401K Update - Automatic

In the world of 401K investing, I believe that without a doubt the biggest factor that helps participants is the automated process. Regardless of what the markets do, if you have longer than 5 years till retirement then the more important factor is how much and how often.

A lot of the people I talk to are concerned with what the markets will do from here and whether it’s a good time to get in or out. Firstly, again in my opinion, if your time horizon to retirement is longer than 5 years the answer is “it doesn’t matter”.

I use an example of purchasing a share of stock that starts at $20 and over the next 12 months the stock goes down to $14.50 and over the next 12 months the stock rebounds and comes back to its original price of $20. So, after 2 years the stock is the same price that it was when you started. Most logical people would not think that’s very exciting, as the stock has not for one day been above the price it started when you first invested.

However, if you automated your process and purchased the stock consistently each month during that 2-year period you would have made 17.125% on your total investment. That’s without any additional dividends or fees.*

This I believe shows how the process can work in your favor even when markets don’t participate. Yes, the math works both ways, however if you don’t believe that the market has an upwards bias over time then investing in stocks is probably not for you.

A great book by David Bach called The Automatic Millionaire shows many great situations like this. I think I originally read this book in 2004 and it was one of those things that made sense, but life happens and things get in the way. But, the 401K is the ultimate automation process and with some companies offering incentives such as a match, it sweetens the pot even more.

Now if your time horizon to end participating in the 401K is under 5 years, we should have a separate conversation.

Market Update

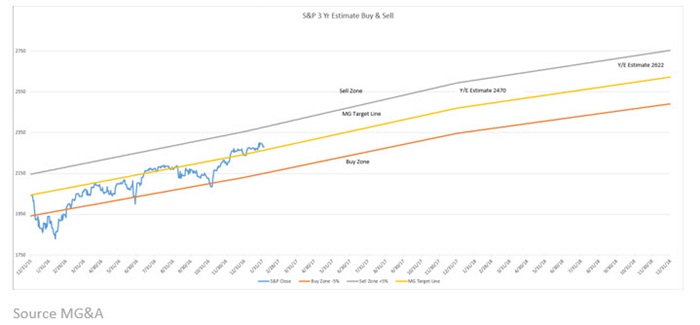

If you’re not aware we make year-end forecasts on the market (S&P 500). If you don’t have an opinion you shouldn’t give recommendations. Our year end forecast for the S&P 500 at year end 2017 is 2470 and 2018 2622. That is 8.9% upside potential for 2017 and 15.6% for 2018. I like to track the market based both my mean lines as well as 5% above and below the current levels. See below.

Here are the market returns for 1/31

Conservative Model—40% S&P 500 and 60% Barclay Aggregate Bond Index

Moderate Model—60% S&P 500 and 40% Barclay Aggregate Bond Index

Source: Raymond James—Performance Analysis

Should you have any questions, please feel free to reach out to us

Regards,

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

*This is a hypothetical illustration and is not intended to reflect the actual performance of any particular security. Future performance cannot be guaranteed and investment yields will fluctuate with market conditions.

Raymond James is not affiliated with and does not endorse the services or opinions of David Bach.