Hit The High Side

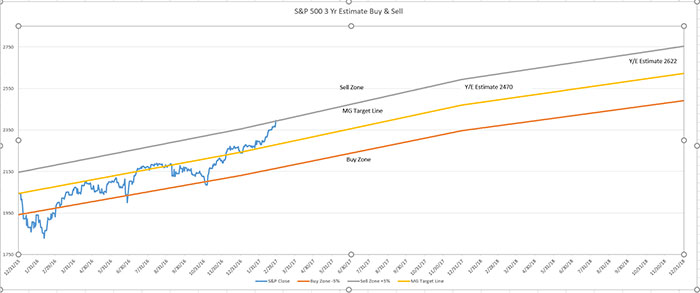

First time in 2 years our Buy Sell Sheet has hit the top of our 5% price target. Wednesday’s rally following President Trumps address to the joint session of congress, provided the 1.5% move to breach the high end of the scale

.

.

Now it’s worth noting that I still believe that we are in the midst of a 20-year equity bull run, but that does not mean it will be a straight line. According to Deutsche Bank, the average trading days between 5% dips are 90 days and 387 between 10% corrections. We have not had a 5% pullback since prior to the election when the S&P was 2085. Wednesdays close of 2395 is just shy of a 15% return.

Per the White House website, there are no major speeches scheduled for the next few weeks, so now the momentum built on from the speech will need confirmation from the house and senate by way of action. The next few weeks will determine what we can expect to ultimately get passed and how much compromise will be needed.

Interesting stat I read last week was that the percentage of economists predicting a rate increase in the Feds march meeting rose from 20% up to 70% following the speech. It’s amazing what a positive attitude can do. Literally change the world….

As always should you have any questions or concerns, please don’t hesitate to give us a call.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.