Rates on the Rise

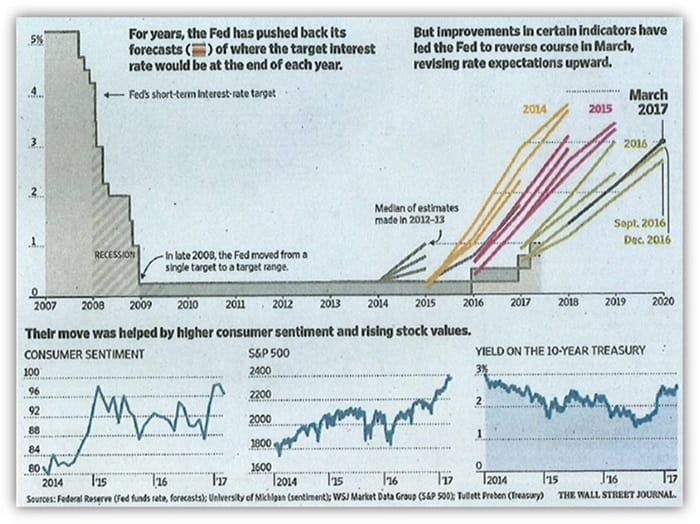

We got our first rate rise last week, of the expected three for this year. Although we have had several false starts in the last few years, it looks and feels as though now we are off to the races. The chart below highlights Fed language and expectations.

A CNBC article last week stated the average person with a $200,000 loan may see a $60 a month increase to the mortgage however saves won’t see much for a while. And this is the reason we like the banks. Banks at their core borrow money at one level and loan it out at another. As rates rise you will see a lag between how quickly rates go up on loans compared to what banks pay in interest.

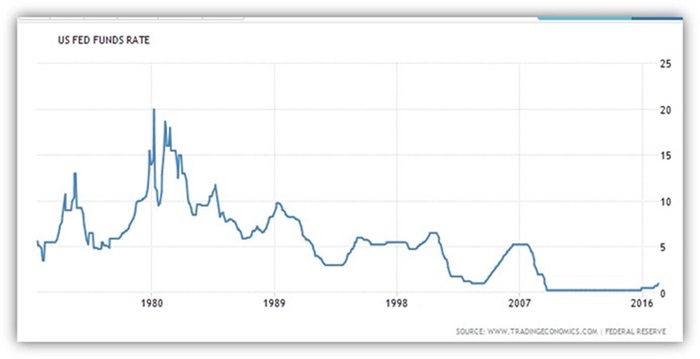

We have embarked on a major shift from 30 years of rate decline to what I think could be a long period of rate increases.

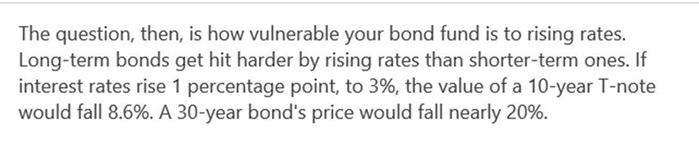

This shift I think will have a bigger impact than most, especially those in my industry, even know or acknowledge. A lot of financial advisors for years have not paid too much attention to duration risk as they were able to buy long dated bonds (giving the highest yield) and relied on those bonds being called in the future due to rates dropping. As rates drop the issuer had the option to call the bond and refinance at a lower rate. This doesn’t look likely to continue in the future.

What this means is that most bonds that are out there today may well be held all the way to maturity, and that can leave investors holding paper for many years. But that’s not the worst of it. Those that own long term bond funds have a bigger risk, due to the fund rarely holding the bonds to maturity. This creates a battle over the yield you receive versus the depreciation of the bond fund price. Here is some text from a USA today article:

We manage “duration” risk by owning bonds directly, short to intermediate duration, and laddering so that we are able to take advantage of longer bonds/higher yields as bonds mature or get called.

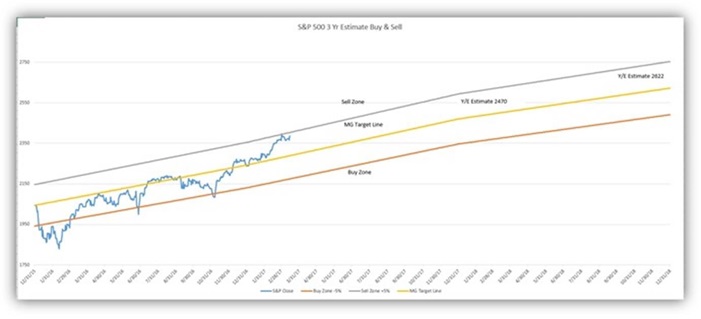

Here is the Buy/Sell for last week:

We have been preparing for this for some time, and I welcome it. As always if you have any questions or concerns, don’t hesitate to call.

Have a great week,

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.