The Calm Before the Next Circus

Just shy of $3 Billion was spent in the campaigns for House, Senate and Gubernatorial races during the midterm elections. This doubled the amount of money spent on the 2014 mid terms according to a NBC report. Florida was at the top of the list with the Senate and Governor races spending over $350 million, in the Orlando/Daytona/Melbourne market, topping the ad buy with $110 Million, which can explain why our ad rates went up considerably in the last two months.

I guess no one said democracy was free…..

Now the results are in (well mostly) at the time of writing, with a few races too close to call. We know that the House has flipped to Democrat and the Senate will remain Republican. This will mean gridlock, as I detailed previously, (click here for article). I believe this will be good for the markets, as status quo flourishes.

What we need to expect however is a higher level of negative talk that has potential to shift markets on a short-term basis. Impeachment, filibusters, calls for resignation, will be more of the norm in the coming couple of years, as we now start the run up to the 2020 Presidential election. The following catch phrase will ring true, “Volatility creates Opportunity”, as the noise will make it harder to focus the long-term outlook. We do have potential for the market to actually focus on fundamentals over the next couple of quarters, before the ramp up really begins.

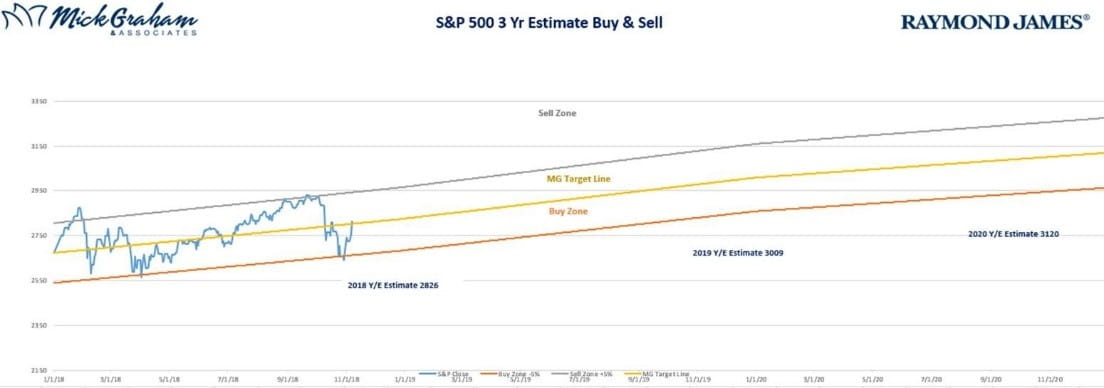

Last week I put out our three-year forecasts of S&P 500 fair value through 2020. (See buy sell below) Those numbers showed high single digit returns over the next couple of years, as earnings continue to grow but not as fast as we’ve seen over the last 12 months, as the one-off effect of tax reform is digested through the numbers.

Here is the buy sell.

Source: MG&A

As always please feel free to call with any questions.

The S&P is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results.