Headline the Fed

Last Wednesday’s 600 odd point jump has been credited to a speech given by Fed President Jerome Powell on Wednesday at the Economic Club of New York. Actually, you can narrow it down to two words, “Just Below”.

The “Just Below” is referencing what is classified by the markets as “Neutral Level” for Interest Rates. Neutral is the level of Fed Funds Rate (Short Term Interest rates) where the Fed believes they are at a level where they don’t need to do anything based on the current level of economic data. Like a teeter totter with two kids of the same size on each side.

Before we jump to thank the Fed President for the 2 plus percentage point jump in the major indexes, let’s remember what cost us a couple of thousand Dow points in the first place. The Fed has 5 major roles that all center around conducting the nations monetary and baking industry to give stability to the financial system. I underlined the stability. As recently as a month ago, Mr. Powell said that we are “a long way from Neutral”, according to the New York Times. This I believe was one of the major reasons for the October rut, or if you need to label it a correction.

In an attempt to provide transparency, I feel this Fed President, compared to his recent predecessors, is causing unnecessary market volatility. I’d prefer to hear comments that state fundamentally that based on recent data the economy is on track to grow at X percentage points, which is plus or minus what we would like to see. We will continue to review the data to determine if growth comes in above or below our expectations and adjust our current forecast accordingly.

Although this sounds like a cry session on what I think was unnecessary volatility, there will always be something that causes volatility in the market, warranted or otherwise. Rather than try to fight it, we need to accept it and react accordingly. For long term investors, (which is what many of us), these moves don’t change the long-term thesis, but create some near-term opportunity.

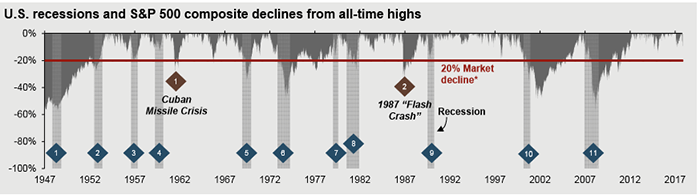

With each correction there is a possibility that it could develop into a Bear Market (identified by a decrease of over 20% from the high), but the magnitude of corrections and bear markets are very different. Corrections are generally quick and start for any reason or no reason at all. Investor sentiment is the main driver, where bear markets are generally fundamentally driven and are long grinds lower rather than sharp drops.

There is a fairly high correlation between bear markets and recessions. As you’ll see from the chart below, of the past 11 recessions (detailed by two negative quarters of GDP), bear markets have been a cause or effect.

Source: JP Morgan

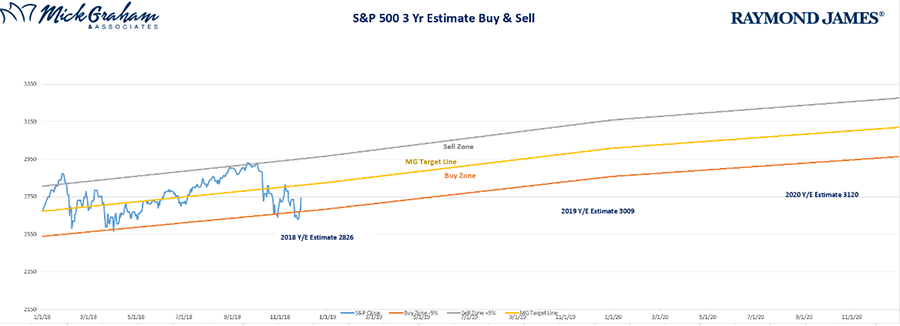

Given that even the Fed is forecasting (and want) GDP growth of between 2-4%, I don’t see anything in the near future (meaning several years) that will be the cause or affect of recession number 12. Overall, I still think stocks have more going for them than against them. Uncertainty maybe high in a few areas, but as it fades, I expect that the tide should turn, and we can rally for several quarters. As you’ll see from the Buy/Sell, we’re not that far away from market fairly valued even though it may feel like it due what I feel was a third quarter that over shot.

Here’s the buy sell

Source: MG&A

As always should you have any questions or concerns, don’t hesitate to contact us.

The information contained in this letter does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any opinions are those of Mick Graham and not necessarily those of Raymond James.