Earnings Triple Plays

Were in the midst of earnings and given our stance for the secular bull market, we are looking for earnings to start to show the results of our thesis. It’s a real tug of war between earnings and the way the overall market interprets that data. The market today is priced on expectations of the future and movements from day to day and/or hour to hour, among other things are based on 3 major areas.

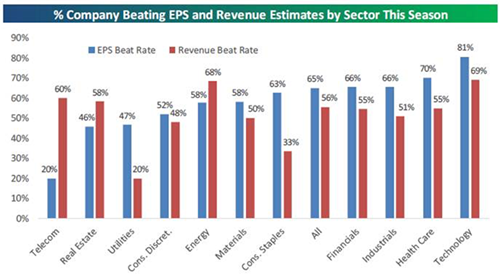

Earnings, Revenue & Forward Guidance. When companies beat on all three measures we call this the triple play. We have seen several triple plays so far, this cycle and Im encouraged that the sectors that are providing a good percentage of Earnings and revenue beats are sectors that we suggest should be over weighted such as Technology.

Source: Raymond James Investment Strategy

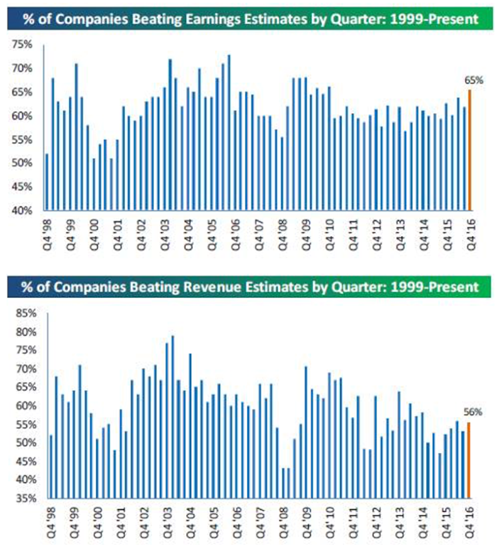

This is the type of data needed to drive this bull run into an earnings driven bull market from an interest rate driven. We have yet to see any meaningful fiscal policy changes that we have placed a lot of our focus on, and it’s encouraging to see these results prior to any meaningful changes.

Source: Raymond James Investment Strategy

Last week the markets got a boost from jobs numbers that came in ahead of forecasts, (225,000 against 175,000).

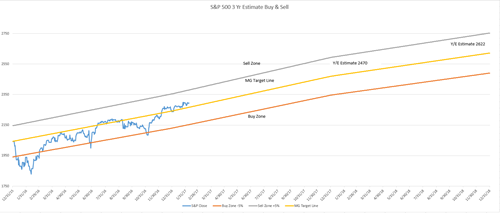

The S&P 500 is still tracking along our Buy/Sell Model and so far, we have not seen a major movement since the election.

Source MG&A

As always should you have any questions or concerns, please don’t hesitate to give us a call.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.