Single Stock Strategy

With all the volatility in the past few weeks we’ve seen some individual stocks take a substantially bigger hit than others. That leads to several conversations that I’ve had in the past many weeks on when to sell a position.

First let’s talk about what not to do…

- Let emotions take over. So far this quarter there have been a number of stocks that have gone into bear market territory (20% below their recent highs), with at least one stock down over 50%. These moves are often headline related and reaction to that news is often swift and violent. Reacting on fear is often the worst thing you can do. The market overreacts on the up side and down side, and it’s quite possible that a single down grade by an analyst can be determined widely and is not an accurate reflection of what is really happening.

- Overconcentration. I’ve written previously about my first manager at the first brokerage house that I worked, keeping all of his bonus and retirement in the company stock. He was set to retire right when 2008 financial crisis hit, and he watched the value of his retirement portfolio go down around 80% over the course of that time. I use the rule of 4.5. I never want my portfolios to hold a position that is greater than 4.5% of the overall value. A concentrated position certainly has the potential to give outperformance but the same is true on the downside, and if you’re at the stage where you are withdrawing from the portfolio, (or near the stage), that can be devastating. I have a few people who see the trade confirmations of a particular position and ask why I sold such a small percentage of that stock, and most of the time the answer is to not let the exposure of that stock get above the limits I’ve set on it. Even the great Warren Buffett changed his opinion on diversification after getting crushed early on in his career.

- Listen to any one person. I read a lot of research. I mean I read a lot. I have my favorite analysts and others that I think found their designations in a box of Corn Flakes. Either way, I won’t use what one of them have said about a single position. Instead, I use that to platform from to make an overall decision.

Here’s what you should do…

- Take a breath. It’s very possible that you will experience a 20% or more hit to one or many of your positions each year. If three 5% moves and one 10% is normal each year, then some of those positions are going to be down more than that and others not as much. Now I’m not saying do nothing, I’m saying rather than putting that stock on the chopping block, use it to initiate the next series of questions.

- Has anything fundamentally changed in the company? Business goes through life cycles. Expansion and retraction, a lot like my waistline, although it seems to be going in the same direction for the last few years. Does the company still produce and sell the same goods and services? What’s the trend of their market share? What’s the progress into new products or regions? What innovation is coming down the pipe? These are all questions that can ultimately affect the earnings in the future, Not this quarter or next, but several quarters in the future. Sometimes companies need to reinvent themselves and that is problematic to shareholders, because they may not look the same as the company you originally bought, and that is a situation that you may not want to invest in.

- Do you believe in what the management team is saying and executing on? Look just like in life, some people have an uncanny ability to deliver above expectation and others are just full of hot air. If the stock has been hit hard, is the management team still positive on the future forecasts? What’s the history of the company delivering on what it says it will do each quarter? If you have a company that consistently over reaches and under delivers, then you need to decide whether their goals are achievable or it’s a pipe dream.

- Listen to the conference calls. Each company is required to present their quarterly reports to “the street” and set revenue and earning guidance for the next quarter and fiscal year. A group of CEOs don’t like this including Jamie Dimon (JP Morgan) and Warren Buffett (Berkshire Hathaway), however unfortunately for them if they want our money, the SEC requires them to do so. Their complaints are not without merit, as quarter figures can be manipulated to look good or bad, and it has the potential to discourage CEOs to invest in future earnings. Such as R&D or marketing expenses in the current quarter that won’t hit the earnings statement for many quarters in the future. Each company that is publicly traded on a major exchange should have an investor relations page on their website. From this tab you can follow the links and look both and the financial statements and listen to the conference calls online. You don’t have to listen live, in fact, I like to listen after the analysts have published their reports of the earnings call and read through their interpretation of the quarter and guidance. There is a lot to be gained by listening that does not jump out at you on paper, such as the excitement in the voices of the company executives on growth prospects.

- Analysts. Get familiar with the analysts that cover the stocks at different research houses. As I’ve said above, I’ve got my favorites. I find that there are analysts that believe everything the company says and others that question everything. I like to read both sides and form my own opinion. Most websites such as Yahoo Finance will give you a consensus price objective of each stock, meaning the mean of all the analysts that cover that stock. Over the years I’ve found this to be a pretty good starting point. From there I look to find things that the street is missing. As Ken Fisher says, “To outperform, you need to know something others don’t”. What’s better than the reports on earnings is the notes from management meetings. Most “good” analysts will spend some time with the management of the companies they cover and either attend an analyst day or better, still do a site visit or one of meeting with management throughout the quarter to check their progress and take a bigger picture view of the outlook for the company. I find these reports to be a great read.

- Lower your cost average. If you’ve chosen a sector/sub sector and ultimately a stock you believe in for at least the next couple of years, and you pull the trigger and buy it, unless something fundamental has changed or there’s a managerial problem (as detailed above), then you should be always looking to lower your overall cost in that position. For example, you purchase a stock at 100 and buy 10 shares and it goes down to 80. You now have the option to buy another 10 shares, which would lower your overall average to 90. Now when it gets back to 100, you’ve made money. This strategy in any one quarter can work against you because it’s tough to catch a falling knife but remember we’re here for the long term.

Ok I realize there’s a bunch of detail here, and if you’re not saying, “That’s what I pay you for”, then you should be managing your own portfolio!!! I wanted to give you the above detail to show you my decision-making process. Spinning the wheel proved ineffective after the 90s so this is what I’ve used since….

It’s been a tough quarter I know, but I’m still hopeful the indexes will get back closer to where we started the quarter by year end. It’s now time if you haven’t already to start thinking about taxes for this year. I’ll devote the next article to that with some strategies that I’m reviewing.

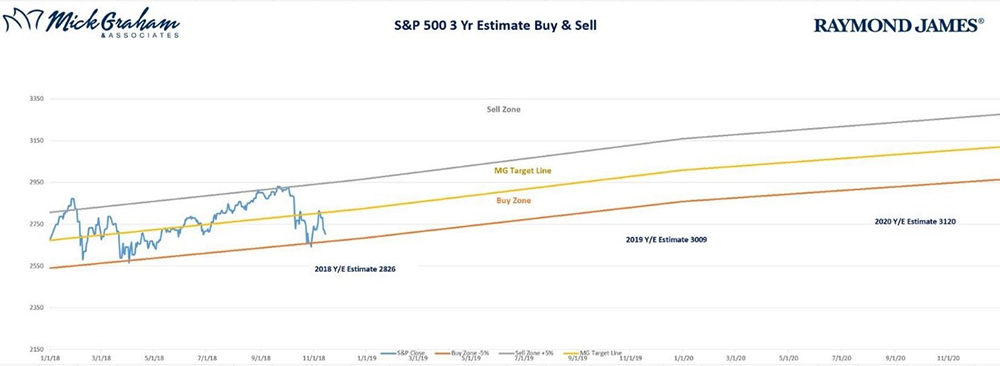

With that….here’s the Buy/Sell

Source: MG&A

As always please feel free to call with any questions.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James.

Expressions of each opinion are of this date and are subject to change without notice. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability. Diversification and asset allocation do not ensure a profit or protect against a loss.