Secular Bull Markets

In my client meetings, I’ve been saying that we are in the “Midst” of a secular bull market since the financial crisis and we have many years left to go. So, what is a secular bull market? The basic definition is a long-term trend that lasts between 5-25 years driving the market higher.

Being in a secular bull market does not mean that we won’t have “bear market” periods throughout the run, just that any bear market will not reverse the trend higher. (A bear market is defined as a downturn of 20% from the peak of broad indexes).

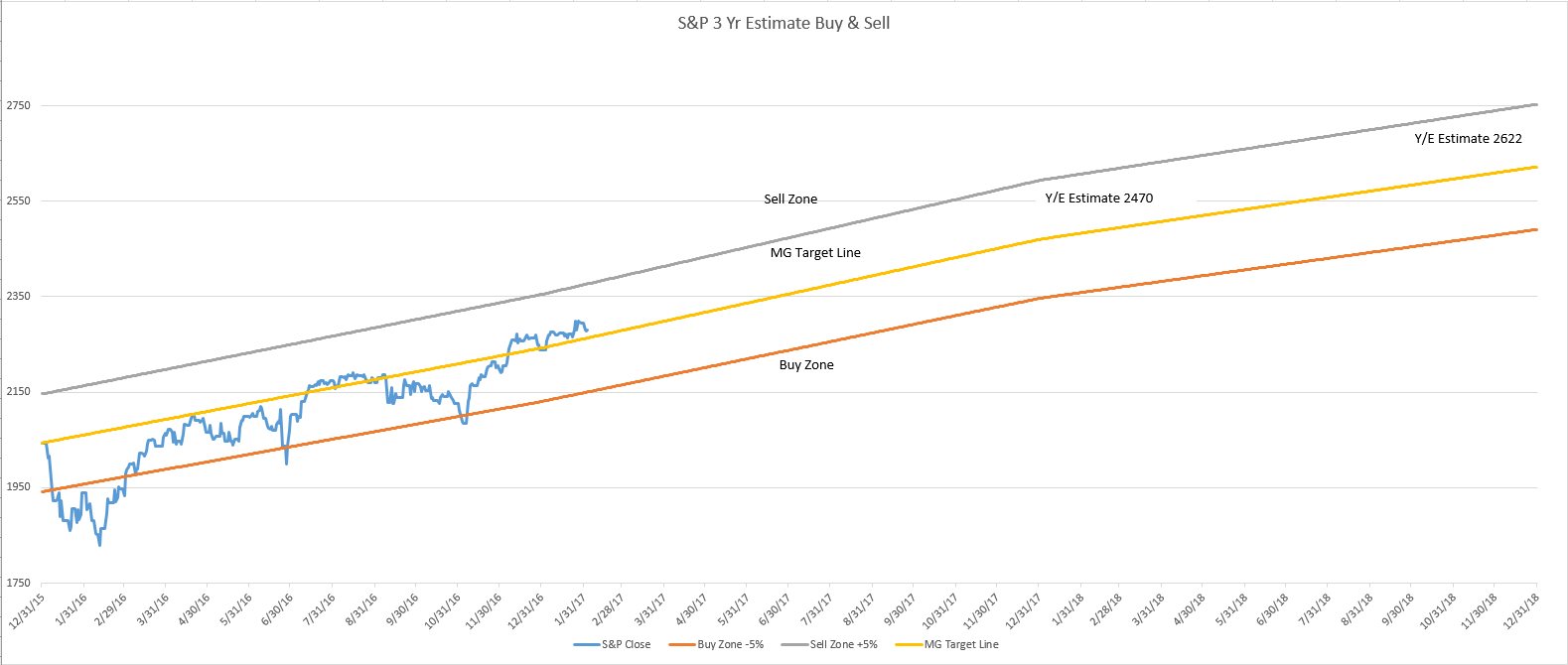

We argue that the first part of this secular bull market was originally driven by monetary policy, (low rates), that provided a lower cost of capital to help spur growth. The second part of this rally will need to be driven by fiscal policy and earnings growth, and we believe that this started to happen in the 2nd quarter of 2016. The Trump rally has certainly helped draw some attention to the opportunities that lay out there for companies to generate profits. Regardless of what can ultimately be agreed to in regards to tax reform and infrastructure spending, CEO’s see the “pro-Business” discussions and a green light to invest some of the capital that has been on the sidelines. Whether that capital is spent on M&A, stock re-purchases or dividends it should ultimately be good for markets.

Why do I write this now? Because I think that a pullback in the near term would not surprise and in fact is completely normal during long term secular bull runs. If we maintain the view that we are in a secular bull market, we will view any pullbacks or corrections as longer term buying opportunities.

Source MG&A

As always should you have any questions or concerns, please don’t hesitate to give us a call

Have a great week.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.