Broken Record Alert: Back to Earnings

As you know, I’ve said for a long time that it all comes back to earnings. Therefore, given that we are now starting earnings season I wanted to show you a quick recap of market valuation.

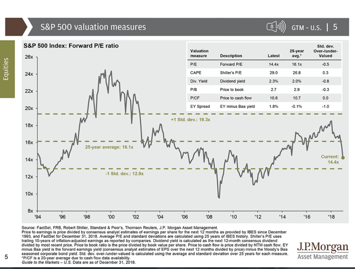

At the start of last year the tax cuts and jobs act had us raise our multiple on the market to 19 times as we waited for the earnings to come in and prove us right. I also made the decision to lower the multiple back to long term averages over the course of the next two years and in hindsight that time frame may have been a bit too long. Nonetheless what we’ve seen in the last 3 months has reduced multiples back to levels not seen since the end of 2013.

Source: JP Morgan

Anyway, here’s a reminder of how I value the market and why I think we’re at extremely cheap levels.

We have a lot of noise and movements in the markets both up and down based on any number of events, most of which have absolutely nothing to do with the long term. At the end of the day however it all comes back to corporate profits, and how much we are willing to pay for those profits. Any index you look at (Dow Jones, S&P 500, Russell 2000 etc.) move dramatically on a daily basis, a significant driver of that is expectations. The markets usually move today based on what the investors feel the underlying companies will be doing in 6 months. You often hear about companies beating earnings and the stock price actually goes down. This may be because the price of a company today is based on what investors feel it will be worth 6 or 12 months from now. A quarter might have been good but if guidance is bad, or there were one time events in the quarter that helped, that may not happen again. When expectations change so does the price.

I ask myself through every time of large movement, is anything that’s being said likely to affect the earnings of the S&P? If so, then we need to discuss reducing or preserving positions. If not, then it could be a buying opportunity.

So there is and will always be a lot of noise around the markets, but what we really need to pay attention to is earnings and what we have to pay to get these earnings.

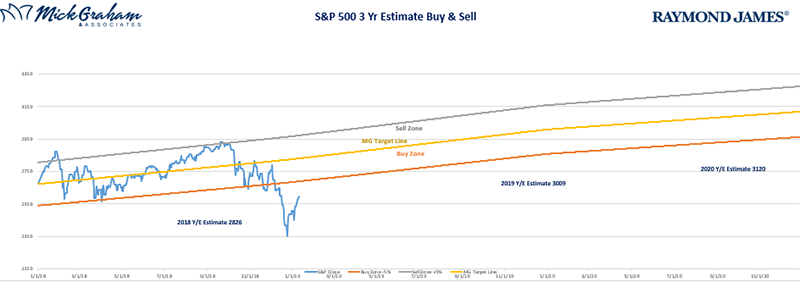

Here is this week’s buy/sell

Source: MG&A

As always feel free to give us a call with any questions.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The S&P 500 is an unmanaged index of 500 widely held stock that is generally considered representative of the US stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and the index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results.