Oil Drops

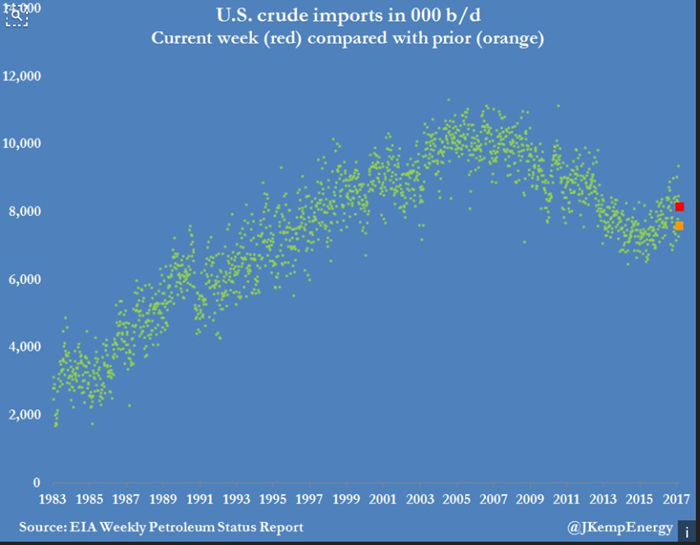

Last Wednesday night we saw one of the biggest drops in crude oil futures, breaking the $50 a barrel level (down 5.61%) which was the biggest drop seen since February of last year. From all reports the reasons were inventory levels steadily rising and US production numbers jumping 8.2 million barrels a day from the previous week. This forced long side traders to put their hands up in surrender. OPEC had previously reduced production starting in January of this year, however the recent reports show this effort to not have the affect they were looking for.

Source:EIA.gov

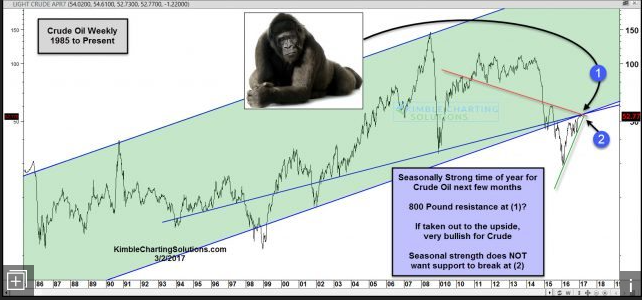

As you know I'm not much of a technician, however the graph below caught my attention. Now technical analysis (reading charts) is 100% correct after the fact, meaning after the chart is developed you can always figure out a pattern, so I place little relevance on it, preferring to look at the fundamentals.

Source: Kimblecharting.com

Why is this important?

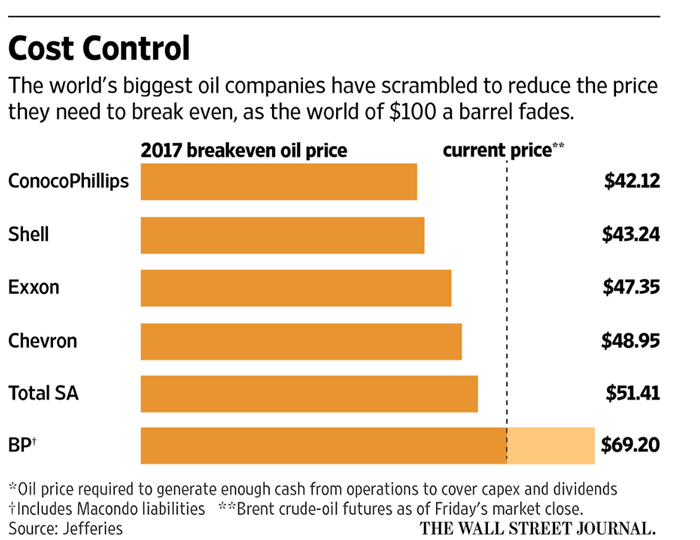

There are 6 basic asset classes that the average investor can invest in. Stocks, bonds, cash, currency, commodities and real estate. Sometimes when one asset class is affected it can roll into others. Oil prices for instance will usually have an impact on currencies especially in those countries that are heavily reliant on oil exports, such as Canada, Russia and some middle eastern countries. Obviously as someone who manages portfolios I'm also concerned with what oil prices will do to the energy companies we own. For the past few years most large oil and gas companies have been focused on lower cast production techniques such as using new technology in existing basins, which provides a return in a much shorter period. In fact, a majority oil companies per the Wall Street Journal have reduced their breakeven oil price cost to under $50 per barrel and are focused on continuing that trend.

Now a good asset allocation would be to have exposure to all the asset classes I listed earlier, however the commodities space has been disconnected in my opinion for some time, however Im starting to get more comfortable especially when we have long term infrastructure projects potentially on the horizon.

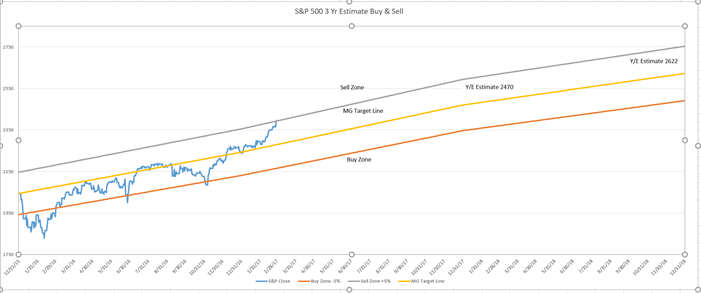

Here is the Buy/Sell for last week.

As always should you have any questions or concerns please don’t hesitate to contact us.

Have a great week

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. Commodities and currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Diversification and asset allocation do not ensure a profit or protect against a loss.