Higher and Higher

Happy Presidents Day!!!! The markets and our offices are closed today in celebration of Washington’s birthday and all Presidents thereafter. With a couple of exceptions!!! J

The markets have continued a charge higher, with the Dow Jones Industrial Average (DJIA) closer to 21,000 than 20,000. The question asked is when will the penny drop and we get a correction. It feels un natural that we continue to post new highs every day and the most common term I hear is “This cannot continue”.

There are a couple of things to note here; Yes, this is normal, and no one can predict what the market will do on any given day, week or month.

First… Most of us are still bearing the scars of at least the last few “market crashes or bear markets”. From financial crisis, terrorist attacks, dot com, black Friday or black Monday it feels like watching a toddler run around, it’s only a matter of time before there is a fall. As much as that makes sense, it should also feel normal that we have times where we have extended periods of higher highs. The well documented long term average return of the DJIA is approximately 7%, and if we all remember the rule of 72 then you could expect a double every 10 years. It feels crazy to think about Dow 40,000 but that’s what’s on the cards if you do the math.

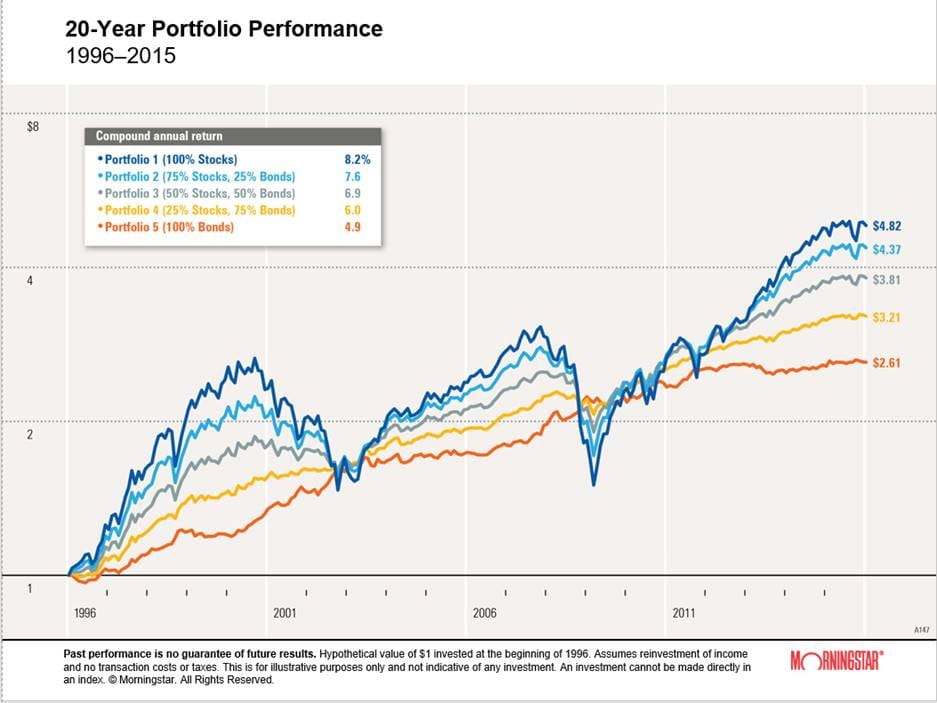

Secondly, although it’s impossible to predict the market, there are strategies to employ to help ride the waves or volatility the market gives us. Jim Cramer says bulls and bears make money and pigs get slaughtered is designed to tell you not to get greedy. In a balanced portfolio, when stock markets run your weighting can shift and it may be time to ring the bell and rebalance the portfolio to be in line with your risk tolerance. The graph below highlights the performance and volatility of differently allocated portfolios.

Source: Morningstar

So how can we invest in companies that are at all-time highs? Because good companies Cultivate, propagate, Innovate, Generate and create. The U.S. is still the world’s largest consumer and consumption accounts for 70% of the U.S. economy. We are always looking for ways to make our lives more efficient, travel to new places and share experiences with our friends and family. That’s what makes the world go round. As long as the consumer is hungry there will always be companies looking for ways to satisfy the appetite.

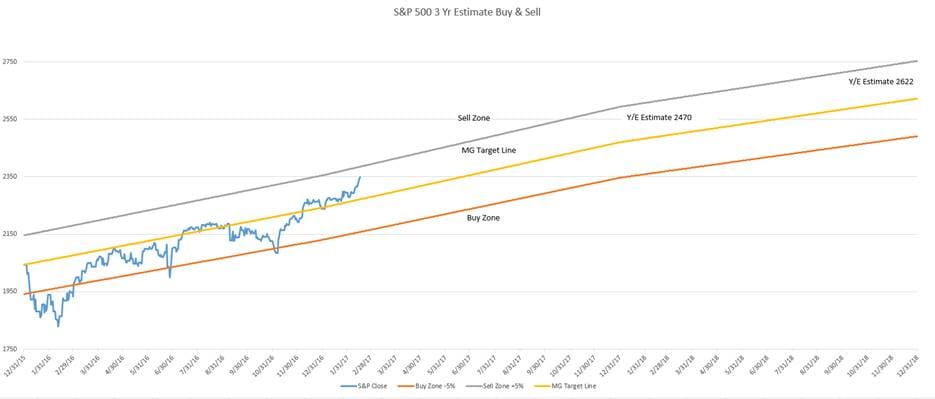

A little spike in the buy/sell sheet, however still well within the ranges

Source MG&A

As always should you have any questions or concerns, please don’t hesitate to give us a call.

Mick Graham CPM

Branch Manager

Raymond James Financial Services.

T 321.610.3200 // C 321.474.5263

3270 Suntree Blvd, Suite 129, Melbourne FL 32940

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. All investing involves some degree of risk, investors may incur a profit or loss regardless of the strategy or strategies employed. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability.. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC

Raymond James Financial Services does not accept orders and/or instructions regarding your account by e-mail, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. E-mail sent through the Internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all e-mail. Any information provided in this e-mail has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.