Rising Rates Effect on High Net Worth Clients

Given the recent move in rates I wanted to highlight some moves that have happened in the bond markets that may affect some of your high net worth clients.

Last week the Fed finally made a move in rates, the second in 10 years, however the fixed income (bond) markets have made moves well prior to that. I’ve argued for some time that the Fed is a reactionary force, driven by the markets and we saw that last week.

I want to draw your attention to a few items that I think are important to High Net Worth Clients, given the fact that we have not been in this position for many, many years.

- The effect of rising rates on bond prices

- Strategies to help preserve portfolios in this environment

- Munis will still be one of the well aligned places to be for High Net Worth

- Pitfalls to avoid

- De Minims Tax Rule

- Effect of Rising Yields on Price. Not spending a lot of time here given the audience, but enough to say that clients who hold fixed income accounts will probably see a negative number on their statements this quarter.

- Quarter to Date the Barclays Agg Index is down (3.64%)

- Quarter to Date the Barclays Muni Index is down (3.95%)

This will be a big shock to most

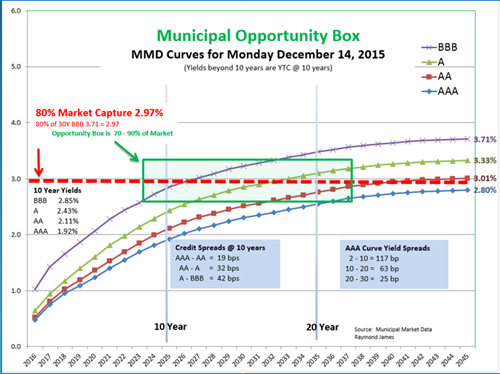

- This is the exact reason we create ladders. As rates rise you use the cash from maturing bonds to go out on the yield curve to increase the current yield of the portfolio. There is usually a sweet spot on the yield curve as the graph below highlights. You can pick up 80% of the yield within the box highlighted.

Source…. MG&A

- Municipal Securities in my opinion will still be a great place to be for investors in high income brackets. I’m feeling more and more that rather than tax cuts we will see tax reform as conservative republicans look for cost neutral solutions. This in my opinion will equate to reduced deductions to offset cuts in rates or scales. I also feel that we are now hearing the word compromise more often from the transition team and this will lead to tax rates and scales somewhere between where they were previously stated in the campaign and where we are now.

- BE CAREFUL with fixed income products that are levered or income substitutes. Under FINRA rules I’m not allowed to talk about mutual funds, however any product that does not hold bonds to maturity should be at least watched and understood. I gain comfort in, and educate my clients on, the fact that when we buy individual bonds that we are buying the current yield and that should not change if there are no issues with the borrower. If we obtain an insured bond that is paying a current yield of 4% then regardless of whether rates rise or fall, if the borrower is solvent you will receive your income and c=have the option to hold it till maturity.

Although I’m comfortable going down the quality scale, I still only buy and recommend investment grade bonds to my clients.

- De Minims Rule. It’s been a while since we’ve had to worry about this rule since rates have come down for so long. Given the moves we have had in the municipal markets I’m starting to see opportunities to buy bonds at a discount. I’m not a CPA, and don’t even play one on TV, so for those of you that are not CPA’s like me, seek independent advice. However, if you search google it will tell you that gains paid on bonds that are bought at a discount beyond a quarter point a year, will be taxed at capital gains. Furthermore, if the bond is purchased at a “substantial discount” then it’s possible that the gain could be subject to ordinary income tax. Each bond when purchased will have this information. Again, it’s just a refresher.

For those of you that don’t know, I manage “in house” portfolios for both institutional clients and individuals. I keep it simple with high quality stocks that focus on the generation of free cash flow and dividend growth, and investment grade bonds. I feel this is an efficient way to manage client investments as I can both explain what securities are in the portfolio and why, as well as keep fees to a minimum by not paying any third parties.

This is a generic email and may be too much or too little for those that read it, so if you have any questions or comments please feel free to reach out to me.

Regards,

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of Raymond James Financial Services we are not qualified to render advice on tax or legal matters Past performance may not be indicative of future results.

It is not possible to invest directly in an index. Barclays Capital U.S. Aggregate Bond Index is made up of the Barclays Capital U.S. Government / Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Based Securities Index, including securities that are of investment grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $100 million. The Barclays Capital Long-Term Municipal Bond Index is composed of those securities included in the Municipal Bond Index that have maturities greater than 22 years. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices rise. If a bond is listed as "insured," the insurance relates only to the prompt payment of principal and interest of the securities in the portfolio. This does not remove market risk. Yield and market value will fluctuate with changes in market conditions. Interest is generally exempt from federal taxation and may also be free of state and local taxes for investors residing in the state and/or locality where the bonds were issued. However, bonds may be subject to federal alternative minimum tax (AMT), and profits and losses on tax-exempt bonds may be subject to capital gains tax treatment. Ratings by Moody's/Standard & Poor's. A credit rating of a security is not a recommendation to buy, sell or hold the security and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning Rating Agency. Insurance pertains only to the timely payment of principal and interest. No representation is made as to any insurer's ability to meet its financial commitments. Ratings and insurance do not remove market risk since they do not guarantee the market value of the bond.