Myth Busters – Income Is Not Cash Flow

One of the pushbacks I receive every now and then sounds something like this, “Don’t sell my XYZ stock, I’ve held it forever and it pays a big dividend”, or, “I like high dividend paying stocks because I can live on that in retirement”. It seems completely logical that if you have a lump sum and you can live off 5% of that figure, then buy a stock that pays a 5% dividend. Even buy a stock that pays a higher dividend like 8% and maybe even increase your retirement income. There are plenty of oil pipeline stocks that pay 8% dividends.

Some of these comments come from a long experience of holding companies like Proctor & Gamble or Phillip Morris or Exxon, who have been long term great performers. But I’m here to tell you Income is not Cash Flow. What is needed in retirement is Cash Flow. Cash to pay for your everyday living expenses which when you are no longer working will come from any benefits you receive (social security/pensions etc.) and supplemented from your portfolio.

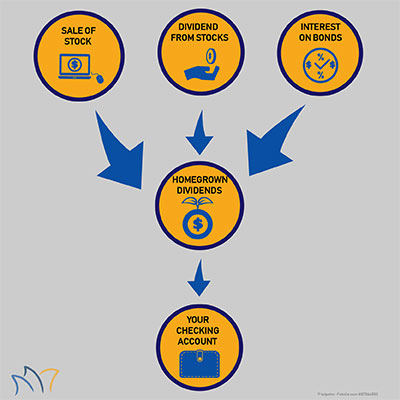

When it comes time to supplement your income or even replace your employment income from your portfolio then I argue that you should create your own dividend strategy. Ken Fisher calls this HomeGrown Dividend Strategy, which I’ve adopted.

A HomeGrown dividend strategy is a combination of dividends, interest from bonds and yes, the sale of stocks. Selling stocks is not the enemy of the investor its supposed to happen and in fact must happen to protect against becoming over exposed to any one sector of the market and any one stock. This is one of our basic risk management measures, which is also the most overlooked and thus accounts for a large portion of why the retail investor underperforms the institutional investor.

Let me dig a little deeper. Within the stock market, I’ve detailed in previous articles the different sectors. Energy, Technology, Financials etc. We also differentiate stocks between Large Cap and Small Cap and Growth Stocks and Value Stocks. Large Cap stocks (as defined by Investopedia) is a stock with a market cap of $10 Billion or more. I classify it as $20 Billion and above. Small cap companies are defined as companies with a market cap of below $2 Billion.

Growth stocks are companies that are anticipated to grow their market cap faster than the average of the market, while a value company is defined as a company that has relatively low value compared to its fundamentals (low P/E) and generally having a higher than average dividend yield.

As you will see in the chart, growth stocks and value stocks trade leadership during different economic cycles. One does not outperform the other consistently. I suggest that a combination of both is a prudent strategy. A lean towards growth for an investor in the accumulation phase and a lean toward value for those drawing from the portfolio. A lean— not an all or nothing!

As you will see in the chart, growth stocks and value stocks trade leadership during different economic cycles. One does not outperform the other consistently. I suggest that a combination of both is a prudent strategy. A lean towards growth for an investor in the accumulation phase and a lean toward value for those drawing from the portfolio. A lean— not an all or nothing!

A lot of people feel that if a company can pay a dividend that highlights that the company is healthy. We should own a portfolio of healthy stocks, right? Yes, however there is nothing inherently better about a company that pays a dividend. It’s just another way of generating shareholder value. It’s no better or worse that growth of the same value.

There are no guarantees with dividends. The management of a company can choose to increase or decrease a dividend at any time for any reason. Think about what happened to GE recently, where the stock price fell from the low $30s at the start of 2017 and is trading now in the low teens. As the price came down the dividend yield rose, to the point that management cut the dividend by 50% in November of that year. So, for an investor relying on GE dividends to fund cash flow, they got a pay cut of 50% and watched the value of their holdings go down by the same. That’s not to say that GE is a good or bad company. My point here is that dividends are not the holy grail when it comes to retirement income. Think HomeGrown.

I tell people I manage risk and that leads to managing portfolios. I’m always thinking about what can affect the outcomes we have for our clients. At the front of that list is longevity. We are living longer and as the decades flow, studies show that the next generation will live longer still. That said, a portfolio at full retirement age (say 66) will likely need to sustain the client for 20 or even 30 years. Over that period there will be many different market leaders and overexposure (or even as I’ve seen in some investors account sole exposure) can be devastating. Having to cut your income in retirement due to that overexposure will not be a good conversation at the dinner table.

Here is the buy/sell

Source: MG&A

As always should you have any questions or concerns, please feel free to call.

Opinions expressed are those of the Mick Graham and are not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Mick Graham, Raymond James Financial Services, Inc., its affiliates, officers, directors or branch offices may in the normal course of business have a position in any securities mentioned in this report. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein.