Q1 Review

Today marks the first day of the 2nd quarter. The end of the first quarter each year for me is always a reflection of how quickly time goes by, I think due to the fact that I’ve just got over the holidays, but mainly as my eldest daughter has her birthday on April 1st each year I say “I can’t believe I have a XX-year-old. This year she leaves her teens behind, and for the first time is lodging her own tax return. It’s funny to see her exuberance in the expectation of receiving a refund, and how that will correlate to an experience with some of her friends. I tell her “Enjoy it kiddo, this time of year won’t always be as enjoyable” ……

A quarter is a good period to review, to take stock (pardon the pun) of strategy and results. We can start to put some reasoning around performance and determine any shifts in longer term strategy. So how was the 1st quarter??

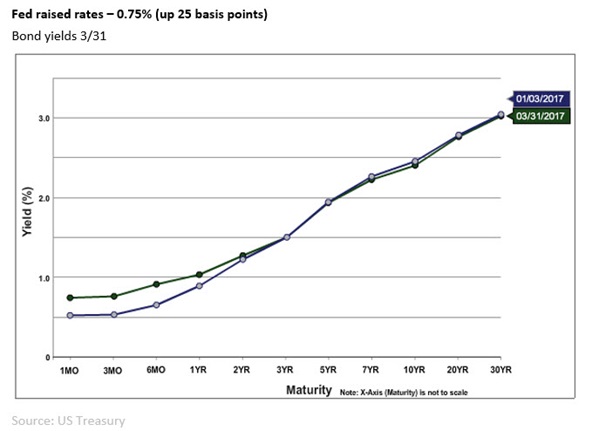

Other than financial statistics, items that affected the markets were often political. President Trump took the oath of office in January and at the end of the quarter there have been concerns on whether the administration will be able to deliver on the promises given throughout the campaign. Health care being the biggest and most recent road block.

Look Ahead

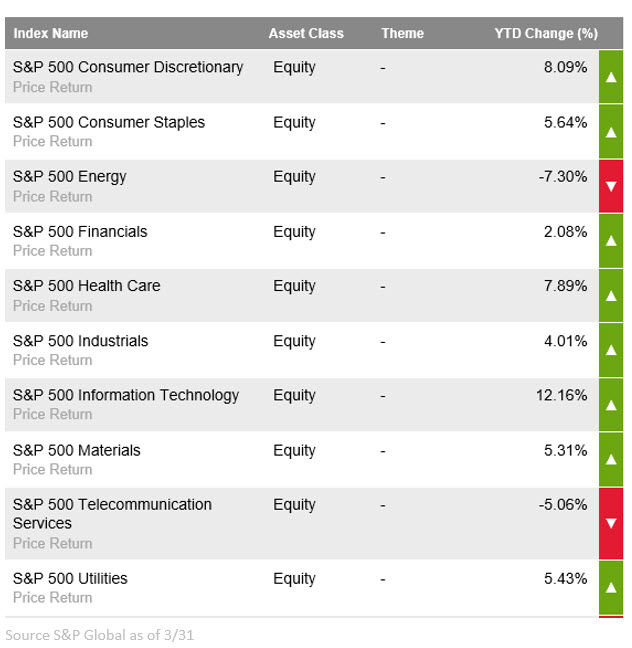

As we look forward to the 2nd quarter and in fact the rest of the year, we anticipate seeing the best returns coming from risk sectors. Risk sectors meaning equities over bonds. We will be watching earnings closely as always, however this time around we are looking for earnings growth to start to match market expectations. We saw a turn around in the 3rd quarter of last year in earnings growth, and as I’ve stated many times I believe earnings growth will be the catalyst that drives the second half of this long-term bull run.

Last week I mentioned caution in the short term as the buy/sell sheet hit the top end of the range. We continue with that short-term theme as we head into a week that will give us some manufacturing numbers and a meeting between Presidents Trump and Xi Jinping.

Have a great week, and as always feel free to call with any questions or concerns.

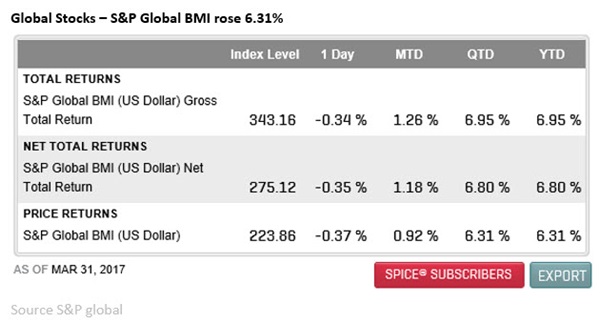

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The S&P Global BMI (Broad Market Index), which comprises the S&P Developed BMI and S&P merging BMI, is a comprehensive, rules-based index measuring global stock market performance. The S&P 500® Consumer Discretionary, Consumer Staples, Energy, Financial, Healthcare, Industrials, Information Technology, Materials, Telecommunication Services and Utilities Indexes are comprised of those companies included in the S&P 500 that are classified as members of the GICS® (Global Industry Classification Standard) for their individual sectors.