Our Investment Philosophy – Appropriate Risk/Low Fees

I listened to Larry Fink last week on CNBC. Larry is the head of Blackrock, one of the world’s biggest investment managers. As listed on their website, Assets Under Management (AUM) was $5.1 Trillion at the end of 2016. Yes, trillion with a “T”. The purpose of what he came on the show for, was to discuss computers’ roles in investment management now and in the future. This came on the back of an announcement that Blackrock will revamp its equity business by lowering fees and laying off some jobs, and will rely to a greater degree on computers and algorithms on executing in its active management business. This comes as no surprise to us as I’ve been saying for some time and underperformance of active managers (mainly due to fees) is big deal, and something most clients are and should be upset about.

So, it made me think, I spend a lot of time talking to new or prospective clients about my investment philosophy, especially on the fee issue, but don’t spend a great deal of time on it with you. So here are my thoughts and why I believe our process is the best strategy for you:

- Determine Appropriate Risk

- Manage Against a Benchmark for both Risk and Return

- Do it in the most cost effective manner possible

- Determine Appropriate Risk

Every person has different goals. Initially we spend some time on determining what is the appropriate level of risk a client needs to achieve a goal. Regardless of what I think the markets will do in the short or long time, I do not believe in taking risk for risk sake. If a client does not need risk to achieve their goals then I won’t be recommending it.

The graph above is what we call the Efficient Frontier. It’s developed as part of the Modern Portfolio Theory, and highlights risk versus return between the two major asset classes for investors being stocks and bonds. You’ll see (according to the theory) that and allocation of 33% stocks/67% bonds, typically lowers risk while increasing potential return, while moving from a 60% stock allocation to 100% stock typically gives slightly higher potential return, but increases risk dramatically. All of us that invest funds, should fit somewhere on this frontier above the curve.

- Manage against a Benchmark (Net)

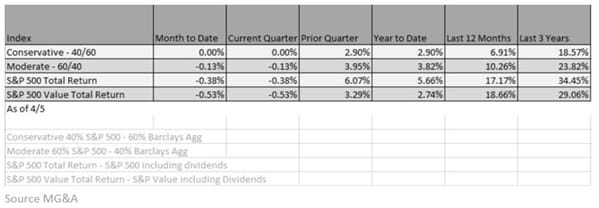

For some time, I’ve been hearing advertisements from money managers that highlight “Lifestyle” and “Needs” rather than returns. In fact, I’ve sat through many presentations that encourage Advisors not to discuss returns and discuss things like vacations and giving. In my opinion this usually means there has been some long-term underperformance. Each quarter I complete reports that measure performance against a benchmark, net of fees.

Now my aim for the portfolios I manage is to obviously beat the index it’s measured against, but do so with lower volatility. However, with that said, should there be a large movement away from the index (both higher or lower) you should ask questions, as it may signal there is excess risk.

- Do It in the Most Cost Efficient Manner Possible

Larry Fink finally said it in his interview, the costs of trading have gone down. Therefore, it’s not as expensive to run a portfolio as it used to be. That costs saving should go to the investor. Now the more hands in the pot the more expensive it will be, and this is the main reason I decided many years ago to manage portfolios in-house. We ran hypothetical portfolios for some time before we made the transition to manage in house to ensure we could potentially mimic the benchmarks.

Many Advisors use third party managers, such as mutual funds, ETFs or just have the whole account managed by an outside manager, each of these scenarios can add additional cost. I’m interested in return net of ALL fees, not just one of the fees. I believe the best way to measure this is your return versus the index.

In Summary,

I want to be sure I’ve given you my philosophy on managing money, and give a peek inside how we do that. Im happy that the industry is heading in our direction of efficient portfolio management and with each quarter we go through, we will always be discussing ways we can potentially add value to both the portfolio and relationship.

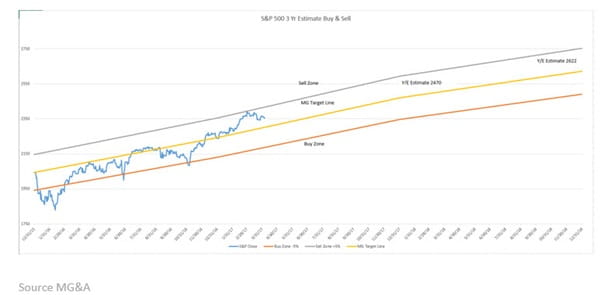

Here is the Buy/Sell for last week.

Have a great week, and as always feel free to call with any questions or concerns.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.