There’s Just a Way to Act, @ElonMusk

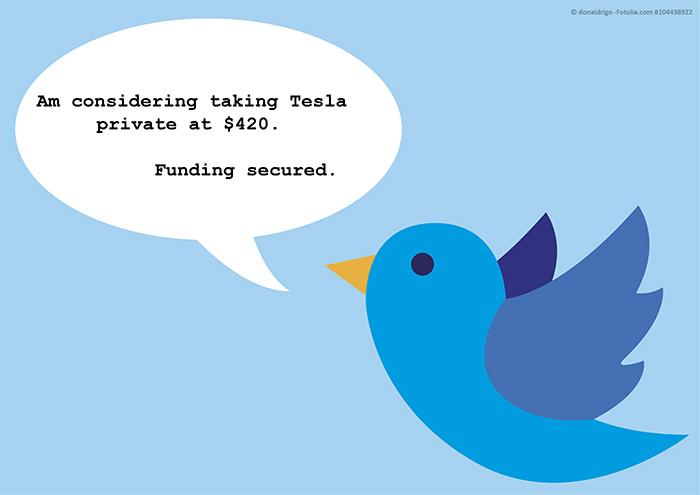

The new media has its pros and cons. 24-hour news can be a blessing and a curse. Today, with social media platforms, news travels faster than the speed of light. Just over a week ago Elon Musk tweeted “Am considering taking Tesla private at $420. Funding secured.” Instantly the stock rallied 11%. As the story was investigated, journalists soon started reporting that they were unable to find where the funds would be coming from, and as of today have dismissed Musk’s comments, and the stock has come back to earth.

It’s part of a bigger issue that we as investors face when looking for places to employ our capital with an ambition to receive growth. For growth investors, equities (or stocks), are the go-to asset class. Within that asset class you have public companies (traded on an exchange) or private. To access the private equity market, you either need to do a deal personally, or obtain access through a private equity fund. Public companies are governed by several federal regulations that include quarterly & annual filings, insider trades, quiet periods & fair disclosure rules. There have been many Acts that have been put in place over the years, however still today, the Act that still governs a large majority of public companies is the Securities Act of 1933. This 85-year-old law has two main objectives:

- require that investors receive financial and other significant information concerning securities being offered for public sale; and

- prohibit deceit, misrepresentations, and other fraud in the sale of securities.

So, what’s got my feathers ruffled about the Musk comments? It’s hard enough to make investment decisions without false, misleading or what I can only imagine was him being humorous, when he tweeted in April that Tesla has gone bankrupt:

Look, I like a joke as much as the next guy, but I’m not a fan of joking around with people’s money. There’re only two reasons that I could fathom a company deciding to become publicly traded given all the regulations that come with it:

- You need capital for growth, or

- You are cashing in your personal equity

Either way, you want/need, or desire other people’s money and it comes with responsibilities. I won’t be shedding a tear if Elon Musk gets hit with a fine or sanctions for his tweets. There are some out there that bought the stock on the way up through the 11% rally and have now lost money. No, it wasn’t me. In fact, I’d love to see him make everyone whole that lost money in those purchases, which from my math would be somewhere close to $800 Million. I just hope he didn’t sell any shares after the announcement. Ask Martha how that worked out. I think Elon Musk is a once in a generation mind, and I think his contribution to society will be long lasting, and I believe he’ll inspire the next generation of innovators, however there’s just a way to act.

Either way, you want/need, or desire other people’s money and it comes with responsibilities. I won’t be shedding a tear if Elon Musk gets hit with a fine or sanctions for his tweets. There are some out there that bought the stock on the way up through the 11% rally and have now lost money. No, it wasn’t me. In fact, I’d love to see him make everyone whole that lost money in those purchases, which from my math would be somewhere close to $800 Million. I just hope he didn’t sell any shares after the announcement. Ask Martha how that worked out. I think Elon Musk is a once in a generation mind, and I think his contribution to society will be long lasting, and I believe he’ll inspire the next generation of innovators, however there’s just a way to act.

Private companies have much less regulations on reporting, which is more in line with what you and I have. File tax returns and deliver on whatever reporting promises have been made. Investing in private equity (as mentioned before) is an option, and although it is commonly known that private company returns out pace private equity (see graph below), does come with its pitfalls.

- Usually your money is locked up for a specified period.

- There is no easily observable price, making it hard to see if your profitable at a glance

- The costs to access these markets are generally higher. You generally need to hire a manager to make the purchases.

Source: WSJ

Some companies are just better off being private, and some are better off being public, for the benefit of all parties. I just hope this new way of communicating is not accepted as the new norm for CEOs of public companies. It moves investing long term from calculable back to a crap shoot.

Here is the buy/sell

Source: MG&A

As always should you have any questions or concerns, please don’t hesitate to call.

The S&P 500 is an unmanaged index of 500 widely held stocks that’s generally considered representative of the U.S. stock market. One can not invest directly into an index. Index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary and past performance does not guarantee future results. Investing involves risk and investors may incur a profit or a loss.