Hitting Singles

In this business, when you’re wrong, acknowledge it, correct it, and move on as fast as possible. For the past few weeks, I’ve been an advocate for building up cash, as we head into the full swing of the election. Since the time I suggested building a war chest, the markets have continued to generally make new highs and new highs.

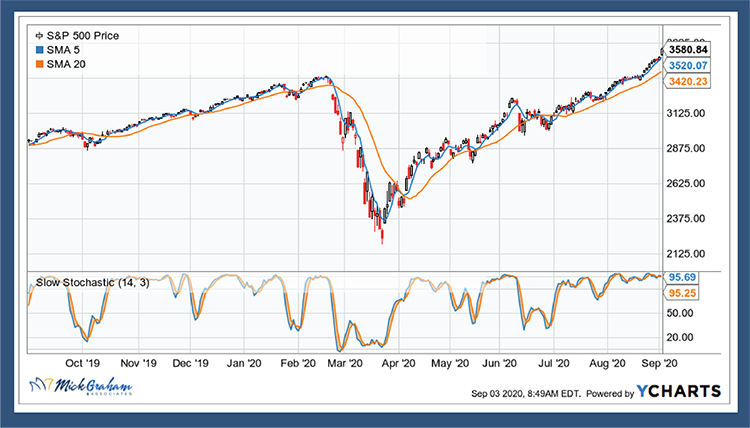

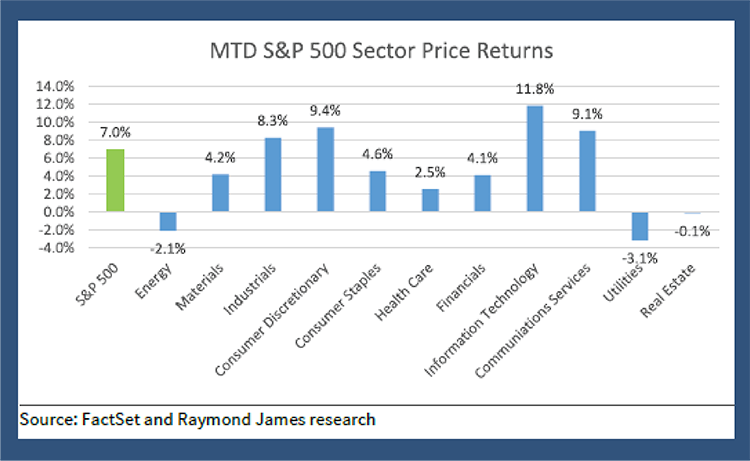

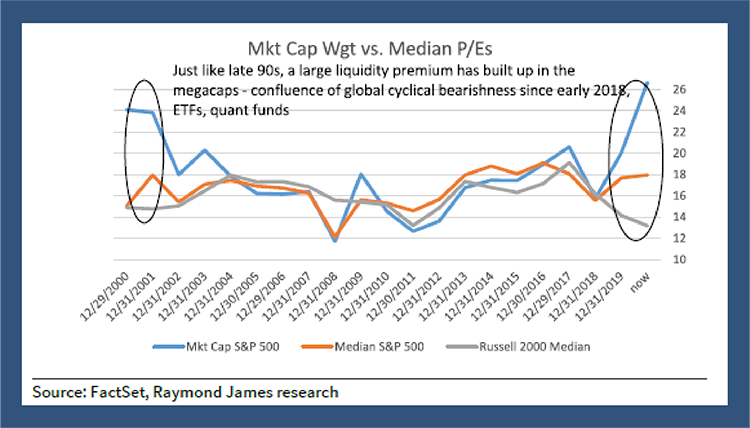

The S&P 500 closed on Wednesday last week at 3580, seemingly defying gravity. The charge higher, (to the extent of 7% in August), was led again by the large cap technology related companies. The interesting part of this rally is, although I would argue that the overall valuation of the S&P 500 is expensive, the median stock remains inexpensive.

The valuation breadth between the large cap companies vs. small cap is as historic as the current multiple. At 27 times 2020 EPS estimates, this is about as high as I’ve seen the valuations for the S&P 500, although when you look at the median stock in the index it comes in around 18 times, historically below the longer term average of 19. The divergence gets even wider when you add in small caps, (using the Russell 2000 index).

A look back in time, when the divergence looked similar, takes you back to the year 2000. The “Tech Bubble” was a time when companies with dot.com in their names where raising billions in public markets without any fundamental basis. The big difference this time around is the companies that have led the rally, have a fundamental reason for it. The question is, will their earnings eventually grow into the supersized expectations placed on them?

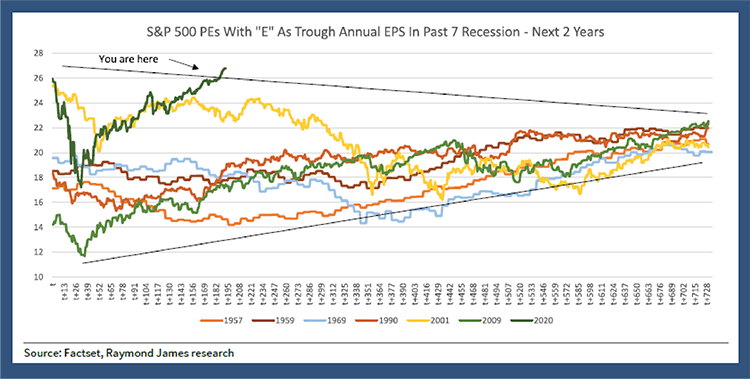

The chart below, (I’ve shown you previously) highlights P/Es start to normalize in the next 2 years in a recession’s recovery. This recovery doesn’t seem to be following the playbook, driven no doubt by the unprecedented stimulus flooding the market.

Is this time different? Maybe. However this turns out, I still don’t like to over pay for anything, especially securities. So, I’m sticking to my guns and still advising for suitable individuals, that building up some cash at this time, especially from the companies that have led the rally, can be prudent.

This situation is the exact reason why I can never go all in (one way or the other), no matter how strongly I feel. When making tactical moves in a portfolio, (such as overweighting or underweighting an asset class or security), you can never let the move be a make or break. Managing money for others is about hitting singles, not swinging for the fences. So, although raising a little cash has meant missing out on some of the gains, our strategies still had the majority of the portfolios participating. As we have recently seen, when things move, it can happen violently. Preparation is key.

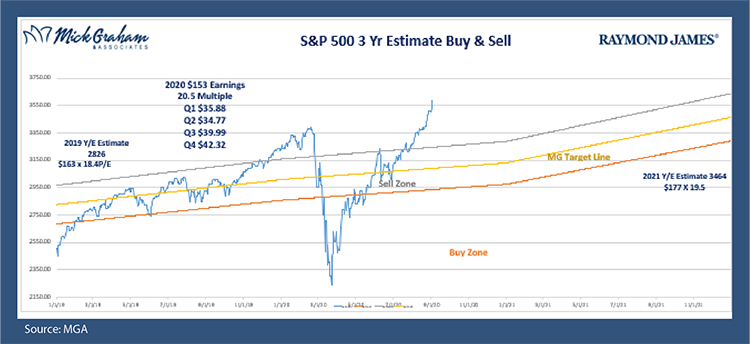

With all that said, here is the buy/sell

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham, and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.