Bye-Bye Bear

To watch/listen to this week’s article, please click here.

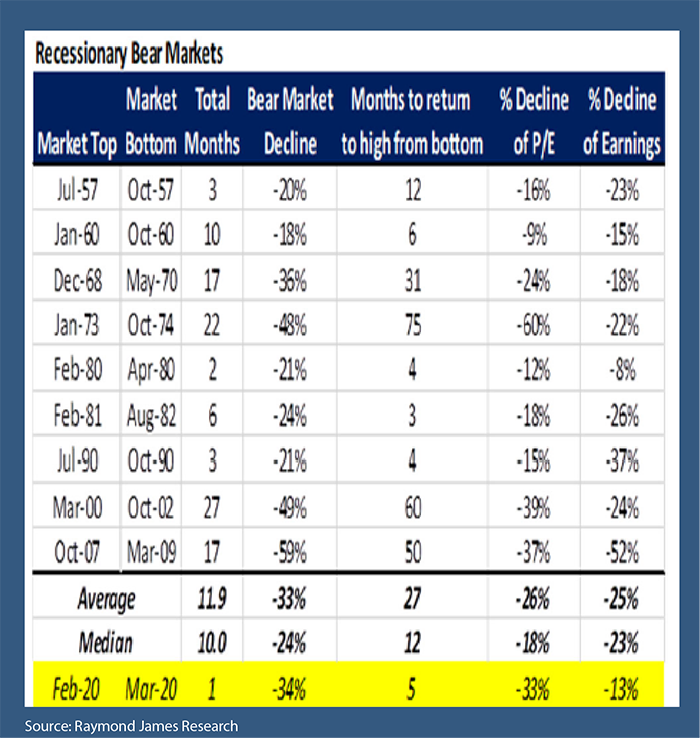

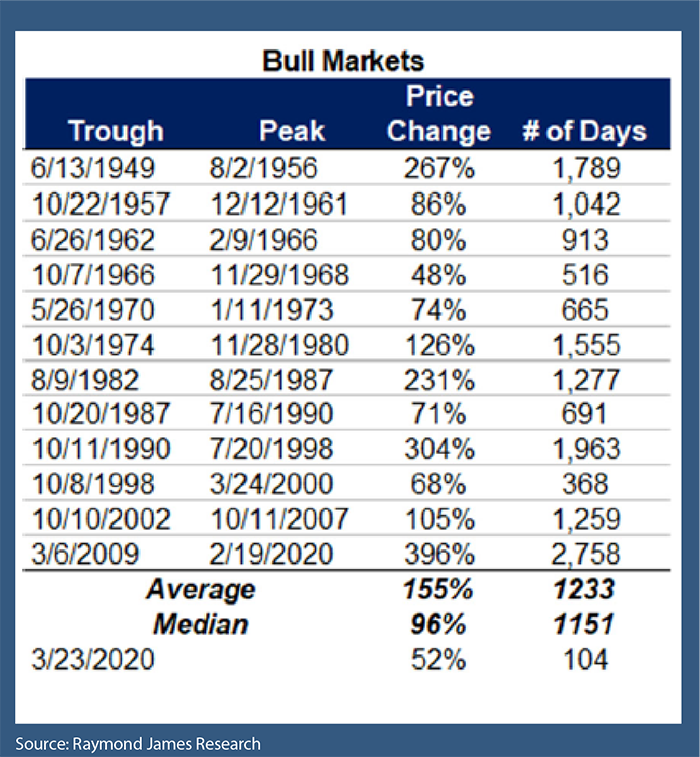

By way of putting in a new high last week, we are officially out of the bear market, and now in a bull market. As of the time of writing, we are now 52% above the market lows of March 23rd. Wow, what a whipsaw. Total duration of the bear market…1 month. It took 5 months to get it back, which funny enough, is not the fastest.

You can see from the stats above, the average length of the recessionary bear markets is 27 months, with a median of 12 months. The good news for us now is that the average bull market is 3 years in length and returns 150%. But I think we all know by now things are anything but normal or average.

The past few articles I’ve written have been devoted to pointing out my reasonings for a sideways or weak market, at least through the election. The circus in D.C. has kept the market from looking towards the election, as it anticipates another round of stimulus. Latest reporting has the Republicans looking to do another $1 Trillion, while the Democrats are looking at a $3 Trillion package. However it works out, more money into the economy will be a short term win for corporate earnings, but is not something that can be sustained in the long run.

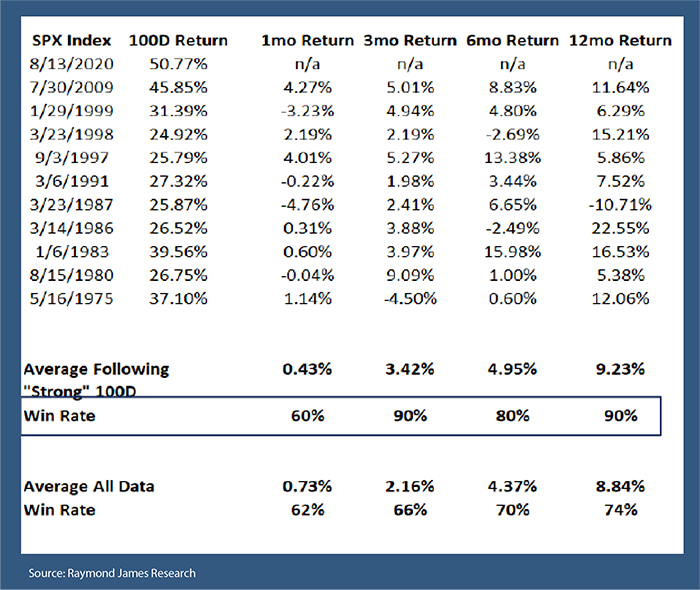

There are data points that give some positive signals. The past 100 days have been the best that the market has posted, since coming out of the great depression. Historically, when we have had a strong 100 day period, the next 12 months have been positive 90% of the time.

None of the dates indicated however, took place while in the midst of a pandemic, and within 3 months of an election, therefore I’m not putting much emphasis on this. I do put faith in a longer term move higher, when we get some clarity on what the next four years will look like from a fiscal standpoint. That we may not know till sometime after November 3rd.

I’m still sitting in the camp that we may see the market take a breath and it may be time to keep a little on the sideline, on the off chance we get to pick up some great companies at lower prices.

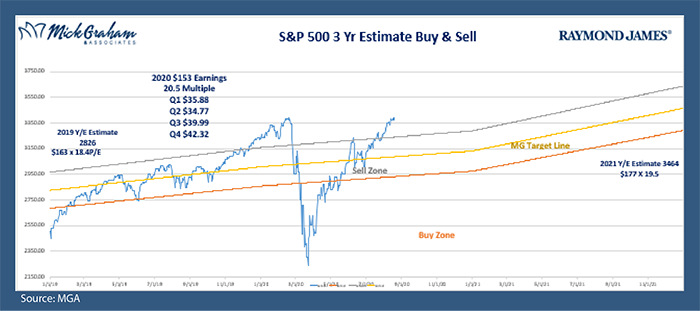

With that said, here’s the Buy/ Sell…

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.