $-35 a barrel, yes negative. I think most people were caught off guard that it could go past zero. If you had a large dock and some deep water in your backyard you could’ve parked a tanker full of oil overnight and been paid to take it. Yes, the first half of the year has been crazy.

But don’t lose faith. This is what markets do. Overshoot and undershoot…we call that volatility. Volatility sounds scary however volatility creates opportunity.

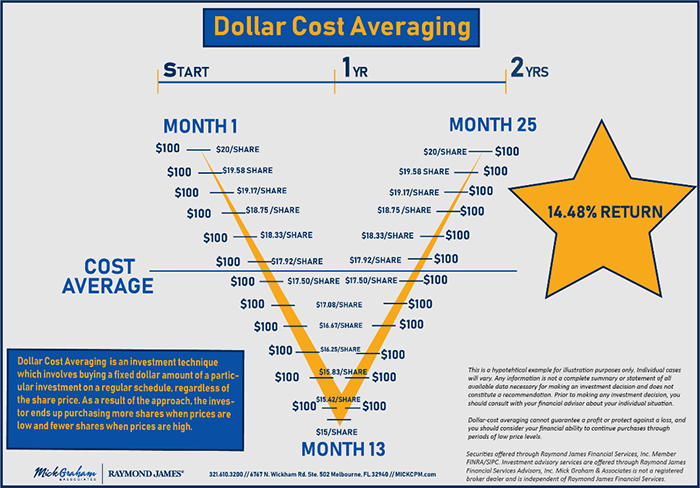

It’s easy to look back now and say, “if I only would have bought at the market bottom then I’d be great”. But you did buy at the bottom. If you did not change your contribution amount and your investment selections, then you were buying each pay period while the market was in free fall. That’s why 401k plans work so great. By nature, when you automatically invest each pay period, you are using one of the greatest risk reduction strategies available to any investor….Dollar Cost Averaging!!!!!

Let’s skip what we have all gone through and rather look at the light at the end of the tunnel. Or at least the end of this year and beyond.

We are still waiting for a vaccine, it looks like we’ll be getting another stimulus package which will increase the overall size of the governments balance sheet to amounts that most never dreamed of, and we’ll have an election this year that will prove to be entertaining if nothing else. Therefore, the potential for volatility/opportunity is there.

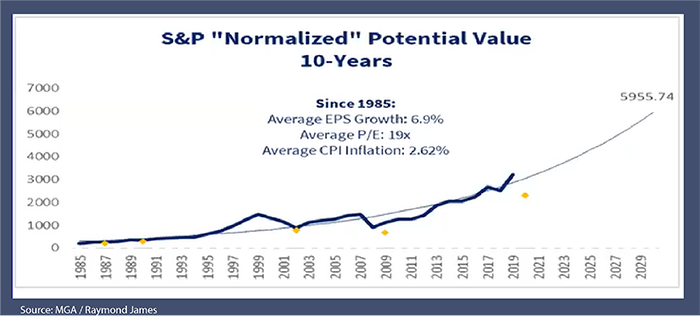

In the world of 401k, a short-term outlook on the economy is about as useful as a glass hammer. They have long term objectives by design. This is money that has been put away for when you’re no longer working, and then hopefully for a really long time after that. Therefore, although I want you to pay attention to the short term, I want you to always keep the next phase in mind.

Yes, we are now technically in a recession. But just like day follows night, spring follows winter, so too will follow an economic expansion. There is nothing that we have been through (including this pandemic), that I believe will halt or even decline the long-term growth rate of U.S. companies’ earnings.

For the past 50 years, we have averaged a 6.9% rate of growth. That’s important because the market is priced on a multiple of that number. So, 2020 is expected to be a year where earnings decline year over year. However, that means that future years have the ability to be better, to get that average rate.

The one thing I do want you to remember is that the market today is priced on expectations of earnings around 6 months ahead. So, it’s more important to focus on what you believe will happen from here rather than what’s happening now or has already happened.

I’m very bullish long term. The next few months leading into the election may end up being choppy for the markets, however that’s the time to be excited.

Keep the faith, and if you need a pep talk, then feel free to give me a call. 321-610-3200.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.