Spotting the Bear

I must have read and heard the term “Bear Market” more than a dozen times last week as I travelled around North Carolina. Early week declines were subsequently followed by a rally. Understandably, a lot of people were nervous and concerned about this being the start of a bear market. (A bear market is a prolonged, fundamentally driven, broad market sell off that is 20% or greater). What we have seen so far can just be classified as a correction. Corrections are generally short, sharp sentiment driven drop of 10% or more, the cause of which are generally psychological.

Now, spotting a bear market although difficult, is not impossible. I see it coming from two different areas:

- Something happens in the global economy that is totally unexpected and will be devastating to corporate earnings in the near term. The best and most recent example is manufactured derivative products by investment banks that culminated with several of the largest global institutions getting caught with these products on their balance sheet. When the market dried up for these products, they had to be written down, and due to the amount of leverage that these products had, became virtually impossible to see how deep the rabbit hole was.

- Is more of a slow grinding bear where we see one of the following, recession (two negative quarters of GDP), excess sentiment (earnings forecasts too aggressive and companies cannot meet them), change in regulation (that affects companies’ ability to earn), drains on liquidity (banks stop lending by an inverted global yield curve) and/or major world wars.

So, what can we sum the current volatility up to? Start of a bear?? I just don’t see it. Obviously, I can’t see anything that is unexpected as detailed in point 1, and I’m unable to find any justification for a recession, excess sentiment, change in regulation or drains in liquidity.

Therefore, I can sum this up to a correction. The market is the greatest pre-pricer of all things that are known, meaning if you’ve read it, heard it or watched it, then the market has accounted for that already. Now when the market accounts for these things, it depends whether these things are justified before either the market will bounce back or look for something else to pre -price. So, when I relate that comment to the tariffs that are giving the talking heads on TV so much to talk about, the market has already pre-priced a substantial amount of earnings to be affected. It’s only if the effect of tariffs turn out to be much bigger than expected, like a global embargo, that from this point has the potential to solidify the concerns that are already priced.

I’ve written before what the total effect of tariffs could be, and in my opinion, these tariffs would need to be many times bigger than the amount they are now to have any meaningful long-term effect on the market. Click here to read the article.

I think we will see some resolution either some time before year end or shortly after, because I believe China is waiting to see how much power the President will yield following the midterm elections. The belief being that if the Republicans lose a branch of government this will weaken the Presidents bargaining position. I think this belief is ill advised but given the fact that the tariffs hurt the Chinese economy much worse than the U.S., it’s the only explanation I can come up with.

So again, at the risk of sounding repetitious, I think we have just started the final leg of this secular bull market and the final leg has generally given the best returns. So, I tell you if you liked stocks a month ago, you have to love them here.

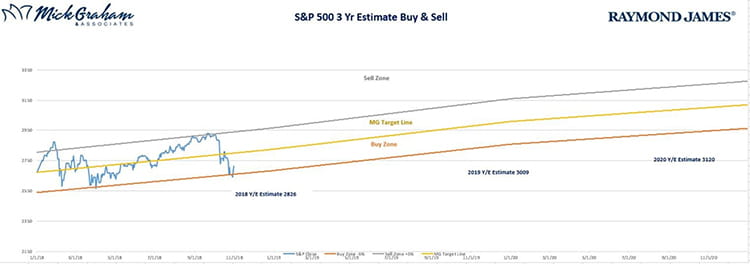

Here’s the buy sell

Source: MG&A

As always please feel free to call with any questions or concerns.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.