Political Predictions & the Market

Political ads are in full force, and here in Florida we will get front row seats to some of the best battles in the country. A governorship and Senate seat set to be elected in November, that has already seen race as an issue and literal mud slinging with each of the Senate candidates blaming each other for the red tide and lagoon issues. This is sure to be a campaign season that will see the gloves off across the country.

I’m without doubt the worst political forecaster in the business. Dating back to the early 2000s, I have been batting one thousand in selecting losers in national campaigns. My predictions for state and local elections look a little better, but not that much. It’s just as well that the markets move despite those in office. Poly (Greek word for many), Ticks (meaning small blood sucking parasites), “politics” contributes to headline risk, however in my research adds little long term.

So, with the above admission of my election predicting prowess, I give you my thoughts on the outcome of the midterms. From my 7-8 minutes of research on senate races, I don’t see a way that the Republicans lose any seats, in fact I predict they will pick up a seat or two. The house on the other hand is a different matter. Democrats look to be contesting a lot more national races than Republicans, and I predict that the Democrats will take the house. If I’m correct, that will put us back to not getting many bills passed and we return to the gridlock that we have become accustomed to in the past many years.

Doom and Gloom for the markets…right? This will be the end of the bull run?? Should I move to Canada??? No, I think it’s actually really good. I’ll go into the historical statistics below, however here is my overriding theme:

- The market is priced on a multiple of earnings

- Companies will figure out a way to make money despite poly-ticks.

- The market really only cares about things that are 24-30 months out in advance

- Gridlock means status quo, and that gives CEO’s faith to make decisions based on nothing will change

- The third year of a Presidential Cycle has historically been the best year for the market.

The market is priced on a multiple of earnings

I’ve written about this in depth, however in summary the market is priced on two things. The earnings of the companies within the index (i.e. S&P 500), times by a multiple of those earnings. For instance, as of writing today, earnings for the S&P 500 after the 2nd quarter is on track to be around $150 per share, meaning if the S&P 500 was 1 company rather than 500 companies, the earnings of that company would be $155. At a multiple of 19 times trailing the market would be 2945. Two things to consider here, ultimately for the market to go up, earnings need to grow or the multiple needs to go up.

Companies will make money despite poly-tics

I’ve always said companies will figure out a way to make money and return value to shareholders, they just need to know what the playing field looks like. During the last administration, you’ve seen several companies move headquarters to overseas markets that were beneficial to bottom line earnings, which included corporate taxes, talent acquisition and distribution. If one part of the globe becomes too onerous to operate in and there is another part of the globe that can assist the bottom line, then that’s where they will ultimately go. Since tax reform passed last year, you’ve seen less of an exodus and more money returned to the U.S. This was a business decision not based on poly-ticks.

The market really only cares about 24-30 months in advance

The next tsunami will come, no one knows when or how big it will be or how long it will last. For

example, we all know that social security is going broke. Any internet search on the topic shows that around the year 2034, the trust fund will be insolvent. The country’s biggest entitlement, that funds millions of peoples lives, something that we account for in every client’s financial plan, will be insolvent in 16 years. Why are we not running for the hills? Because it’s so far in the future that it gets no credibility on todays earnings. I have no doubt that many things will happen to continue to push out the 16-year figure, there are many magical things mathematics can do to assist, but the research tells you that this is failing, and the stock market doesn’t seem to care. What about if the Democrats win both houses and the White House in 2020 and reverse all the tax cuts? Again, too far out to consider.

Gridlock means status quo

As detailed above companies will make money despite poly-ticks, companies will make money in any environment they just want to know what the landscape is. Gridlock gives you clarity. A Democratic house will no doubt block any legislation that the Senate Republicans or White House want to push through. Although a sane person would argue this holds back our country and economy in making leaps and bounds forward, it can give the CEO confidence that the business decisions made now will not be affected by a regulatory or legislative change in the short term. Is it sad? Absolutely. But that’s the world we live in.

The third year of a Presidential cycle has historically been the best

I’ll start with the stats. According to thestreet.com, the average returns for the S&P 500 during presidential cycles are as follows

Year 1 - 7.13%

Year 2 - 6.39%

Year 3 - 20.98%

Year 4 - 9.96%

Furthermore, the third year of a Presidential cycle has been positive 91.39% of a time according to a Fisher Investment report. The report goes on to say that we have not had a down year in the third year of a presidential cycle since 1939. Breaking it down even further the quarter of a midterm election and following two quarters have been positive 87% of the time.

Obviously past performance is no guarantee of future results; however, history is the only real data point we can use to make predictions on the future. I feel that these data points are too compelling to be random.

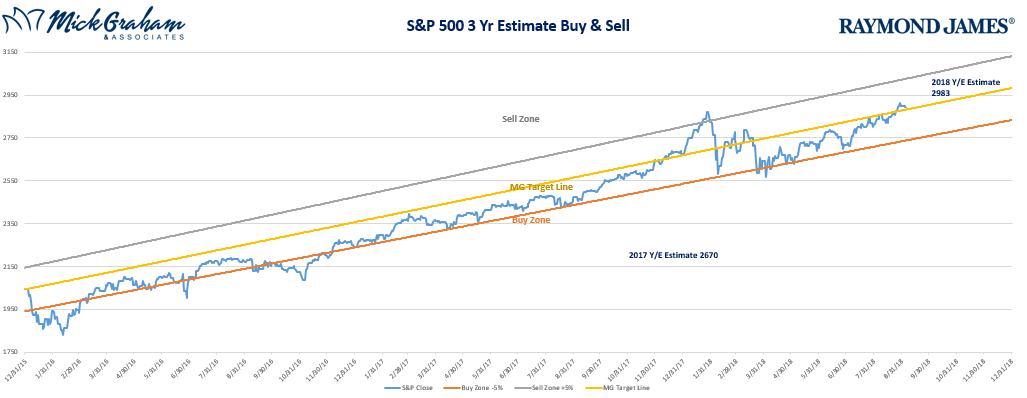

With that, here’s the buy sell

Source: MG&A

I’ll be travelling next week, but still contactable through the normal means. Should you have any questions or concerns please don’t hesitate to contact us.

Any opinions are those of Mick Graham and not necessarily those of Raymond James.