Grit Your Teeth and Squeeze My Hand

The end of the calendar year hasn’t seemed to stop the market from continuing to get trounced.

I know you’re feeling concerned and certainly it’s hard to look at the December statements. But again, the market is doing what markets generally do. What we need to be sure we don’t do is fall right into the trap of doing what the retail investor typically does…that’s sell at the bottom.

Historically retail investors have underperformed the overall markets by a significant amount mainly due to poor timing decisions. I understand the thought to sell to protect your capital. I do, but history shows us that this system more often than not doesn’t work.

Here are a few stats:

Missing the best 5 days can drop your overall return by 35%. Source: Fidelity

Following all negative years since 1926 the market has averaged 12.4% Source: First Trust Portfolios

Last year was a year which stocks and bonds both trailed cash. When those years have occurred, the major indexes have averaged of a 15% return. Source: JP Morgan

As of now we are in a correction. When markets have fallen 10 to 20% from recent highs, historically, the next move higher has been over 40%. Source: JP Morgan

Now I’ve read everything from “this time is different” to “a recession is looming” to “a pending stock market crash” by the TV talking heads. I’ve heard it this time and I’ve heard it in 23 of the last 3 recessions. In my opinion, fear can be a good sign for the stock market. Fear is where the money can be potentially made.

When there is fear in the air I like to look at the statistics above. There are many more that I can give but my take away for you is that corrections are part of a normal market cycle, there has only been 3 bear markets since 1926 that have not come with recessions. The rebounds on the stock indexes have been swift and strong up an average of 29% through that time. Source: FirstTrust Portfolios

Here is my call to action: Stay the course. Historically, we know it should turn around. What we can’t afford is to be on the sideline when that happens. Grit your teeth. My hand is here if you need to squeeze it.

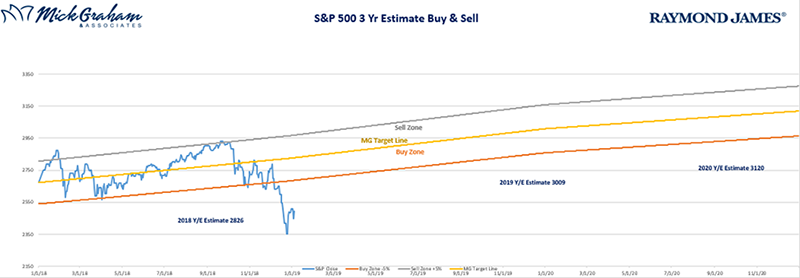

Source: MG&A

The information contained in this material does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Holding stocks for the long-term does not ensure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. The S&P 500 is an unmanaged index of 500 widely held stocks that’s generally considered representative of the U.S. stock market.